Kraken Raises $800 Million As Citadel Lifts Valuation To $20 Billion

0

0

Kraken has raised $800 million in new funding, including a $200 million strategic investment from Citadel Securities, valuing the crypto exchange at about $20 billion. The deal lands during a choppy phase for digital assets yet shows that large institutions still want direct exposure to the infrastructure that powers crypto trading.

A Fast Two-Stage Funding Cycle

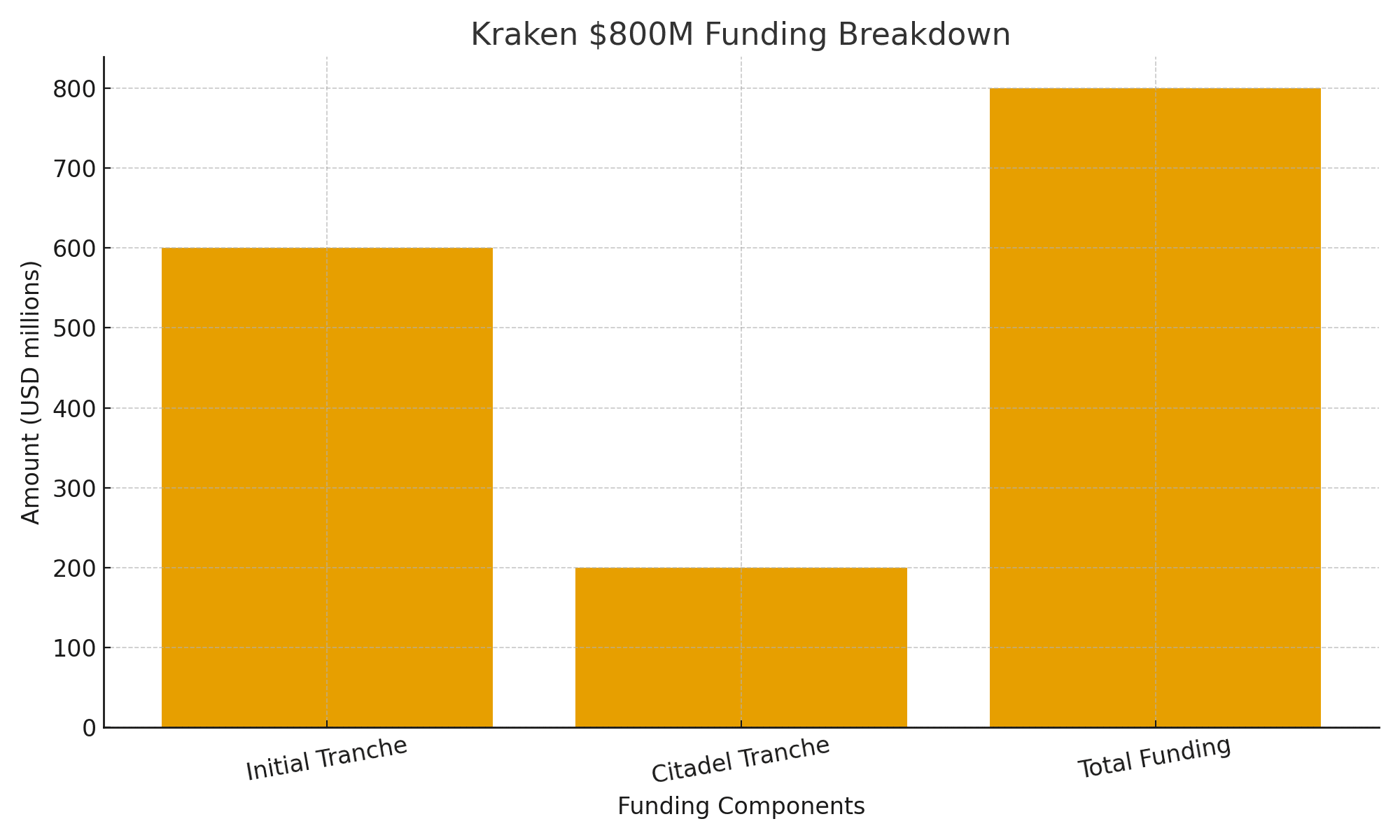

The raise came in two back to back tranches. Earlier in the year, Kraken secured roughly $600 million from institutional investors at a valuation near $15 billion. The latest round, led by Citadel Securities, pushed the valuation to about $20 billion and lifted total recent funding to $800 million. In a short window, the company strengthened its balance sheet and reset its price tag higher.

