🌟 We're ETHernal

0

0

GM, and welcome to another edition of CoinStats Scoop! 🥂 Here’s an overview of this week’s newsletter:

The usual market overview and analysis with another green week throughout the crypto space

Updates on this week’s noteworthy news and developments

Breaking down Ethereum’s recent Shapella upgrade and ETH’s positive price movement

Reading & thinking about memes, crypto markets, and the factors driving them

Providing Tweets & Memes that capture the highlights of the crypto space

Weekly wrap-up: predictions & takeaways.

Market Overview

Another week in crypto has passed, and we've been rewarded with widespread price increases and green charts across the space. This week's main event was the much-anticipated ETH Shapella upgrade resulting in ETH closing the week with a 13% increase and comfortably above the crucial psychological level of 2k. 🤩

As for BTC, its substantial yet trailing gain of 8.5% paved the way for ETH and other altcoins to thrive in the ecosystem. Like ETH, BTC is also currently above its key psychological level of 30k, which is worth keeping an eye on in the upcoming days and weeks.

Now, to the rest of the ecosystem. As per usual, when ETH takes the lead and rises before BTC, it signals an upward trend for altcoins in the market. This week, many altcoins across different sectors expanded alongside ETH, with some top-performing tokens being:

Layer 2 & Scaling Tokens — INJ +58%, ARB +40%, ROSE +27%, OP +19%, KLAY +13%, MINA +12%

DeFi — DYDX +17%, CVX +15%, MKR +14%, JOE +11%, OSMO +11%, GMX +10%, COMP +9%, SNX +8%, AAVE +7%,

Alternative L1s — SOL +22%, NEAR +17%, ADA +16%, ATOM +16%, FTM +12%, APT +12%, BNB +12%, DOT +10%, AVAX +10%, CANTO +10%,

Infrastructure Tokens — RNDR +37%, HNT +27%, GRT +17%, LINK +12%, AR +12%, FIL +9%, RUNE +7%,

Gaming Tokens — RON +31%, MAGIC +21%, IMX +15%, APE +7%,

Miscellaneous Tokens — Bridging (SYN +33%, STG +14%), Dog Coins (FLOKI +15%, DOGE +10%), NFT platforms (BLUR +32%), Liquid Staking Tokens (RPL +29%)

As you can see, the alternative L1 token sector showed significant strength this week, with ETH's rally propelling the entire sector upwards. It may not seem entirely rational, but as ETH's market cap and fully diluted valuation increase, alternative L1 tokens follow suit as the entire sector is swiftly repriced. Furthermore, when ETH outperforms BTC, investors tend to increase their exposure to riskier assets across all crypto sectors, resulting in a market-wide rally. 😇

The market is currently hovering above the crucial psychological levels of 30k and 2k for BTC and ETH, respectively. Although the aggressive rally could potentially slow down, the overall trend remains upward. 💪

https://twitter.com/NoodleofBinance/status/1647318361939013632?s=20

While it's important to note that NoodleofBinance is just another Twitter user, they have a track record of being generally accurate about macro-market trends over the years. We at CoinStats share similar thoughts with Noodle, but we must also acknowledge that the market trajectory won't always be a straight upward line.

Nonetheless, despite the occasional bumps and bruises, the future of crypto looks promising as dedicated teams, including CoinStats, continue to develop and innovate in the space. We remain focused on the bright future that lies ahead for crypto. 🌞

News & Developments

Twitter and EToro partner to announce the launch of crypto trading offered directly to Twitter users, EToro to provide Twitter users with crypto assets' real-time prices

Michael Saylor’s $4 billion BTC bet is back in profit with BTC above 30k

Since The Merge, Ethereum has been burning ETH at an annual rate of $5.5 billion, reducing supply even as demand for ETH and its DApps continues to soar

Aptos (APT), the recently launched L1 blockchain, announced a $20 million incentive fund for artists creating on its blockchain

London Stock Exchange unit plans to start clearing Bitcoin futures and options

Binance completes Binance Chain’s BNB token's 23rd quarterly burn; this time, the exchange burned 2 million tokens worth around $674 million

Binance and the Brazilian Football Federation partnered to launch a free NFT to boost fan engagement for the league and attract more customers to Binance

The contributor team behind the upcoming L1 blockchain Sei has raised $30 million in two strategic funding rounds

Uniswap Labs receives Apple’s approval for their iOS mobile wallet launch

Metalpha, a Hong Kong-based digital asset manager, is raising $100 million to launch a licensed service in Hong Kong to allow investors to access GrayScale’s digital asset trusts comprising BTC, ETH & many other tokens

Global gaming company Razer announces the launch of zVentures Web3 Incubator to help founders and developers build next-generation blockchain-enabled gaming projects

Shapella Is Successful

As noted in the Market Overview, Ethereum successfully completed its Shapella upgrade this week, enabling staked ETH withdrawals. Some market participants worried that this upgrade would negatively impact ETH's price, as staked ETH could potentially be withdrawn from the Beacon chain and immediately sold.

