What Are Cross-Chain Swaps?

3

0

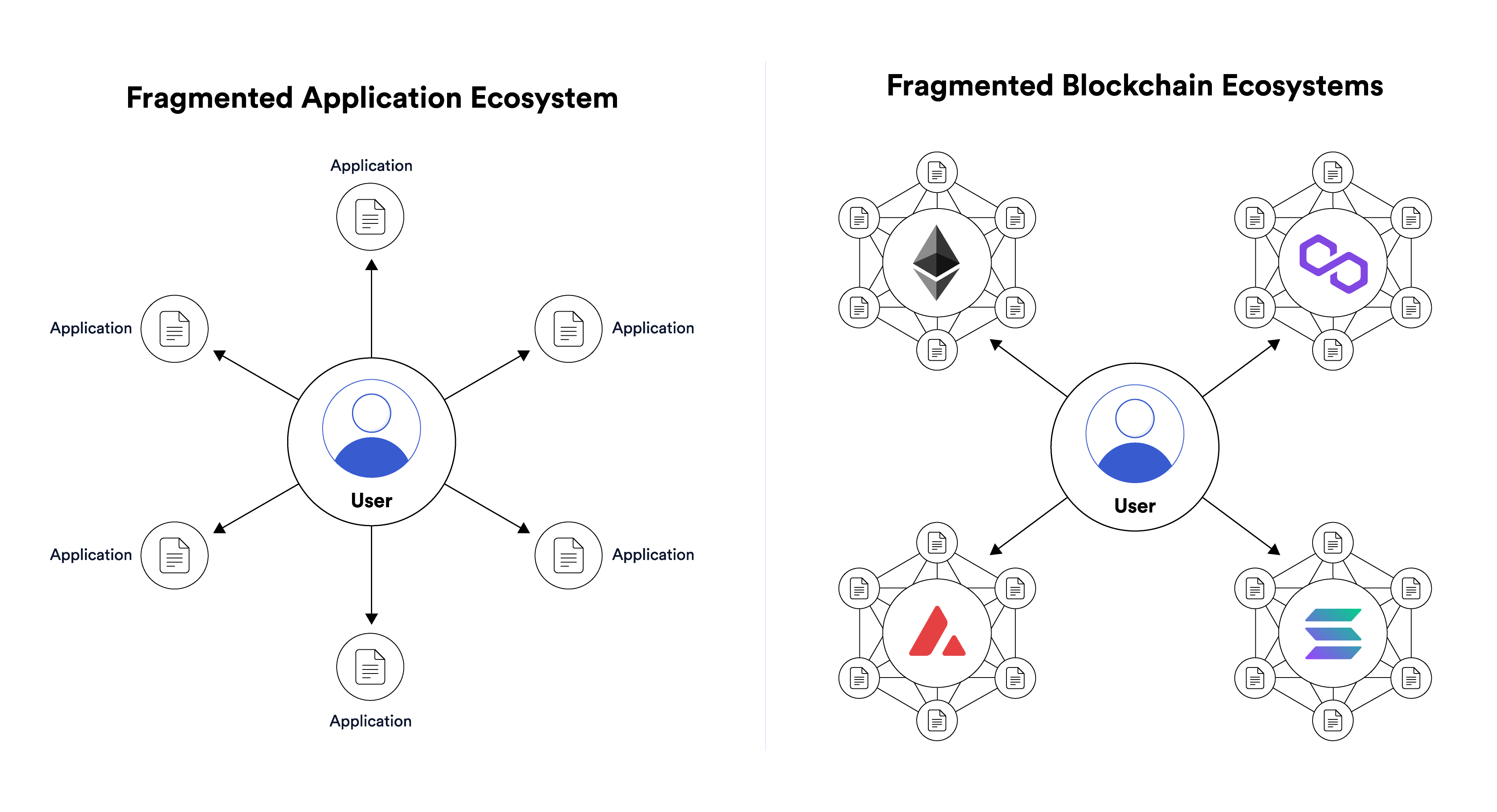

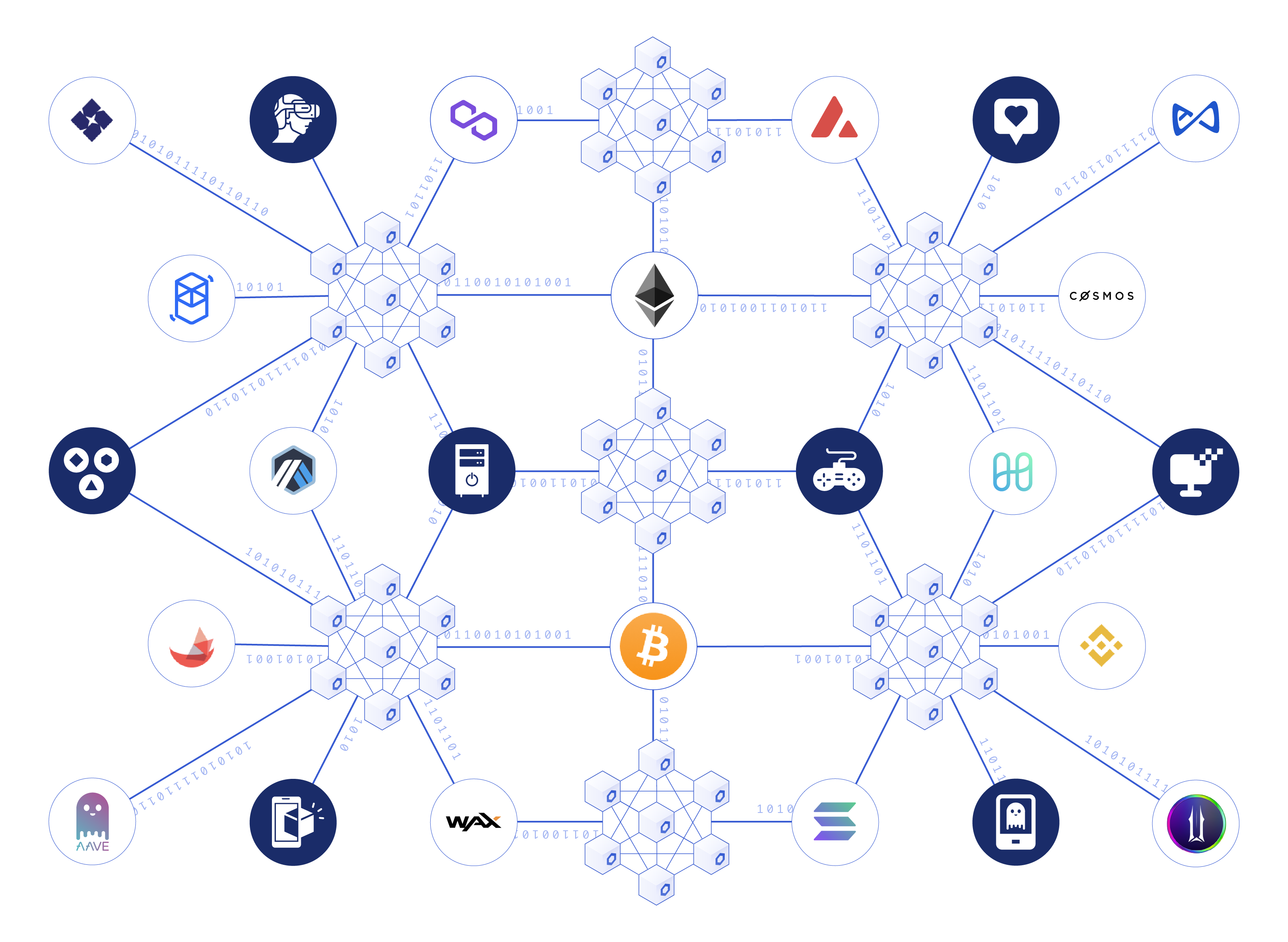

Individual blockchains are holistic digital environments where all applications are connected by an underlying network. But with the proliferation of blockchain networks, and a lack of connection between blockchains, there is a growing demand for cross-chain infrastructure that provides users with interoperability across many blockchain networks.

