A Regulated Stablecoin Means Having a Regulator | Paxos

1

0

I have been reading with a combination of disbelief and exasperation the recent claims by Circle that “USDC has become the world’s most trusted and well-regulated dollar digital currency,” as well as by Tether that “Tether is registered and regulated.” Neither USDC nor Tether is a regulated digital asset, for the simple reason that neither token has a regulator. In fact, neither USDC nor Tether tokens are “stablecoins” in anything other than name. These tokens are backed by illiquid and risky debt obligations — a critical weakness that no prudential regulator would allow to exist as this creates undue risk for their customers.

This is the key issue. Even if USDC or Tether adjusted their reserving practices so that their tokens were to actually become stablecoins (legitimately backed, 1:1, by US dollar or equivalents), rather than just in name, that should still be of grave concern to customers, regulators and public interest groups. As we have all seen time and again, proper regulation of financial services firms — which must include comprehensive oversight of the products and services offered by those firms — is the only way to protect clients and customers. What does that mean tangibly? There is direct oversight of client protections, resolution planning if there is a failure, privacy protections, consistent reserving practices plus audits and exams to verify this. In other words, even if USDC or Tether decided to now fully back their tokens with dollars, there would be nothing to prevent them from changing those practices back at will.

As a former financial regulator, and through my role at Paxos Trust Company, I have participated in the hard work of getting actual regulated stablecoins approved by an actual regulator, subject to the actual limitations that being regulated puts on a token. So I know what it means for a digital asset to be regulated; it means that a prudential regulator imposes safety and soundness requirements on the reserves backing the asset. As this ecosystem rapidly expands, it’s important to clarify what regulation is and what it is not.

This is deeply important as the crypto industry generally and specifically stablecoins shifts from early adopter instruments to mainstream consumer payments for goods and services. This shift has the potential to change the lives of everyone in the world, particularly those without ready access to the financial system — unfortunately, still billions of people today. Transparency in operations is crucial and should be required, but in itself is not enough. Trustworthiness and regulation are instrumental to realizing the enormous potential of stablecoins in the long-term.

REGULATED STABLECOINS

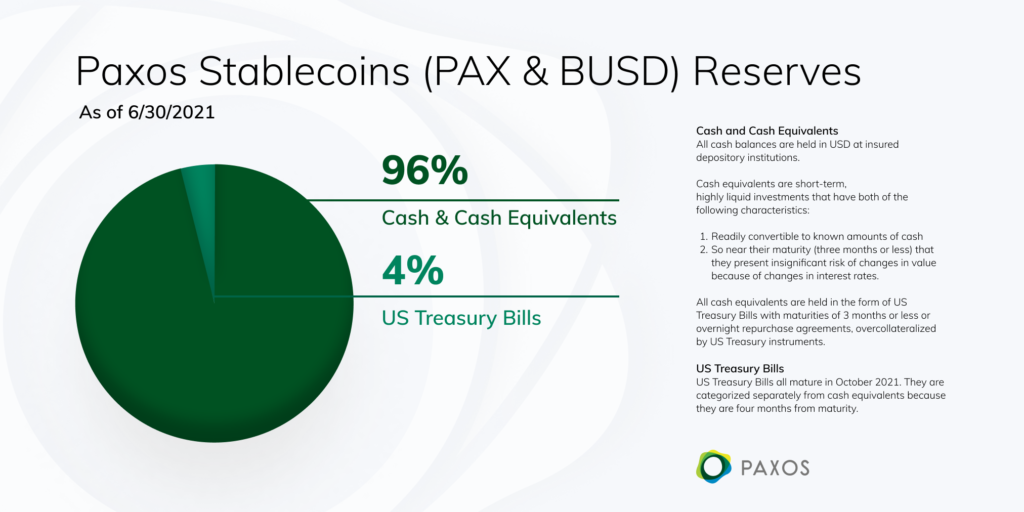

As of today, there are exactly three regulated dollar-backed stablecoins in the world: Paxos Standard (“PAX”) and Binance Dollar (“BUSD”), both issued by Paxos Trust Company, and the Gemini Dollar (“GUSD”), issued by Gemini Trust Company. Paxos and Gemini are both Trust companies regulated by the New York State Department of Financial Services (“NYDFS”). Trusts are required to have their products and services approved and supervised by NYDFS. PAX , BUSD and GUSD are expressly approved by the NYDFS and supervised by the regulator on an ongoing basis. This means:

- The value of each stablecoin token is tied directly to the value of the US dollar, and the amount of “reserve” dollars equal or exceed the number of stablecoins outstanding.

- Regulators are overseeing the establishment and maintenance of reserves backing the stablecoins.

- Reserves may only be held in the safest forms, such as FDIC-insured bank accounts and in short-term maturity US Treasury instruments.

- Reserves are fully segregated from corporate assets, specifically for the benefit of token holders, and are held bankruptcy remote pursuant to the New York Banking Law.

Regulatory oversight is important because it assures stablecoin users that the dollars underlying their stablecoins are secure and will be immediately available when they want them. The NYDFS ensures the Trust companies and their individual tokens are following its strict rules at all times. Additionally, NYDFS regulatory oversight meets the ten high-level recommendations for stablecoins set forth by the Financial Stability Board in an important report issued last year for the G20.

