SmartCoin: Defi Sensation with a Mysterious Prize is Going Viral After Announcing Memecoin Airdrop

3

0

What is SmartCoin?

SmartCoin, an innovative, self-feeding yield farm on Avalanche, has gone viral on Twitter and Telegram after generating jaw-dropping APRs that reached 26,000% and looping yield-farmers into a social experiment that is not always what it seems. The project has many in the Defi space paying close attention for what’s next.

Emin Gün Sirer, founder of Avalabs, recently stated on Avalanche’s podcast that, “SmartCoin is doing amazing marketing…their tweets are funny, irreverent, and amazing.”

@el33th4xor, CEO of @avalabsofficial and legendary crypto Twitter giga-brain, knows what's coming for the Smart Ecosystem and that the best marketing team in crypto is just getting warmed up.

— SmartCoin?(?,?) #GetSMRTr (@0xSmartCoin) November 5, 2021

Strap in folks. pic.twitter.com/vdLb1SuRoy

This all points to SmartCoin’s two primary goals: to provide safe, stable, and profitable crypto experiences, and to completely break Defi. To that effect, SmartCoin is a multi-phased project with each phase veiled in mystery. As a social experiment, the tokenomics, investing strategies, and core mechanics of the platform are subject to drastically evolve from phase to phase, with each iteration exploring a key concept in economic theory, human behavior, and Web3 innovation. The video below provides more details.

In a recent phase, SmartCoin announced a memecoin airdrop to all liquidity providers sometime in November. Given the recent frenzy and volume of transactions created by memecoins, it is not surprising to see projects like SmartCoin using meme token momentum to produce an innovative take on yield farming and marketing in Defi. Other announcements have included single-sided staking, leaderboards, podcasts, and a big marketing rollout.

Rumors are circulating that SmartCoin plans to invest over $500,000 on marketing and promotions.

How does SmartCoin work?

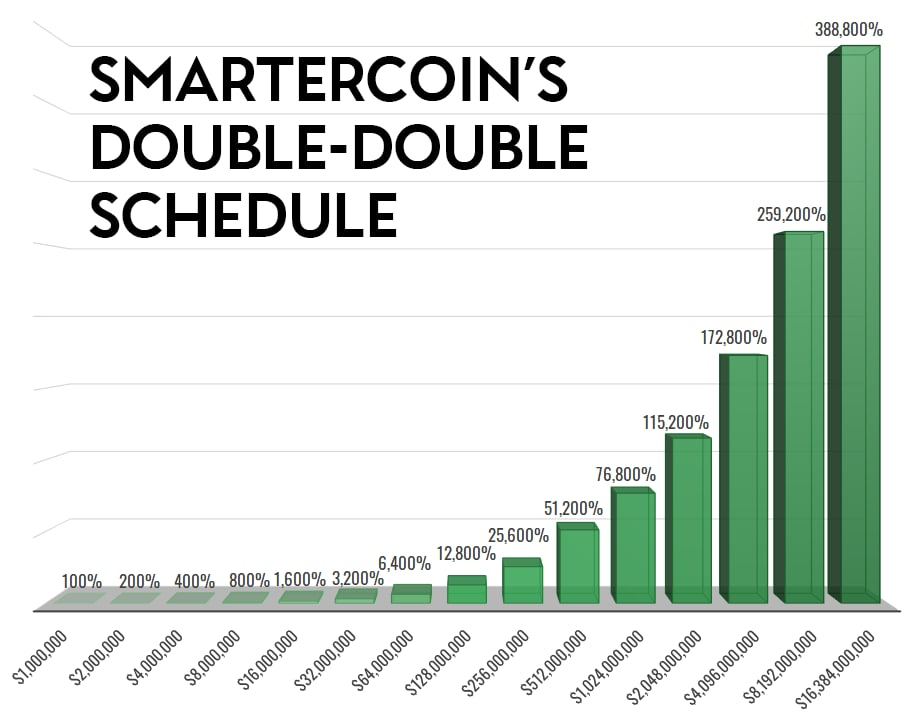

SmartCoin is underpinned by a fundamental hook that has captured Defi's attention: when TVL (total value locked) doubles, APR% doubles. In theory, this creates a self feeding loop—the higher the APR%, the more interest yield farmers will receive to stake their liquidity. If enough farmers stake liquidity, the total value locked (TVL) eventually doubles, which leads to a second doubling of the APR and so on, creating a cycle of loops, illustrated below.

