Why Shiba Inu Could See a Bounce Despite Market Slump

0

0

Leading meme coin Shiba Inu (SHIB) has fallen 2% today amid broader market weakness, maintaining a largely sideways trajectory it has held since the beginning of August.

This muted performance reflects the overall market’s cautious sentiment, with investors remaining hesitant. However, readings from two key on-chain metrics suggest that SHIB could be poised for a rebound.

SHIB Might Be Poised for a Bounce

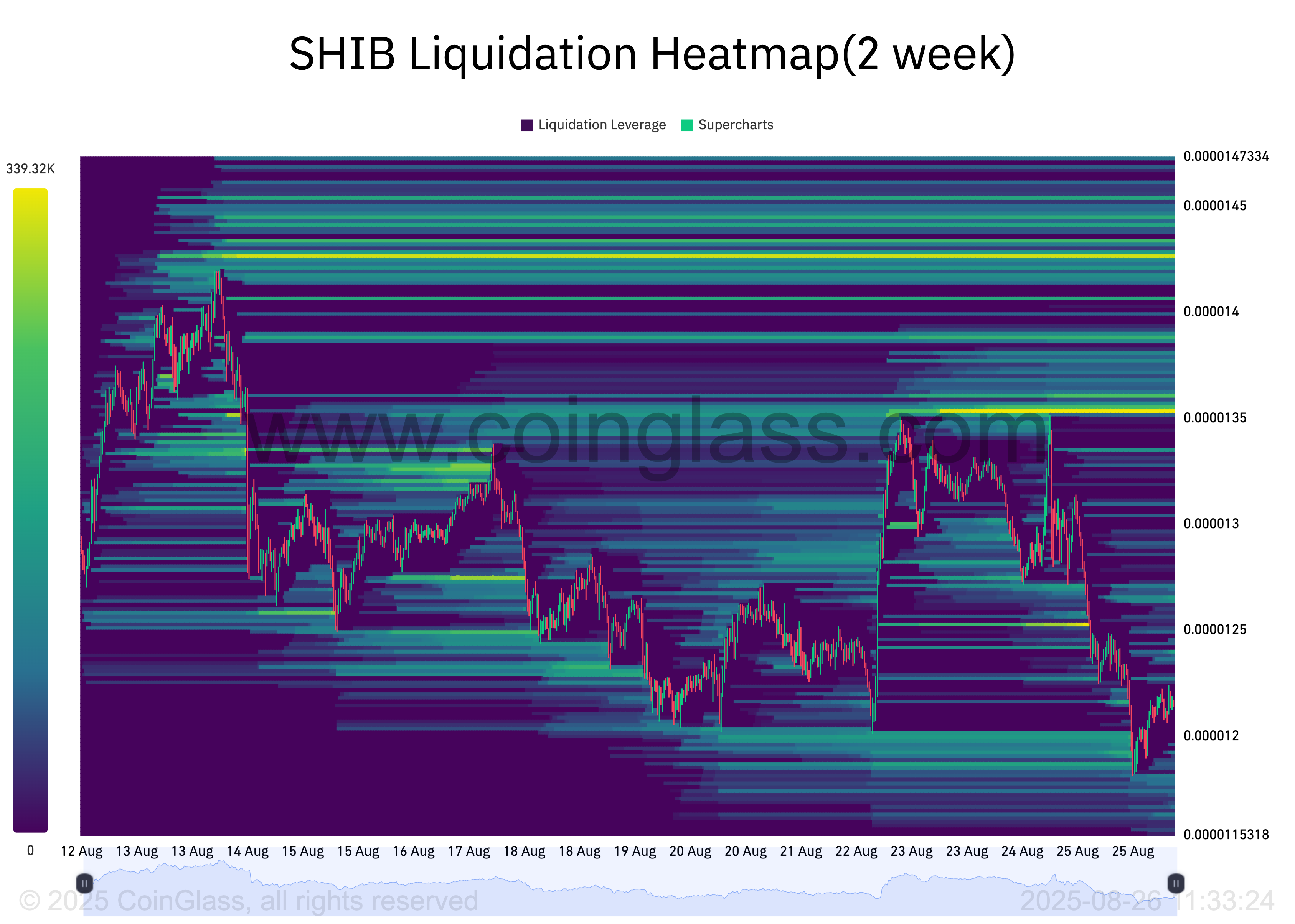

An assessment of SHIB’s Liquidation Heatmap reveals potential buying pressure that could spark renewed upward momentum. According to Coinglass data, a concentration of leveraged positions and liquidity exists above the meme coin’s price near the $0.0000135 region.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