Investors in the deal include trading firms and alternative asset managers that usually focus on complex strategies in equities, derivatives and foreign exchange. Their willingness to own equity in a crypto exchange suggests that they expect trading volumes, fee pools and product innovation in digital assets to remain strong. The cash matters, but so do the closer ties to liquidity providers that can deepen order books in major pairs.

Citadel Securities Moves Toward The Center Of Crypto

Citadel Securities has tested digital assets for several years at a cautious distance. This $200 million stake brings the firm much closer to the center of the market. For Kraken, the partnership offers more than a higher valuation. It opens room for joint work on risk models, execution algorithms and surveillance tools that connect onchain trading with activity in traditional markets.

Fuel For Global Expansion And On-chain Products

Kraken plans to direct much of the new capital toward geographic expansion and new product lines. The company has highlighted opportunities in Latin America, Asia Pacific and the wider Europe, Middle East and Africa region, where demand is rising for regulated exchanges and reliable fiat on ramps. Building local compliance teams, winning licenses and setting up regional custody hubs will be central to that push.

On the product side, Kraken is leaning into derivatives and tokenization. The exchange has already bought a United States based futures venue, which helps link leveraged trading with spot markets. Management also wants to bring more traditional instruments onchain so that investors can access familiar exposures while settling trades directly on public networks rather than through slower legacy rails.

What This Funding Says About Key Crypto Indicators

A round of this size, at a higher valuation, sends useful signals about several core crypto indicators. Moving from roughly $15 billion to $20 billion in a short period suggests that investors still pay a premium for exchanges that have diversified revenue, strong compliance and institutional grade systems, even in a year of sharp price swings.

Liquidity and volume form the next indicator set. As firms such as Citadel Securities deepen their involvement, order books for major assets tend to become thicker and more stable. That can improve price discovery, lower slippage for both retail users and funds and reduce the chance that a single wave of selling triggers outsized liquidations across the market.

IPO Expectations And The Road Ahead

The funding round also increases speculation that Kraken is preparing for a public listing. A stronger balance sheet, a clean reference valuation, and a list of high-profile backers are familiar steps for companies that hope to access public markets within the next one or two years. While no timetable has been confirmed, many market participants now see Kraken as a likely entrant in the next wave of crypto related initial public offerings.

For now, the focus sits on execution. Competition among exchanges remains intense, from fee pressure to races for new listings and more advanced derivatives. With this funding and a strategic market-making partner at its side, Kraken appears better positioned to shape that contest.

Frequently Asked Questions FAQs

What is the main outcome of Kraken latest funding round?

Kraken secured a total of $800 million across two recent tranches. The second tranche included a $200 million strategic investment from Citadel Securities, which lifted the exchange valuation to about $20 billion and provided fresh capital for expansion and product development.

How could this deal affect everyday crypto traders and investors?

Stronger backing from large market makers can lead to deeper order books, tighter spreads and more reliable execution on major trading pairs. Over time, that can reduce slippage on large orders, support healthier price discovery and make the market less fragile during periods of sharp volatility.

Why is Citadel Securities involvement viewed as important for the wider crypto market?

Citadel Securities is a major liquidity provider in traditional finance. Its decision to commit long term capital to a crypto exchange signals rising confidence in digital assets as a permanent part of global markets. That message can attract more institutions and encourage higher standards in risk management and regulation.

Glossary Of Key Terms

Valuation

An estimate of the market value of a company, often based on the price paid by investors in a funding round multiplied by the total number of shares.

Liquidity

The ease with which an asset can be bought or sold without causing a sharp change in its price. Higher liquidity usually means tighter bid ask spreads and lower slippage.

Tokenization

The process of representing traditional assets such as stocks, bonds or real estate as digital tokens on a blockchain, which can allow faster settlement and new types of financial products.

Market Maker

A firm that continuously quotes buy and sell prices for assets, providing liquidity to markets and earning a small spread between those prices in return for taking inventory risk.

Onchain Finance

Financial services and products that operate directly on blockchain networks, including trading, lending, yield strategies and tokenized versions of traditional instruments.

Sources

Read More: Kraken Raises $800 Million As Citadel Lifts Valuation To $20 Billion">Kraken Raises $800 Million As Citadel Lifts Valuation To $20 Billion

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.