Where and How to Buy StormX [Step-By-Step Guide]

4

0

StormX is a decentralized platform that runs on the Ethereum network and allows users to earn popular cryptocurrencies such as Bitcoin, Ethereum, the stablecoin Dai, and also StormX’s own token, STMX while shopping online. The idea is that people enable the Chrome browser extension or use the StormX app and then make online purchases at the preferred online partners such as eBay, Microsoft, Uber, Nike, Lego, etc., using traditional fiat currency, and in return, they get crypto cashback rewards.

STMX is the StormX protocol's native token, an ERC-20 token with over $50 million market cap and 10 billion coins in active circulating supply as of late Nov 2022. STMX is used for governance and staking of the StormX platform.

StormX also offers a marketplace (Storm Market) based on blockchain technology to allow users to earn STMX tokens by completing different tasks. Simply download StormX via the iOS or Android app from the App Store or Google Play store or activate the Chrome Button to shop on one of 1,000+ online stores and earn Crypto Cashback from 0.5% to 87.5%, depending on your StormX Reward Membership level.

Read on for our quick step-by-step guide on where and how to buy StormX STMX.

Let's get started!

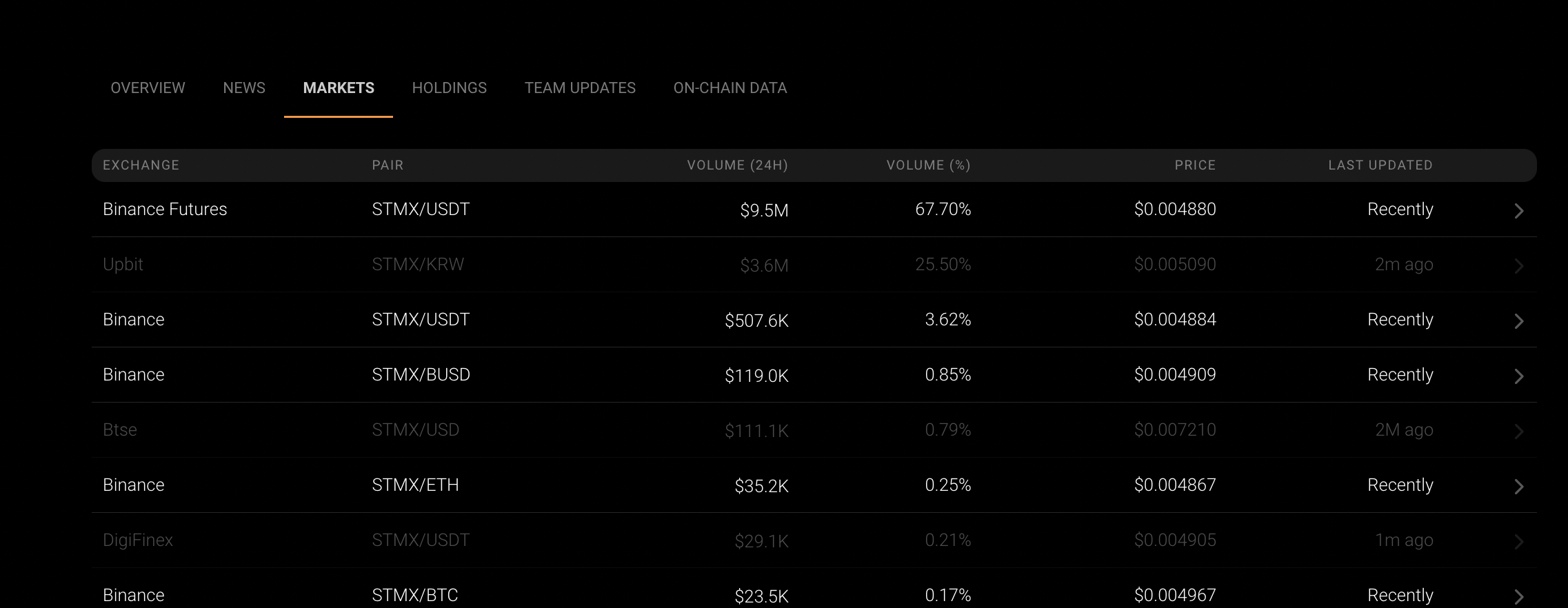

Step #1: Select a Crypto Exchange

Several leading cryptocurrency exchanges offer StormX (STMX), so visit the market page on CoinStats to view the exchange platforms supporting StormX. Compare the exchanges’ security, user experience, fee structure, supported crypto assets, deposit methods, etc., to choose the one with the characteristics you need, such as affordable transaction fees, an intuitive platform, round-the-clock customer service, etc. Also, consider whether the cryptocurrency exchange is regulated by the Financial Industry Regulatory Authority (FINRA) and allows you to buy crypto using your preferred payment method.