SHIB Liquidation Heatmap. Source: Coinglass

SHIB Liquidation Heatmap. Source: Coinglass

A Liquidity Heatmap is an on-chain tool that visualizes areas where large amounts of stop-loss orders, leveraged positions, or buy and sell orders are clustered. These zones act as magnets for price action, as the liquidation of leveraged trades can create rapid price movements.

For SHIB, the heatmap indicates that sufficient liquidity exists just above its current price of $0.0000122. This means that a coordinated wave of buying could push the meme coin higher if market conditions improve.

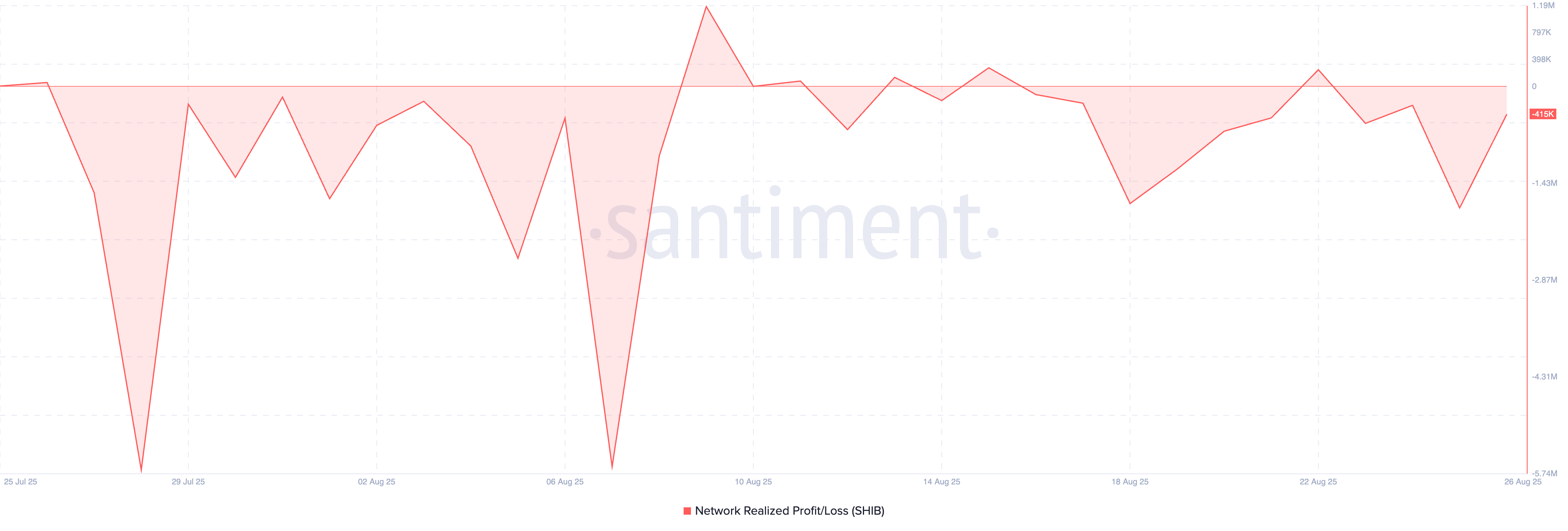

Furthermore, SHIB’s Net Unrealized Profit/Loss (NUPL) has remained mostly negative throughout August, indicating that token holders have been sitting on unrealized losses since the start of the month.

SHIB NUPL. Source: Santiment

SHIB NUPL. Source: Santiment

This metric reflects the net profit or loss of all coins moved on-chain, based on the price at which they were last moved. A positive NPL suggests increasing profitability across the network, while a negative one, like SHIB’s, suggests many holders are in loss.

In such situations, traders are often reluctant to sell at market prices to avoid realizing losses, so they tend to hold their positions. Extended holding periods like this can reduce selling pressure and support an upward momentum for SHIB’s price in the near term.

