💫 Join the Midas Revolution

0

0

CoinStats Scoop

GM, and welcome to another edition of CoinStats Scoop! 🥂 In this week’s newsletter, you'll find:

The usual market overview featuring the latest updates on the overall market

Weekly updates on this week’s noteworthy news and developments

Analysis of the US SEC's actions against Coinbase & Binance

Highlights of crypto's global movement & long-term upward trajectory

Reads about the market's current state and optimistic outlook

Tweets & Memes capturing last week's highlights

Weekly wrap-up: predictions & takeaways.

Market Overview

While altcoins faced an incredibly tough week, BTC and ETH maintained significantly higher values compared to the beginning of the year at 16.6k and 1.2k respectively. Despite the US regulatory actions, the total crypto market remains above the $1 trillion psychological level, and BTC (-4%) and ETH (-7%) demonstrated relatively resilient responses. Although current prices may not feel ideal, it's important to acknowledge these factors. Just six months ago, regulatory actions against Coinbase and Binance could have caused a 10-15% drop in BTC and ETH immediately upon news release. Instead, these two major crypto assets only experienced a modest ~5% decline, highlighting the global nature of crypto as an asset class with millions of holders worldwide. 🤯

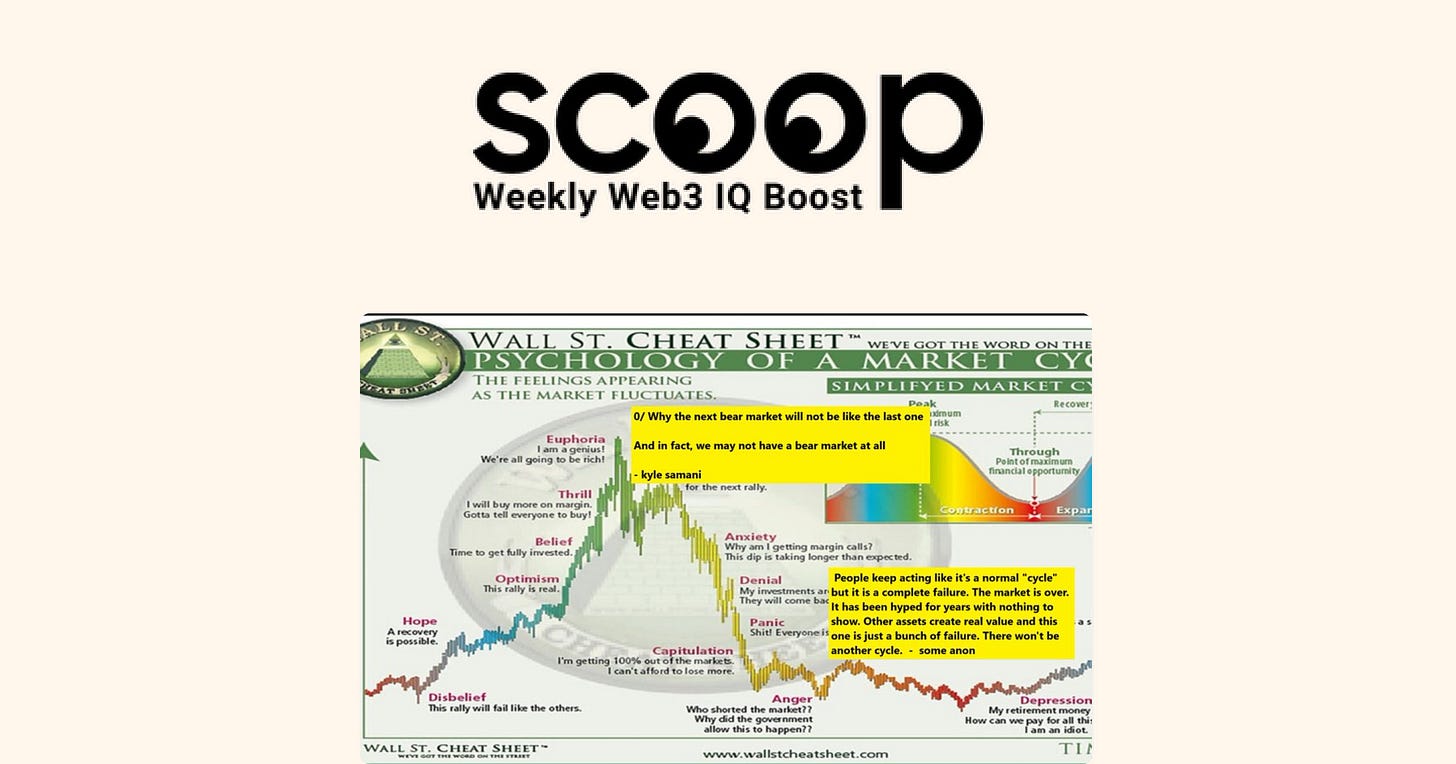

In addition, the recent crypto market sentiment has reached remarkably low levels following an unexpected sell-off on Friday night. On the bright side, crypto has a distinct capacity to reward those who remain steadfast in the face of adversity. Presently, there seems to be a widespread anticipation of further downward movement, although it's worth noting that signs of frustration and pessimism are increasingly emerging, which often precede a subsequent upward shift.

As our feline friend humorously indicates below, the prevailing sentiment appears to be a mix of anger and depression, setting the stage for a potential rebound. 🧐

Despite the possibility of further price declines in the coming weeks and beyond, it's worth noting that the overall upward trend since the beginning of the year remains intact, with BTC and ETH still comfortably above the critical levels of ~20k and ~1.2k. In this week's News & Developments section, you’ll see announcements from Avalanche (AVAX), Chainlink (LINK), and Optimism (OP) regarding advancements contributing to the future growth of crypto. One of the unique aspects of the crypto industry is that while prices are readily visible on the front-facing charts, constant behind-the-scenes building and development work persistently takes place. Fortunately, this continuous progress lays the foundation for the next inevitable cycle and sets the stage for a brighter future for the global asset class. 🌞