However, with the benefit of hindsight, these concerns were greatly exaggerated, as ETH actually rallied 13% despite the upgrade. Fears concerned the potential significant sell pressure from ETH that had been staked on the Beacon chain since December 2020.

Contrary to the expected sell pressure, ETH’s diehard fans, who had staked their tokens for over two years, didn't sell their ETH. Instead, they continued to accumulate rewards for validating the world's second-largest and most active blockchain network. Terence has emphasized the Shapella upgrade's significant achievement and how it has closed the loop of the original Beacon chain design, enabling validators to securely deposit and withdraw their ETH whenever they wish.

https://twitter.com/etherscan/status/1646281789735047168?s=20

As Terence highlights below, Ethereum’s successful Shapella upgrade enabling withdrawals has completed the loop of the Beacon chain design. This gives some of the world’s largest asset managers confidence in ETH’s design, allowing them to buy, stake, and withdraw hundreds of millions of ETH without delay. 🤯

https://twitter.com/terencechain/status/1646279674702729216?s=20

Some other Shapella key takeaways include:

ETH is now a yield-bearing collateral asset you don’t need to sell to make a profit

It has dramatically reduced the number of ETH sellers, while the transition to Proof-of-Stake has increased the demand and buying pressure, resulting in ETH's price rise

ETH has now become a global internet bond that provides staking yield driven by the organic demand of users wanting to pay for ETH blockspace

Shapella's upgrade has significantly reduced the risks associated with the ETH withdrawal process, making it more attractive for institutional investors and large capital allocators to buy and hold ETH.

Indeed, Shapella’s completion is a significant milestone in Ethereum's roadmap, adding to its successful transition to Proof-of-Stake! As Anthony Sassal says, Ethereum just keeps winning.

In addition, Ethereum's continuous efforts to improve itself are notable. The upcoming major upgrade, EIP-4844, is anticipated to occur this year and is expected to increase the L2 ecosystem's scalability drastically. 🤑

https://twitter.com/sassal0x/status/1646324241930006528?s=2

Read of the Week

“On Reflexivity & Imitation” — Matti

Previously, we've featured a few reads from Matti and his investment firm Zee Prime Capital, and here we are again with another read from Matti. Unlike the previous ones, this is a timeless read initially published in November 2020.

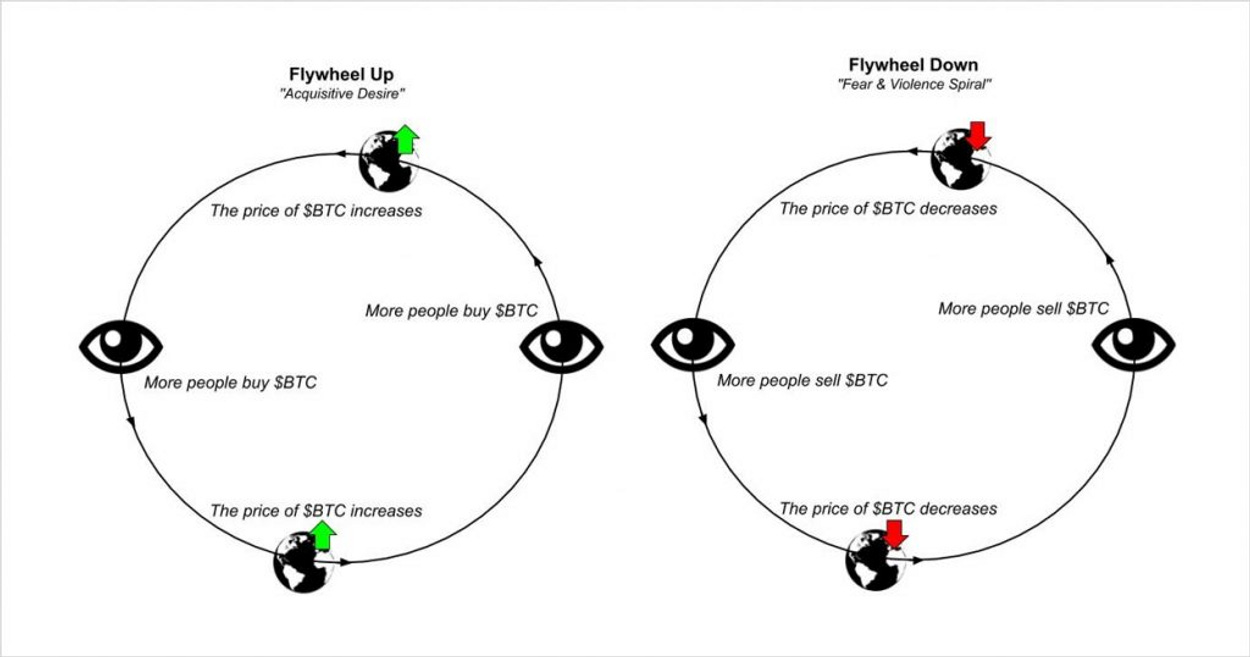

In this post, Matti explains the concepts of reflexivity and imitation, delves into the power of memes and their impact on crypto asset prices, draws on Girad’s mimetic theory, and outlines the flywheel of the desire equilibrium depicted in the image below.

