2

0

With significant interest building up for our upcoming $DOP IDO on Polkastarter (21st of May at 13:30 UTC), we thought this would be a good time to do a recap on DOP tokenomics and its role in Drops governance.

DOP will primarily be used as a governance token for the Drops platform, in both on-chain and off-chain voting processes.

Due to the complexity of the protocol, on-chain voting will be split into two tokens: DOP and voting escrow DOP (veDOP).

The DOP token will directly be used for the governance of the Drops loans protocol, which will determine factors such as collateralization ratios, DOP emissions and the addition of new token markets.

Drops will also enable users to participate in “vote-boosting”, by locking up their DOP for voting escrow DOP (veDOP) — a mechanism inspired by Curve’s veCRV governance. The longer that a user locks their DOP for, the more veDOP tokens they will receive.

veDOP tokens will boost mining APY, collect pool emission and protocol fees, as well as be used for community valuation of NFT assets for use as collateral.

Off-chain voting will be focused on the general direction of the protocol, as well as treasury management. The use of treasury funds — primarily funded by platform fees — will be decided via off-chain voting via a weighted governance model.

Off-chain voting will distribute voting rights across the DOP, veDOP and NDR (Node Runners) tokens as follows:

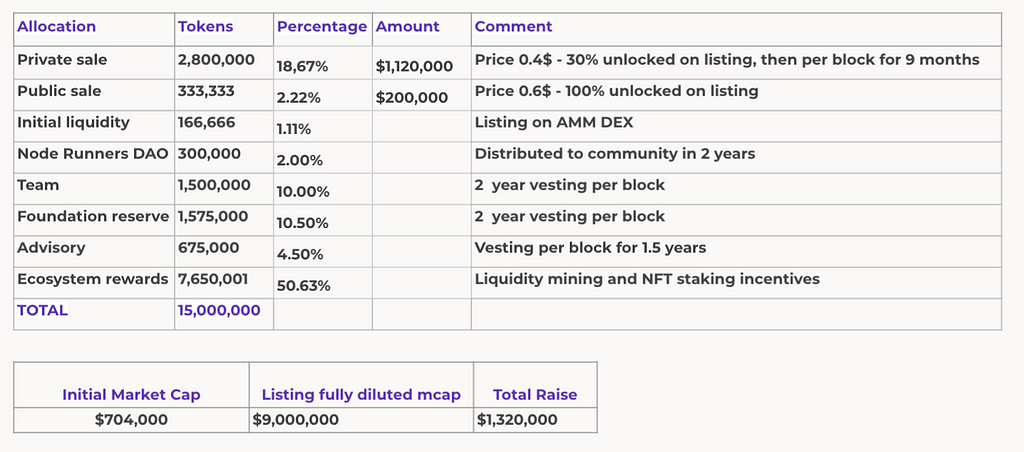

The maximum supply of DOP is 15,000,000 tokens. Here’s how they will be distributed:

*Node Runners DAO

To reward early supporters from the Node Runners community, a staking pool will be created containing 2% of the DOP supply. This will be distributed over the course of two years.

To keep up to date with all the latest development and news on Drops, follow the links below:

Twitter: https://twitter.com/dropsnft

Telegram: https://t.me/dropsnft

Discord: https://discord.gg/Zb9KapDA

Web: https://www.drops.co

2

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.