The recent selloff in altcoins has led to a notable increase in Bitcoin (BTC) dominance, reaching levels not seen since the beginning of 2021.

Despite this week's scary red numbers, the crypto ecosystem continues to thrive with teams working tirelessly to develop and release updates, protocols striving to enhance their tokens and platforms, and cryptocurrencies remaining useful to individuals relying on them. Additionally, on a global scale, numerous countries are eager to embrace crypto, recognizing the economic and tax advantages it offers and the potential for job creation that it brings, which serves as a counterbalance to the adverse consequences of misguided decisions made by certain countries like the United States. 🤯

News & Developments

Avalance (AVAX), launches Arcad3, a program to help traditional gaming companies enter blockchain gaming and accelerate their development

Optimism (OP) completes its long-awaited Bedrock protocol upgrade

CoinStats enables tracking BRC-20 tokens & unisat wallet natively in the CoinStats app

Aave (AAVE), one of crypto’s largest DeFi protocols, initiates the launch of its native stablecoin GHO

NFT-powered Lens Protocol raises $15 million to continue scaling and building its platform on Polygon’s MATIC

Meanwhile, the first ever digital asset-denominated life issurance provider raises $19 million to offer BTC-denominated insurance products

Circle, the second largest stablecoin issuer, announces USDC is now natively available on the leading ETH L2 scaling solution Arbitrum (ARB)

Crypto exchange Kraken officially launches its NFT marketplace, including support for ETH, MATIC, Reddit’s digital collectibles & more

BitGo, the most secure and scalable solution provider for the digital asset economy acquires Prime Trust to expand digital asset and fintech infrastructure services worldwide

Taiko Labs, the builder of a decentalized and Ethereum-equivalent zero-knowledge L2 scaling solution, raises $22 million to further its efforts to scale Ethereum

London-based Gensyn, a blockchain-based marketplace protocol connecting buyers and sellers of compute power, raises $43 million to scale their protocol

SEC vs. Coinbase & Binance

As mentioned in the market overview, it was a tough week for crypto (specifically for the United States based market participants) since SEC filed lawsuits against the biggest US-based exchange, Coinbase, and the largest global exchange, Binance.