“As software-enabled speculation eats the world, the fine line between reality and the game can blur prices, drive desire, desire drives prices. Reflexive assets are prone to volatility as narratives tend to be whimsy. Memes scale information distribution as memes are mere narratives; there is no physical boundary to a meme itself. Price is a coordination data point, informing us about the true state of the world. In a highly reflexive environment, things become valued not at what they are, but how good their memes are.”

In addition to the quotes mentioned above, Matti provides some takeaway thoughts that were incredibly relevant upon publishing in 2020 and remain extremely important today. We believe they will continue to ring true for a long time, especially in the context of crypto and financial assets. The following key points highlight some of these lessons:

Certain financial assets, such as crypto, are more reflexive than others

The amount of money in the system affects the reflexivity of financial assets

Memes and markets share similarities, as both compile information

The mind can influence market movements and vice versa.

Asset prices can be influenced by memes, and the “price becomes the news”

Highly reflexive assets are subject to mimesis, which is the imitation of the real world.

By understanding the concepts of reflexivity, imitation, memes, and mimesis, investors and traders can gain insights into the crypto market and financial assets like crypto and navigate the complex and ever-changing crypto landscape with greater confidence and success.

CoinStats Reads

Welcome to the CoinStats blog, your go-to source for the latest news and insights into the ever-evolving cryptocurrency world.

In this read, we've compiled a series of articles on AI-powered cryptocurrencies and the impact of the AI boom on the crypto market. Our comprehensive guide also highlights the top AI crypto projects and countries driving this trend and presents comprehensive charts.

We're talking tips, strategies, and insider knowledge on how to participate in upcoming airdrops effectively, identify legitimate airdrops, and avoid those nasty scams. With our help, you'll be filling up your wallet with free crypto in no time!

But we don't stop there. We also want to help you succeed in the crypto world, and diversification is key. That's why we've got an article on the benefits of diversifying your crypto portfolio. We'll provide you with tips for selecting a diverse range of coins that can help you reduce risk and increase your chances of long-term success. Trust us; you don't want to put all your eggs in one crypto basket.

We also examine Pancakeswap, the decentralized exchange on Binance Smart Chain for trading cryptocurrencies.

Finally, we address one of the most popular and controversial topics in the cryptocurrency space: Bitcoin. Our article aims to provide you with valuable insights into the risks and rewards of investing in Bitcoin and answer some most commonly asked questions about this revolutionary digital currency.

So what are you waiting for? Dive into our articles and get some insights and tips:

This comprehensive guide discusses the capabilities of AI-powered cryptocurrencies and explores how the the-ai-boom-affected the crypto-market, top AI crypto projects, and countries driving this trend.

Discover crypto-portfolio-diversification strategies and learn from examples to optimize your investments for less risk and more return.

Learn about LayerZero technology, layerzero-airdrop, and funding, as well as tips and strategies for maximizing your chances of receiving the airdrop.

Gain valuable insights into Pancakeswap, the decentralized exchange on Binance Smart Chain for trading cryptocurrencies.

Find out more about the risks and rewards of investing in Bitcoin and get answers to what-are- bitcoins, how does bitcoin mining work, and more.

Tweets & Memes

Uniswap’s Wallet is officially coming to mobile app stores worldwide

https://twitter.com/Uniswap/status/1646514969746501633?s=20

A brief explanation of NFTs and why they’re drastically better than anything before

https://twitter.com/ASvanevik/status/1647258918299791361?s=20

The era of mobile-first crypto has finally begun, with the Solana phone and Uniswap app hitting the market this week

https://twitter.com/JasonYanowitz/status/1646520129008848905?s=20

Wrapping Up

We'll wrap up this week’s CoinStats Scoop with the above tweet demonstrating the potential for mobile crypto applications to tap into the new market. 💫

As usual, we discussed the regular market updates and another incredibly green week throughout the crypto ecosystem. Plus, we covered ETH’s Shapella upgrade and examined the sectors that tend to benefit the most when ETH leads the market upwards.

Finally, we explored the significance of reflexivity, imitation, and memes in the crypto world and highlighted the flurry of news & developments, underscoring the rapidly-evolving landscape of the crypto ecosystem. 💪

CoinStats will continue to guide you through the crypto and DeFi world. We'll see you next week for another edition of CoinStats Scoop! 😎

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.