To achieve this outcome, SmartCoin employs various price stabilization mechanisms in an attempt to offset the sell pressure of high emissions: the Bollinger Booster, SmartBuy, and DumbFee.

Bollinger Bands are a set of trendlines used to determine when prices are high or low relative to a moving average. When SmartCoin prices begin to trend down, SmartCoin employs a booster mechanism, which increases the APR% yield, enticing yield farmers to increase TVL, again.

A second mechanism, known as SmartBuy, is simultaneously implemented during falling price action, augmenting the Bollinger Booster by purchasing SmartCoin at random intervals via a proprietary machine-learning algorithm.

The capital for these “SmartBuys” is supplied from a third innovation aptly named "DumbFee." SmartCoin charges a 7% penalty to liquidity providers when they exit their position from the pool. From that 7% fee, half (the AVAX tokens) fund SmartBuy, supplying it with capital to submit large buy orders. The other half (the SMRTr tokens) is sent to a burn address, slowly removing token supply from the SmartCoin ecosystem.

Game theory, memetics, and Squid Game

SmartCoin's game theory derives from (3,3), a concept that may be familiar to Olympus Dao enthusiasts. In essence, if everyone interacting with the SmartCoin protocol were to cooperate with each other, it would lead to the most profitable outcome, and vice versa. SmartCoin ingeniously weaves this concept into their viral marketing and memes with references to the recent blockbuster Netflix show "Squid Game," whose players relied on cooperation to succeed.

Aside from the high-yields in the SmartCoin defi farm, their social media has hinted that "Diamond hands" (hodlers) will be generously rewarded, creating a cloak of mystery that has the actively growing community buzzing and connecting dots.

Part Defi, part social experiment, part: whatever comes next. SmartCoins' Twitter and Telegram communities have seen viral growth, reaching over 40,000 users across both platforms, most of the growth occurring in the past week.

SmartCoin has regularly tweeted “clues” to encourage the community to DYOR (do your own research). One clue is that "wallet reputation" will be an important factor in determining future rewards. Reputation scores are a new concept in crypto, and speculation on the implications have run rampant in the official SmartCoin community.

Are the devs tracking SmartCoin buys and sells or when players remove or add to LP? It's even been posited that SmartCoin may be collecting social handles tied to the wallets, and tracking social media behavior.

SmartCoin announced on Twitter that the winner of their game may be in store for an 8-figure prize, an enticing carrot for current and future players to follow the clues of the SmartCoin game.

Giga-levered OlympusDAO. Memecoin. High-reputation wallets (lol @ wallets that transfer $smrtr to another wallet). Media blitz. High-profile names coming out supporting. 8-figures to winner(s).

— SmartCoin?(?,?) #GetSMRTr (@0xSmartCoin) November 4, 2021

Few.

Even crypto legend and CEO of Three Arrows Capital, Su Zhu, has chimed in with his take on SmartCoin, calling the project, "One of the most fascinating social experiments I've seen in recent times."

Pretty impressive to see @0xSmartCoin successful migration from phase to phase, and having one of the largest user counts on all of @avalancheavax #Avalanche

— Zhu Su ? (@zhusu) November 2, 2021

One of the most fascinating social experiments I've seen in recent times

Whatever the future holds for SmartCoin and it’s impact on the crypto space as a whole, rest assured the story will be an interesting one to follow.

Founders & Investor Security

SmartCoin employs a fully KYC-verified team of former founders, a Harvard professor, Amazon/Apple developers, a triple-A game architect, and professional yield farmers. They have a direct advisory board composed of core members of both Trader Joe and Avalanche.

The exact identities of the core team have been privately revealed to RugDoctor via their KYC verification process, so a degree of founder authentication does exist.

SmartCoin's smart contracts have been audited by two of the most trustworthy companies in defi: RugDoc and Paladin. The smart contracts were modeled after Avalanche's Dex, Trader Joe. The SmartCoin team has also verified liquidity locks with RugDoc.

How to acquire SmartCoin (SMRTr)

SmartCoin can be acquired on Avalanches' decentralized exchange; TraderJoe.

Learn more at https://smartcoin.farm/

3

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.