UNREGULATED “STABLECOINS”

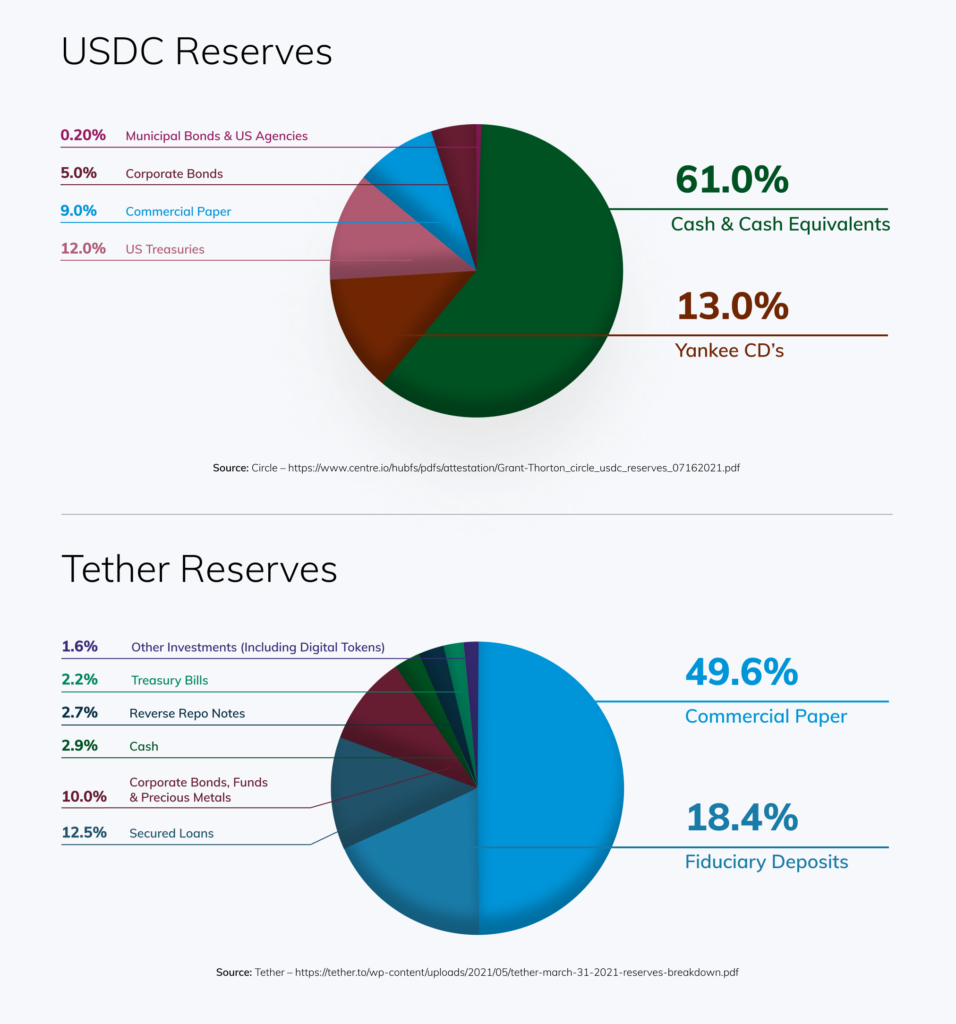

“Stablecoins” not subject to prudential regulation do not have the same oversight and guardrails. USDC and Tether reserves are not comprehensively overseen by any financial regulators. Their reserves are broadly unrestricted and not held bankruptcy-remote under applicable law. This means:

- The USDC and Tether reserves are backed substantially by corporate debt obligations.

- The consumer is not protected or guaranteed to get their dollars back when they redeem the token.

- There is illiquidity risk because these investments have maturities as long as several years.

- There is credit risk from a corporate default.

- There is interest rate risk that can impair the value of longer maturity securities.

- In the case of USDC, reserves are held on Circle’s balance sheet , implying that Circle views USDC reserves as its own property.

- The issuer can (and often does) use consumer funds to pursue risky high-yield investments for its own financial gain.

USDC and Tether are used frequently in the crypto economy and have a useful role to play, just as Bitcoin, Ethereum and other unregulated digital assets play an important role. Users who are willing to tolerate the risk of a token backed by only 61% cash or cash equivalents (in the case of USDC) or 5% (in the case of Tether) should be free to take that risk — subject of course to applicable securities laws. But these tokens are not regulated, and they should never be confused with a regulated token.

The principal value of regulatory oversight is to ensure that the reserves consist of real, liquid, accessible dollars — if neither USDC nor Tether can fulfill these promises, can they even be considered dollar-backed stablecoins?

Originally published at https://www.paxos.com on July 21, 2021.

A Regulated Stablecoin Means Having a Regulator | Paxos was originally published in Paxos on Medium, where people are continuing the conversation by highlighting and responding to this story.

1

0

Gerencie todo seu criptograma, NFT e DeFi de um só lugar

Gerencie todo seu criptograma, NFT e DeFi de um só lugarConecte com segurança o portfólio que você está usando para começar.