In response to SEC’s filing, Brian Armstrong, Coinbase's CEO tweeted that, “we’re proud to represent the industry in court to finally get some clarity around crypto rules. In the meantime, let’s all keep moving forward and building as an industry.” 😤

Despite the short-term impact of US regulatory actions, it is crucial to note that both exchanges, Coinbase and Binance, have affirmed their commitment to operating normally. While the US SEC retains the ability to initiate claims and lawsuits for alleged violations, it is important to recognize that individuals and companies have the opportunity to present their defense in court. Coinbase has consistently expressed its anticipation for its day in court and the opportunity to defend the entire crypto ecosystem. 🤓

Regarding Binance, it is worth noting that they have temporarily ceased accepting new business on their Binance US exchange. However, their global Binance exchange continues to operate normally. It is essential to keep in mind that cryptocurrency is a global asset class, and Binance is an exchange with a global presence located overseas. The regulatory influence of the US SEC primarily affects companies and individuals based in the United States. Therefore, while headlines and commentary may induce concern, it is important to recognize the global nature of crypto and the specific scope of the SEC's regulatory impact.

To further emphasize that point, as you can see above, the global landscape continues to demonstrate a positive attitude towards cryptocurrencies, contrasting with the regulatory challenges faced in the United States. In addition to the UK’s recent statement in support of crypto, we've also received promising news from Europe, marching towards passing a landmark comprehensive crypto framework called MiCA (Markets in Crypto Assets), and Hong Kong, reaffirming retail crypto trading available at select exchanges from June 1st. Latin America and other regions have also continued to embrace crypto, with their citizens adopt worldwide. 💪

In support of our comments, redphonecrypto, an anonymous crypto participant, contributor to the crypto behemoth Delphi, and crypto market veteran, provides some thoughts and optimism about the future in response to SEC’s actions against Binance in particular.

As mentioned in the second point of the tweet, regulatory actions and widespread market fear often coincide with local bottoms and mark the initial stages of a bear market's conclusion. Plus, the thread imparts valuable wisdom highlighted below:

“There’s just not many horseman left for the wolves; signs of seller exhaustion (and crypto exhaustion in general) show up anywhere you look; buy blood, not beauty.” 😤

Competition is always good and if something were to happen to Binance, competition would step up from 3 places: traditional finance/fintech, new exchanges, and DeFi’s continued expansion and development

CZ and Binance are largely responisble for taking crypto user experience from the dark ages into the light, an admirable achievement

The digital realm continues its cannibalization of the old physical infrastructure; “once upon a time you had to walk into a broker’s office to trade; then, you had to pick up a phone; then, you could make your own trades online”

“It’s clear we march toward a world where every piece of the exchange stack is decentralized, from domain name to the backend compute to hosting”

Closing thoughts: “Don’t treat Binance like your wallet. Don’t give up on crypto.”

While the prices and headlines may paint a somber week for the crypto ecosystem, this week’s events also reiterated that crypto is a global asset unaffected in the long term by one country's decision! Previously China had “banned” crypto resulting in short-term panic and tokens selling off but zooming out, it’s almost impossible to see those reactions on a long time frame chart of BTC and ETH! The headlines are scary, but the fact tht crypto is a global asset class means that the reactions and headlines are short-term blips on the long-term trajectory of where crypto is headed. 💫

Read of the Week

“Summertime Sadness” — Onchain Wizard

This week, our read comes from a crypto veteran and the founder of ChainEDGE providing cross chain swap analytics to traders. Despite the somber title, Onchain Wizard provides an optimistic view on the current state of crypto. 💪

Onchain Wizard provides “an overall everything guide to where we are in the crypto cycle, what smart money is buying, and what narratives are driving the market.”

Onchain Wizard brings attention to the profitable strategy of counter-trading and buying when the mainstream media declares that crypto is finished, a strategy that has been consistently rewarding over the past ~8 years. Considering the headline below, it suggests that we are nearing a point where the naysayers will once again be proven wrong about the immense future potential of crypto 😤

“I think there are a lot of near term bottom signals flashing right now. Smart money continues to deploy their stablecoins, with stablecoin holding ratios down to pre Luna levels; with macro liquidity headwinds hopefully abating by the end of this year, I think personally we are within ~10% of a near term bottom on the majors. Despite market sentiment, I am leaning bullish based on smart money accumulation in the market, a number of “sentiment bottoms” and a hopeful reversal in macro conditions later this year.”