In the crypto world, any trader is confronted with the initial choice between centralized and decentralized crypto exchanges, so let's look into the details of each type below.

Centralized Cryptocurrency Exchange

A centralized crypto exchange or CEX, such as Coinbase, eToro, Binance, etc., is governed by a centralized system and charges specific fees for using their services. Most crypto trading takes place on centralized exchanges, allowing users to convert their fiat currencies directly into crypto easily. Centralized exchanges require their users to follow KYC (know your customer) and AML (anti-money laundering) rules by providing some information and personal identification documents. However, a CEX holds your digital assets on its platform while trades go through - raising the risk of hackers stealing the assets.

Pro Tip

You can also open an account on the StormX app and buy StormX tokens with the MoonPay widget if your country is on the list of supported countries.

Decentralized Cryptocurrency Exchange

On the other hand, a decentralized exchange (DEX), like Uniswap, SushiSwap, Shibaswap, etc., is not governed by any central authority; instead, it operates over blockchain and charges no fee except for the gas fee applicable on a particular blockchain, i.e., on the Ethereum blockchain. Decentralized exchanges use smart contracts to let people trade crypto assets without needing regulatory authority. They deploy an automated market maker to remove any intermediaries and give users complete control over their funds. Decentralized exchanges are less user-friendly in terms of interface and currency conversion. For instance, they don't always allow users to deposit fiat money in exchange for crypto; users have to either already own crypto or use a centralized exchange to get crypto. It also takes longer to find someone looking to trade with you as DEX engages in peer-to-peer trade, and if liquidity is low, you may have to accept concessions on price and quickly sell or buy low-volume crypto.

You can also open an account on the StormX app and buy StormX tokens with the MoonPay widget if your country is on the list of supported countries. Depending on your country of residence, you may need to perform a KYC verification by providing a photo ID and your physical address.

Another way is to first buy Bitcoin, Tether, or Ethereum from popular brokers supported in your country, then trade it for StormX.