Perhaps one of the most important primitives for the Web3 ecosystem is cross-chain swaps, which provide an important service by enabling the seamless exchange of one digital asset for another. Just as decentralized exchanges were one of the first primitives for individual blockchain networks, cross-chain swaps are poised to be a foundational component of an interconnected, cross-chain world.

What Is a Cross-Chain Swap?

Put simply, cross-chain swaps are a mechanism for trading a token issued on one blockchain with a token that’s been issued by a different blockchain in a trust-minimized manner.

While users today can already access cross-chain swap functionality through centralized exchanges, this introduces multiple layers of friction (e.g., transferring tokens to an exchange, swapping them directly or indirectly through a medium of exchange such as USD, and then moving the swapped tokens back to a wallet on a different blockchain). Additionally, this process requires users to leverage custodial services and temporarily give up custody of their assets. For something as fundamental as a cross-chain swap, this becomes a key barrier for building a world powered by sovereign digital asset ownership.

How Does a Cross-Chain Swap Work?

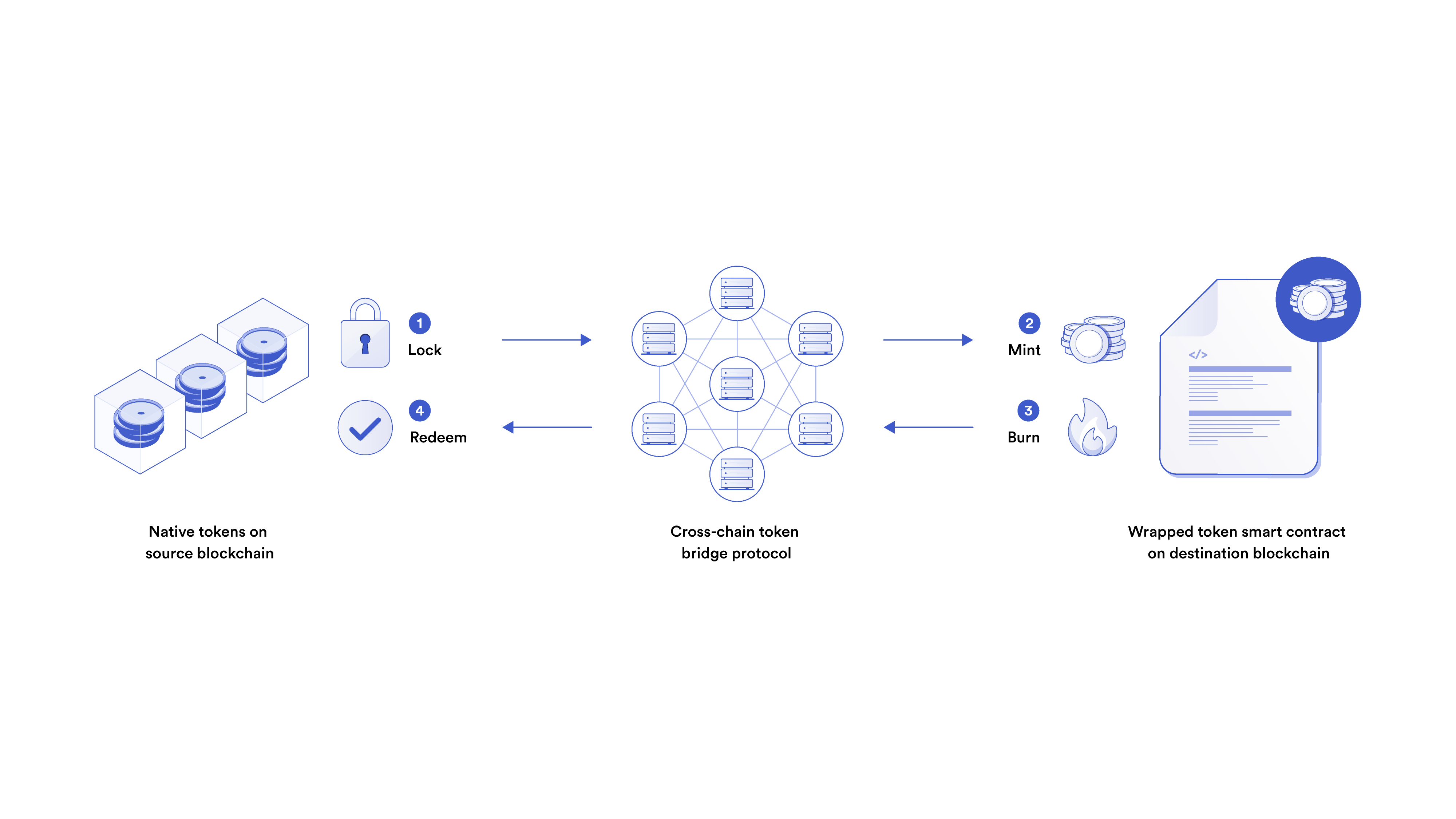

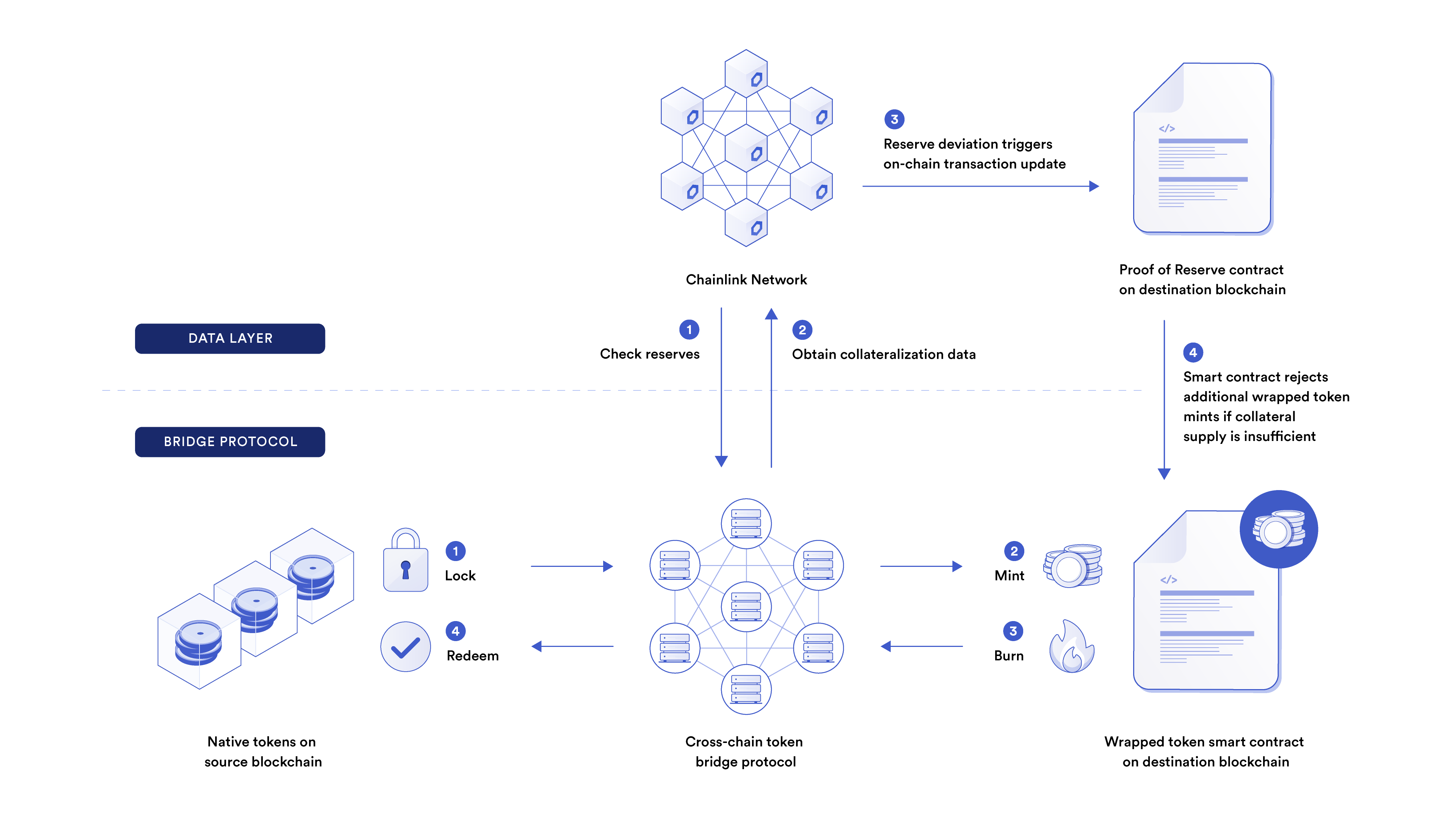

Cross-chain swaps can work in a variety of ways. Many current implementations rely upon cross-chain bridges, which wrap and lock up tokens on a source blockchain to create a 1-to-1 representation on the destination blockchain.

