$74.5M Flees Bitcoin ETFs as XRP, Ethereum and Solana Soak Up Fresh Cash

0

0

The cryptocurrency market saw a major shift on November 17. Investor behavior changed quickly as Bitcoin ETFs recorded $74.5 million in outflows.

At the same time, several large altcoins posted strong inflows. The pattern suggests that traders may be rotating funds from Bitcoin ETFs to assets with stronger short-term narratives.

Altcoin Inflows Strengthen Despite Market Turmoil

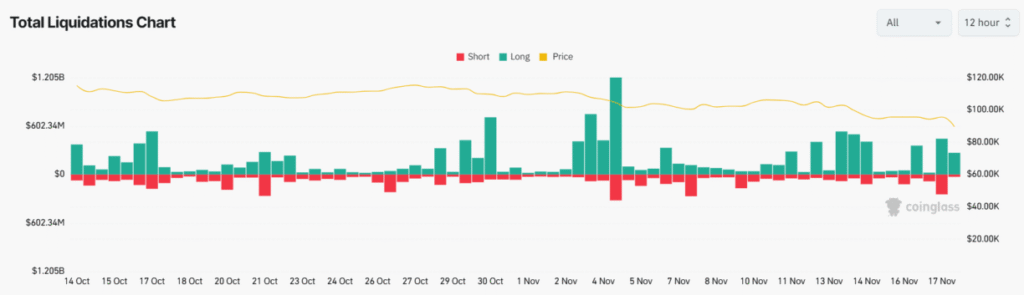

XRP, Ethereum, and Solana led the day with notable inflows. This came during a wider market downturn that erased more than $160 billion from global crypto valuations. Liquidations crossed over $1 billion in 24 hours.

Over 180,000 traders were affected. Despite the volatility, inflow data pointed to growing confidence in selected altcoins.

Market analysts noted that investors are not stepping away from digital assets. Instead, they are moving money from Bitcoin ETFs toward faster-growing altcoins.

The shift does not indicate a long-term bearish outlook for Bitcoin. It does show that investors want exposure to assets with clearer momentum or improving regulatory clarity.

XRP Gains the Largest Inflows

XRP recorded the strongest inflow at $25.41 million. This marked the highest gain among major altcoins. The rise followed recent legal wins that boosted market confidence. The positive sentiment pushed many traders to reduce their exposure to Bitcoin ETFs.

Also Read: BlackRock Bitcoin ETF Faces $257 Million Outflow as Institutions Trim Exposure

Some now view XRP as a more stable or promising option in the short term. XRP’s use in cross-border payment systems also added to its appeal.

Ethereum Shows Strong Institutional Support

Ethereum ended the day with $12.95 million in inflows. This reinforced its status as the top altcoin for institutional investors. Interest in potential Ethereum ETFs continues to grow.

The expanding DeFi ecosystem on Ethereum is another factor. The asset’s steady demand indicates that some investors are shifting capital away from Bitcoin ETFs to diversify their portfolios.

Solana Rises With New ETF Launch

Solana posted $8.2 million in inflows. The rise was supported by growing adoption in NFTs, DeFi, and high-speed applications. The launch of the VanEck VSOL Solana ETF added momentum.

This new product entered the market with a zero-fee promotion. The offer will last until the ETF reaches $1 billion in assets or until February 17, 2026. Many investors see this as a cheaper and more efficient alternative to several Bitcoin ETFs.

VanEck Expands Solana Exposure

VanEck selected SOL Strategies as the staking provider for its Solana ETF. Staking will run through Orangefin, a validator recently acquired by SOL Strategies. The validator operates under ISO 27001 and SOC 2 standards.

The firm stakes more than $437 million worth of assets. VanEck said this experience played a key role in the partnership. The new ETF arrived during a period when more investors are reevaluating their reliance on Bitcoin ETFs.

Daily ETF Inflows Show Growing Interest in Altcoins

Solana ETFs have reported inflows every day since their launch. There have been no outflows to date. This performance stands out in comparison to Bitcoin ETFs, which continue to see uneven activity.

The trend shows that traders are actively seeking new opportunities. Many now view altcoin ETFs as a way to gain diversified exposure.

Crypto Market Crash Adds Pressure

The wider market downturn created additional challenges. Global market cap fell from $3.24 trillion to $3.08 trillion. A large wave of liquidations hit Bitcoin and major altcoins.

The biggest single liquidation was nearly $100 million on Hyperliquid. The volatility added pressure on Bitcoin ETFs, which were already experiencing steady outflows.

Conclusion

The November 17, market data points to a very distinct change. Investors are rotating funds from Bitcoin ETFs to XRP, Ethereum and Solana. The momentum is spurred by legal developments, the expansion of the ecosystem and new ETF offerings.

Altcoins are all the rage right now, and not just Bitcoin ETFs. This rotation could persist as investors look to alternative areas with more attractive near-term potential and clearer advantages in the current climate.

Also Read: $867 Million Rushes Out of Bitcoin ETF: Capitulation or Smart Rotation?

Appendix: Glossary of Key Terms

Bitcoin ETFs: Exchange Traded Funds that track the price of bitcoin.

Altcoins: Cryptocurrencies other than Bitcoin.

Inflows: Money flowing into a cryptocurrency or investment product.

Outflows: Capital taken out of an asset or fund.

Liquidations: Automatically closing positions based on the market fall to avoid higher losses.

Market Cap: The total value of all cryptocurrencies in circulation.

Staking: Committing tokens to a blockchain network in order to vote and gain rewards.

Frequently Asked Questions About Bitcoin ETFs

1- Why did Bitcoin EFTs see massive outflows?

Outflows were likely driven by profit-taking and a short-term rotation to altcoins with stronger momentum.

2- Which altcoin experienced the most inflow?

XRP led in the market with an amount of $25.41 million worth inflow.

3- Is this move away from Bitcoin ETFs for the long term?

It might be short-lived, but sustained growth of altcoin ETFs could have implications for long-term exposure.

4- How did flows respond to market volatility?

The crypto crash influenced heavy liquidations, which have shaped investor sentiment and forced fund rotation.

References

Read More: $74.5M Flees Bitcoin ETFs as XRP, Ethereum and Solana Soak Up Fresh Cash">$74.5M Flees Bitcoin ETFs as XRP, Ethereum and Solana Soak Up Fresh Cash

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.