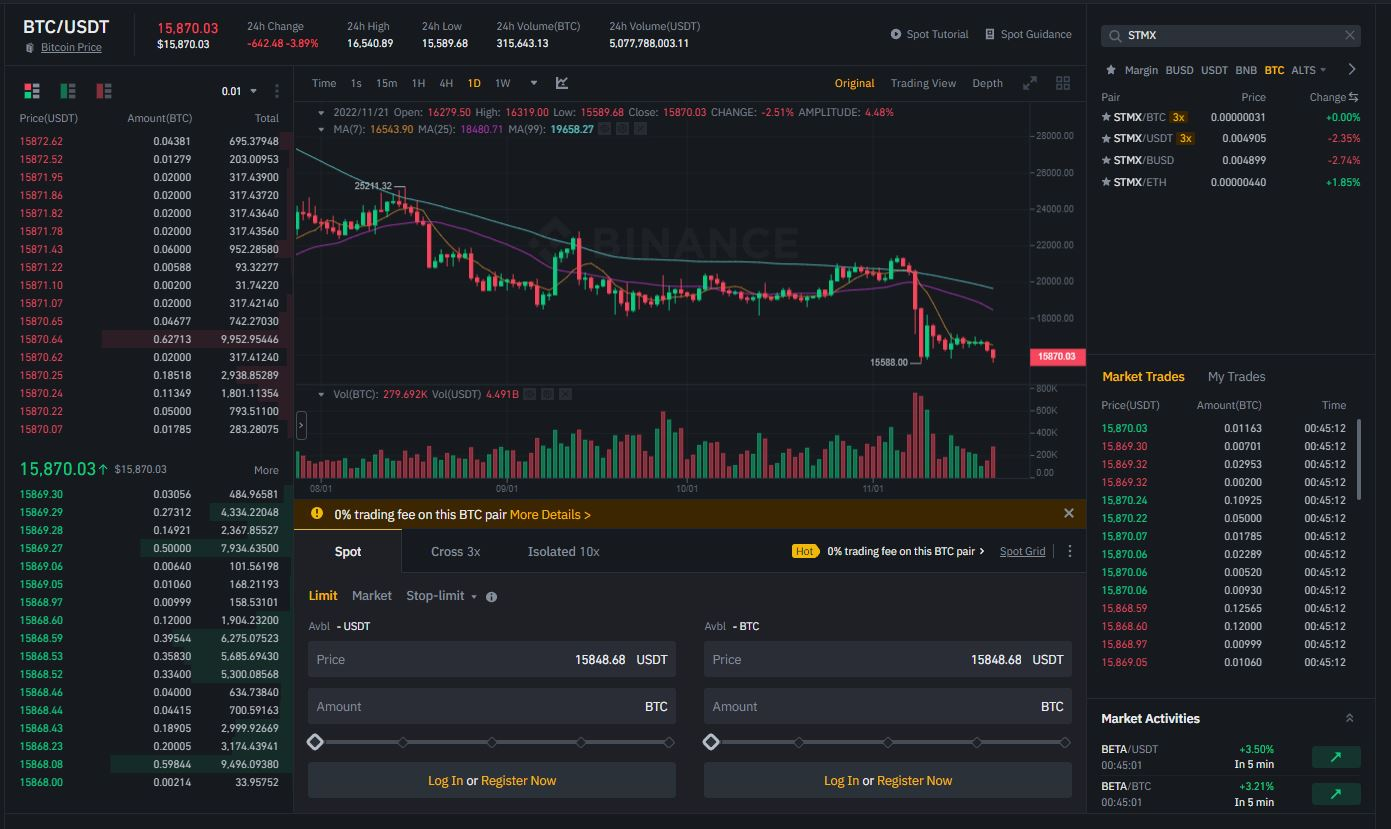

StormX offers a list of exchanges where you can purchase StormX STMX tokens. We'll demonstrate the remaining steps on the Binance exchange as an example, with references to its decentralized counterparts.

NOTE: StormX token STMX price is volatile, like the price of any other crypto asset you might want to consider. So, ensure to check the token's current market price and do your own research before investing in StormX.

Step #2: Create an Account

After you've chosen a cryptocurrency exchange that fulfills all your criteria, the following step is to register with the exchange using a valid email or mobile number. Binance, like many other cryptocurrency exchanges, offers a hassle-free registration with only an email address or valid phone number. A link will be sent to your address or mobile phone, and you must click it to verify your account. Once the account is activated, you must create an elaborate password, and you’re good to go.

While Binance doesn't have mandatory KYC and AML requirements, users must complete the KYC verification process to gain full access and increase higher deposits and withdrawal limits.

In contrast, decentralized exchanges typically don't require verification processes, and you can simply connect your wallet to buy tokens without further ado.

Step #3: Deposit Funds

The next step is to deposit USD, crypto, or other funds. Binance supports several deposit methods, including buying crypto with fiat currencies. Simply select your preferred currency and the deposit method, such as a bank transfer, wire transfer, credit or debit cards, e-wallets, PayPal, etc. Tap on “Deposit Funds,” enter the amount you want to deposit and click “Deposit.”

Some deposit methods are extremely fast, while others, depending on the amount, require a confirmation from authorities. Remember to evaluate the fees of different deposit methods since some have more significant fees than others.

You can choose one of the following options:

Buy With a Credit or Debit Card

Linking your credit or debit card to your crypto account is advantageous as it lets you make instant or recurring purchases, but be aware that it attracts an additional fee.

Purchase StormX Through Wire Transfer

Making a bank transfer from your local bank account is usually free, but you should still double-check with your exchange.

Buy STMX with another crypto

STMX can be traded for another currency like Ethereum or a stablecoin like Binance USD (BUSD); the trading pairs vary, and you must search for STMX on the spot market to select a pair from the list of available trading pairs.

NOTE: We recommend doing a test run first and transferring a small amount to ensure no surprises.

Step #4: Buy StormX STMX

Follow the steps below to place a market buy order to buy STMX instantly at the current price:

- Click the search bar, enter STMX, and select “Buy STMX.”

- Select a trading pair you wish to buy SRM against.