To perform a cross-chain swap, a user must lock up their tokens on the base blockchain, mint wrapped tokens on the destination blockchain, and then swap using a native decentralized exchange to buy the digital asset they desire. This process can be automated on the backend by cross-chain exchange protocols so that the user only needs to specify the asset they want to swap for and the digital asset they wish to receive. While this is a tried-and-true method of facilitating cross-chain swaps, users must trust in the security of the underlying bridge implementation.

There are also other ways to architect bridge protocols. The example above is a “lock-and-mint” bridge model. Other bridge protocols may use a “burn-and-mint” approach, in which tokens on a source blockchain are burnt and then minted on the destination blockchain, or a “lock-and-unlock” model where native supply exists independently on different blockchains. That said, cross-chain swaps that use bridging protocols all follow the same framework: Tokens on the source blockchain are locked or burned, and the user receives an equivalent number of tokens on the destination blockchain. Only then can they make the swap.

Atomic Swaps

Another method for facilitating cross-chain swaps is to use time-locked smart contracts through a process commonly known as an atomic swap.

Let’s imagine there are two counterparties (Alice and Bob) in an atomic swap, each aiming to swap one digital asset for the other’s. Both Alice and Bob lock up the correct amount of tokens in a smart contract on their respective blockchains. Only once both parties put the correct amount of tokens in each smart contract can they be unlocked. Alice receives the digital assets that Bob has originally locked up, and vice versa.

While atomic swaps are one of the most decentralized options for facilitating cross-chain swaps, it’s not a very generalizable or scalable model. For example, atomic swaps generally require blockchains to use the same hashing function, both counterparties to agree on the amount and exchange price, and the ability to wait a variable amount of time for the swap to go through.

Cross-Chain Liquidity

Cross-chain infrastructure, from bridges to exchanges, plays a crucial role in securely unlocking cross-chain liquidity. As more blockchains enter the Web3 industry and the adoption of new and existing blockchains continues to grow, liquidity becomes trapped across these digital environments. Fragmented liquidity decreases market efficiency across all blockchains, diminishes the utility of digital assets, and acts as a barrier for developers aiming to capture users across many blockchains.

Cross-chain bridges, swaps, exchanges, and other tools enable the formation of various types of cross-chain liquidity pools—connection points that help various blockchains access or transport liquidity from another blockchain. This is absolutely crucial for creating a unified Web3.

Chainlink for Cross-Chain Applications

At its core, the cross-chain problem that blockchains face today can be boiled down to data delivery and synchronization across blockchains. After all, tokens are simply a specific type of data stored on a blockchain’s decentralized ledger.