In addition to the wise words and thoughts above, Onchain Wizard highlights the narratives driving the current market below:

Memecoins — The category is still dominating decentralized exchange (DEX) trading volumes (although losing some steam as of late)

Liquid Staking Derivative Finance (LSDFi) — “Probably the largest fundamental narrative over the summer.” LSDFi refers to the financial primiatives built on top of the growing number of staked ETH

Arbitrum Low Cap Gems — the continued quiet success of a few recent token launches on Arbitrum

Trading Tools — Memecoins are driving DEX market attention, and automated bots helping trade memecoin tokens have been gaining momentum.

CoinStats Reads: Midas, a Smart & User-Friendly Alerting System for NFTs

CoinStats Midas is a smart and user-friendly NFT alerting system revolutionizing NFT trading. It was desiged to address the challenges faced by traders in tracking and identifying promising NFT transactions. Unlike other tools, Midas utilizes statistical significance to deliver meaningful alerts in the bustling NFT market.

By analyzing wallet interactions with NFTs, Midas identifies statistically significant transactions involving three or more wallets. Integrating with top NFT collection holders, Midas eliminates the need to manually discover promising wallets. Through continuous testing and refinement, Midas evolved to filter out unprofitable trades and focus on wallets with positive profit and loss (PnL) outcomes.

Midas provides users with easy-to-understand alerts that highlight notable wallet activities, such as the number of purchases and average prices. With the PnL checker, wallets' profitability is regularly monitored, ensuring users can make informed decisions. Midas simplifies NFT trading by automating the tracking process, allowing users to spend quality time on other activities without missing out on promising NFT collections.

Future plans for Midas include further integration with platforms like Discord and Telegram, as well as customization options for tech-savvy users. Additionally, Midas aims to extend its intelligent alerting system beyond NFTs to the broader crypto landscape.

In conclusion, CoinStats Midas is a revolutionary tool that makes NFT trading accessible, profitable, and user-friendly. It transforms the noise of the NFT market into valuable insights, inviting you to join the Midas Revolution today!

Tweets & Memes

Crypto is a global market, and the US SEC can only have a brief impact on it 😤

Optimism’s highly anticipated Bedrock upgrade improving the scalabilty of the ETH L2 is live!

As Onchain Wizard highlighted above, when everyone ignores crypto, it’s time to double down

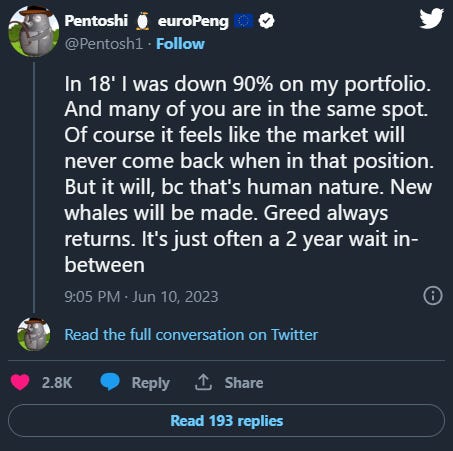

It’s easy to succomb to the negative thoughts, but crypto always returns stronger 💪

Wrapping Up

We'll wrap up this week’s CoinStats Scoop with Pentoshi’s tweet highlighting crypto's ability to bounce back and the fact that the next eventual cycle is slowly approaching. 💫

As usual, we provided the regular market update, talked through endless reasons to be optimistic about the future of crypto, highlighted the global adoption and embrace of crypto despite the US’s recent actions, talked through the countless signals that are likely marking a soon to be bear market bottom, read about the current market and narratives to watch and highlighted the tweets and memes showcasing another week of building toward a promising future for crypto. 💪

CoinStats will continue to guide you through the world of crypto and DeFi. We'll see you next week for another edition of CoinStats Scoop! 😎

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.