- Choose the payment method and the currency you wish to use, and input the amount of STMX or the fiat amount to be spent. Most exchanges automatically convert the amount to show you how many STMX tokens you’ll get.

- Double-check the transaction details and click “Confirm.”

- The STMX tokens will be displayed in your balance once the transaction is processed.

You can also place a limit order indicating that you want to buy STMX at or below a specific price point. Your broker will ask you the number of coins you wish to acquire and the maximum price you're ready to pay for each once you've placed an order. The coins will only appear in your wallet if your broker fulfills your order at or below your requested pricing. The broker may cancel your order at the end of the day or leave it open if the price of StormX exceeds your limit.

To trade STMX on spot markets, go to the Trade page and search for the STMX pairs (STMX/USD, STMX/USDT, etc.). Select the trading pair and check the price chart. Click "Buy STMX," select the "Market," enter your amount or choose what portion of your deposit you'd like to spend by clicking on the percentage buttons. Confirm and click "Buy STMX."

Congratulations on adding some STMX tokens to your crypto portfolio!

Get Inspired

You can also purchase StormX directly on CoinStats with 0 fees. CoinStats offers one of the best crypto portfolio trackers in the market, helping you keep track of your StormX tokens and all your crypto investments from one platform at all times

Step #5 (Optional): Store STMX

While your STMX tokens can be stored in your brokerage exchange wallet, experts highly recommend storing your precious coins away from exchange wallets, as those might be susceptible to hacks and interference. Besides, the recent case with the FTX centralized exchange shows that companies holding crypto for customers can make investment decisions that end in disaster, and there’s no explicit guarantee that customers will get their assets back.

We highly recommend creating a private wallet with your own set of keys. Depending on your investing preferences, you might choose between software and hardware wallets:

Software Wallets

If you’re looking to trade STMX regularly, software or hot wallets provided by your selected crypto exchange will suit you. The strength of software wallets lies in their flexibility and ease of use. A software wallet is the most easy-to-set-up crypto wallet and lets you easily interact with several decentralized finance (DeFi) applications. However, these wallets are vulnerable to security leaks because they're hosted online. So, if you want to keep your private keys in a software wallet, conduct due diligence before choosing one to avoid security issues. We recommend a platform that offers 2-factor authentication as an extra layer of security.

Examples of software wallets include CoinStats Wallet, MetaMask, Coinbase Wallet, Trust Wallet, and Edge Wallet, amongst others.

Hardware Wallets

Hardware or cold wallets are usually considered the safest way to store your cryptocurrencies as they offer offline storage, thereby significantly reducing the risks of a hack. They are secured by a pin and will erase all information after many failed attempts, preventing physical theft. Hardware wallets also let you sign and confirm transactions on the blockchain, giving you an extra layer of protection against cyber attacks. These are more suitable for experienced users who own large amounts of tokens.

Ledger hardware wallets are arguably the most secure hardware wallets letting you securely manage your digital assets. The Nano X is designed for advanced users and offers more storage space and advanced features than Ledger Nano S, designed for crypto beginners.

A hardware wallet is more expensive than a hot wallet, with prices ranging between $50 - $200.

Examples of cold wallets are Trezor Model T, Ledger Nano X, CoolWallet Pro, KeepKey, Ellipal Titan, and SafePal S1, amongst others.

Step #6 (Bonus Step): Track STMX Tokens

The crypto market is volatile, and managing your portfolio could get tricky if you hold multiple assets. Utilizing a portfolio tracker will help you keep track of your StormX tokens and all your crypto investments from one platform at all times. CoinStats offers one of the best crypto portfolio trackers in the market.

You can also monitor the profit, loss, and liquidity of StormX STMX across several exchanges on CoinStats.

CoinStats supports over 250 cryptocurrency exchanges and over 7,000 cryptocurrencies. It offers charting tools, analytical data, advanced search features, and up-to-date news. Here you have the opportunity to connect an unlimited number of portfolios (wallets and exchanges), including:

- Binance

- MetaMask

- Trust Wallet

- Coinbase

- Kraken

- Kucoin

- Bitstamp and 500 others.

To connect, go to the CoinStats Portfolio Tracker page and:

- Click Add Portfolio and Connect Wallet.

- Click the wallet you want to connect to (e.g., Ethereum Wallet).

- Input the wallet address and press Submit.

4

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.