Market Uncertainty Hits SHIB, But a Bounce Remains Possible

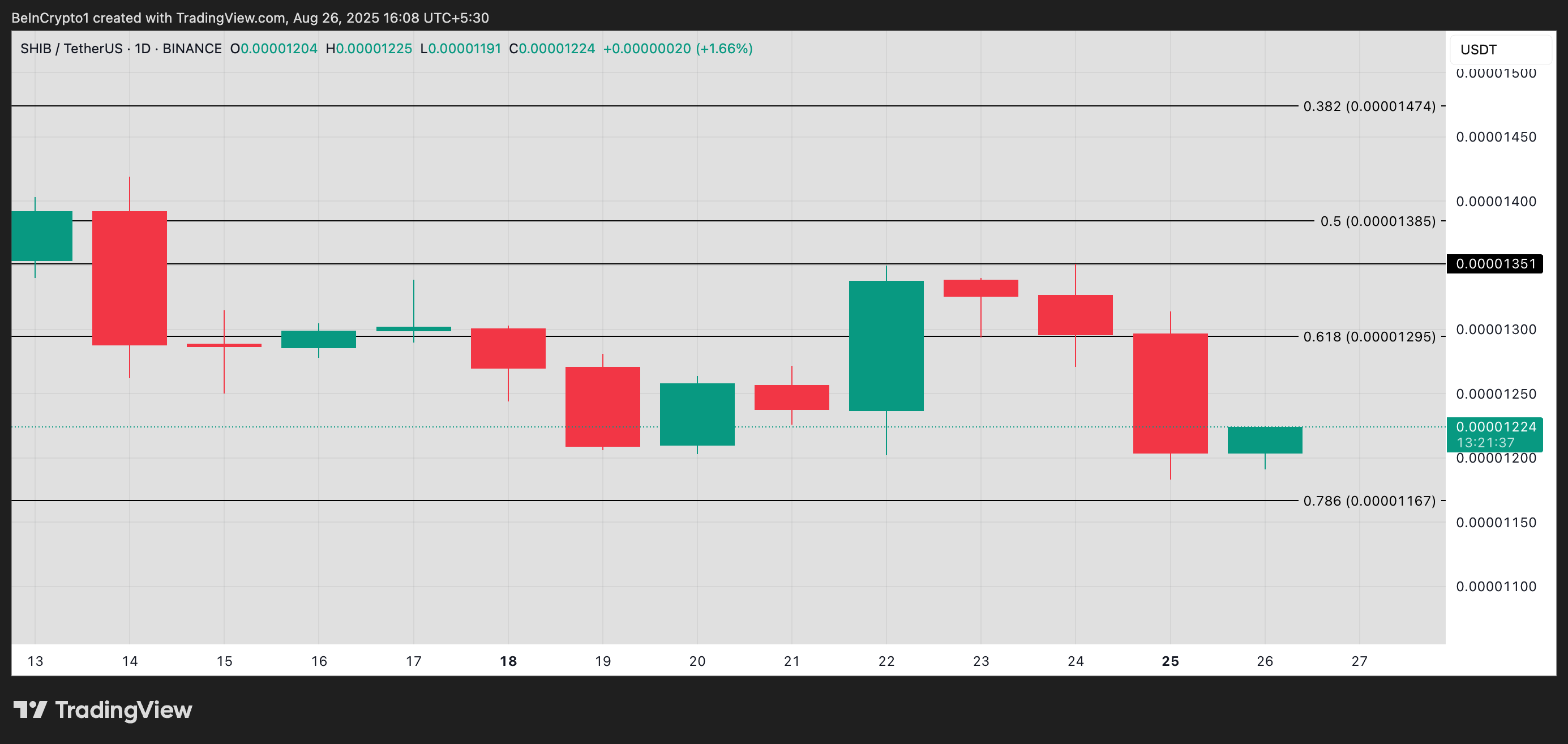

If buyers step in, SHIB could target $0.0000129. A successful break above this resistance level could trigger the next leg up toward $0.0000138.

SHIB Price Analysis. Source: TradingView

SHIB Price Analysis. Source: TradingView

However, if demand wanes and more traders sell, SHIB’s value could plunge below $0.0000167.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.