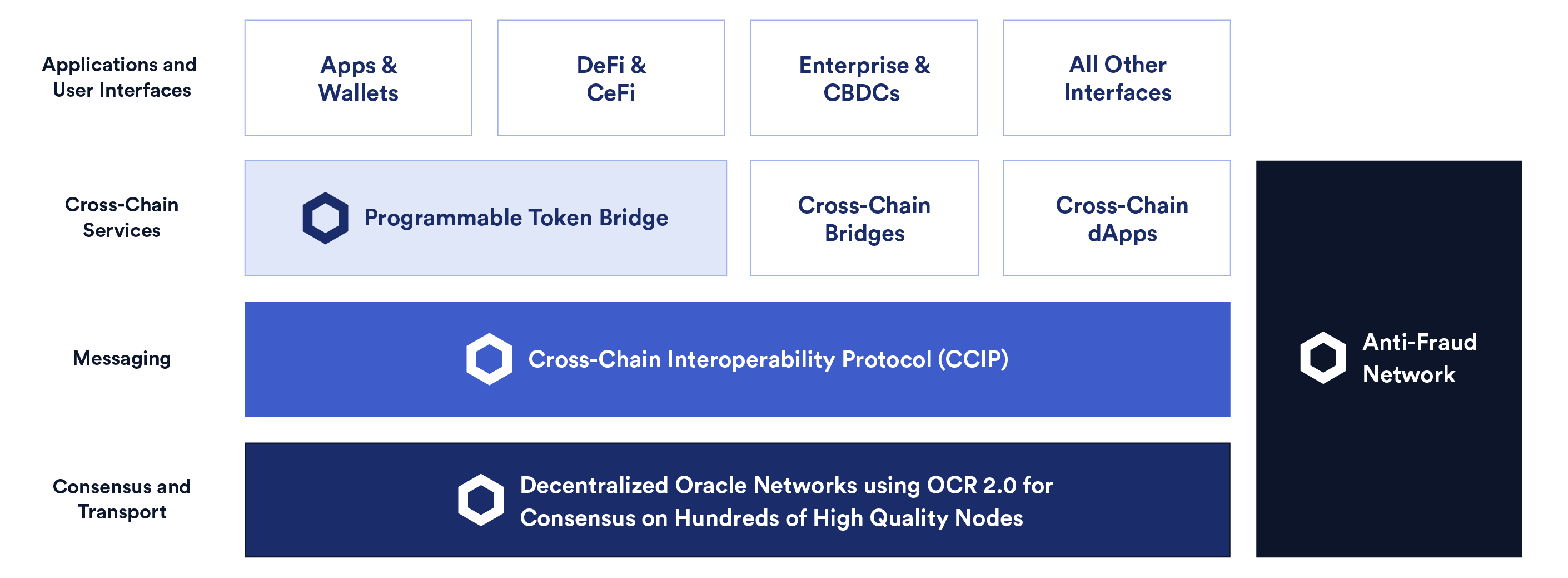

The Cross-Chain Interoperability Protocol (CCIP) is an open standard for cross-chain interoperability that’s currently in development. It’s designed to use Chainlink decentralized oracle networks (DONs) to enable programmable token bridges and secure, arbitrary, and trust-minimized messaging between blockchains. The core goal of CCIP is to establish a universal connection between blockchain networks—both public and private—to unlock isolated tokens and empower the creation of cross-chain applications.

In the context of cross-chain swaps, CCIP can support more efficient liquidity routing by enabling secure and seamless data delivery on liquidity conditions, token balances, and more metrics across various blockchains. Additionally, the programmable token bridge can enable any Web3 developer to build for a cross-chain environment without needing to directly manage the underlying bridge infrastructure. Cross-chain exchanges can then build better user interfaces, facilitate swaps at a lower cost, and offer a wider range of assets due to the unparalleled connectivity provided by the adoption of an open standard.

Conclusion

Cross-chain swaps remove the need for centralized intermediaries by enabling direct exchanges of value and information between blockchain networks. Simply put, they offer a more secure, transparent, and seamless way for users to trade assets across various blockchains.

As Web3 continues to grow and more applications and tokens are built on top of the growing network of blockchain ecosystems, cross-chain infrastructure like CCIP can play an increasingly important role in creating a unified user and developer experience.

Learn more about the emerging cross-chain ecosystem:

- Cross-Chain vs. Multi-Chain

- What Is Cross-Chain?

- What Is a Cross-Chain Bridge?

- What Is Blockchain Interoperability?

- What Are Cross-Chain Smart Contracts?

The post What Are Cross-Chain Swaps? appeared first on Chainlink Blog.

3

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.