Who Owns Microsoft? Biggest MSFT Stockholders in 2023

0

0

The largest stockholders of Microsoft are major financial institutions, including Vanguard, with an 8.31% stake in the company, and BlackRock, controlling 4.55% of all MSFT shares. The largest individual shareholders include Microsoft’s former CEO, Steve Ballmer, with a 4.5% stake in the company, and the founder, Bill Gates, who has 0.5% of all MSFT shares.

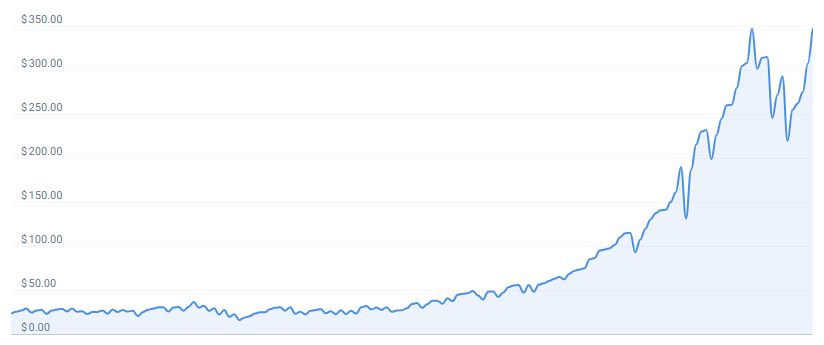

Microsoft, the technology behemoth and the world’s second-most valuable company, has shown impressive price growth over the past years, growing from less than $50 per share in 2016 to $328 in 2023. Under the leadership of CEO Satya Nadella, Microsoft has strung together an impressive streak of successful business results, having increased the annual net income for 5 consecutive years, from $16.57 billion in 2018 to $72.74 billion in 2022.

With Microsoft being one of the hottest companies in the stock market, it is no surprise that many investors are vying for a piece of the pie. In this article, we are going to examine who owns Microsoft, who the largest institutional and individual MSFT investors are, and more.

The price of MSFT saw impressive growth over the past couple of years, following more than a decade-long period of stagnation.

Who owns Microsoft? Examining the top shareholders

The largest share of MSFT stocks is controlled by the largest international financial behemoths like Vanguard, BlackRock, and State Street. Another large part of Microsoft stock is controlled by various mutual funds, with Vanguard’s ETF offering accounting for the largest share. However, current and former Microsoft employees and executives, including Bill Gates and Steve Ballmer, also hold a decent share of the Redmond software giant.

In total, there are 7.441 billion outstanding MSFT shares, with a combined market value of $2.47 billion (at MSFT’s current price of $332.81).

In the following sections, we are going to examine Microsoft’s ownership structure and list the largest MSFT stockholders.

Top 10 institutional owners of Microsoft

The 10 largest institutions that own Microsoft stock control over 27% of all MSFT in circulation. In the table below, you can see the position of the ten biggest holders of MSFT:

| Stockholder | Stake | Shares Owned | Total value |

|---|---|---|---|

| The Vanguard Group, Inc. | 8.31% | 617,968,599 | $202,934,708,226 |

| BlackRock Fund Advisors | 4.55% | 338,306,170 | $111,096,363,166 |

| SSGA Funds Management, Inc. | 3.93% | 292,106,885 | $95,924,979,965 |

| Fidelity Management & Research Co. | 2.36% | 175,254,638 | $57,551,870,573 |

| T. Rowe Price Associates, Inc. | 2.23% | 166,035,734 | $54,524,474,688 |

| Geode Capital Management LLC | 1.94% | 144,365,760 | $47,408,271,926 |

| Capital Research & Management Co. | 1.18% | 87,608,980 | $28,769,912,942 |

| Norges Bank Investment Management | 1.16% | 86,316,926 | $28,345,615,329 |

| Capital Research & Management Co. | 1.14% | 85,020,641 | $27,919,928,298 |

| Capital Research & Management Co. | 1.01% | 75,114,159 | $24,666,738,674 |

Data collected on June 27, 2023. Source: CNN Money

Vanguard

Vanguard is one of the largest investment management companies in the world, with $7.7 trillion in assets under management (AUM). Founded in 1975, it has gained a reputation for its focus on low-cost index funds and exchange-traded funds (ETFs). Vanguard offers a wide range of investment products and services to individual and institutional investors.

- MSFT relative stake: 8.31%

- MSFT shares owned: 617.9 million

- Total value of MSFT owned: $202.9 billion

BlackRock (BLK)

BlackRock is a leading global investment management and financial services company, controlling a whopping $10 trillion in AUM as of 2022. Established in 1988, BlackRock's primary focus is on managing assets for institutional clients such as pension funds, insurance companies, and governments, as well as individual investors.

- MSFT relative stake: 4.55%

- MSFT shares owned: 338.3 million

- Total value of MSFT owned: $111.1 billion

Street State Global Advisors

SSGA Funds Management, also known as State Street Global Advisors (SSGA), is one of the largest investment management firms globally, and a subsidiary of State Street Corporation. As of December 2021, SSGA controlled more than $4.1 trillion in assets.

- MSFT relative stake: 3.93%

- MSFT shares owned: 292.1 million

- Total value of MSFT owned: $96.9 billion

Top 10 mutual funds holding Microsoft

Due to its strong track record of impressive business results and stronghold over PC productivity software, Microsoft is one of the most popular stocks among exchange-traded funds. Interestingly, all three of the largest MSFT stakes are controlled by Vanguard funds.

| Mutual Fund | Stake | Shares Owned | Total value |

|---|---|---|---|

| Vanguard Total Stock Market ETF | 3.12% | 231,954,991 | $76,171,699,494 |

| Vanguard Institutional 500 Index | 2.35% | 174,719,417 | $57,376,109,349 |

| Vanguard 500 Index Fund | 2.35% | 174,695,882 | $57,368,380,690 |

| Government Pension Fund Global | 1.14% | 84,605,733 | $27,783,676,660 |

| SPDR S&P 500 ETF Trust | 1.12% | 83,369,323 | $27,377,651,980 |

| Fidelity 500 Index Fund | 1.11% | 82,773,183 | $27,181,885,565 |

| Invesco QQQ Trust | 1.02% | 75,822,667 | $24,899,405,616 |

| iShares Core S&P 500 ETF | 0.89% | 65,890,739 | $21,637,859,780 |

| Vanguard Growth Index Fund | 0.85% | 63,372,720 | $20,810,967,521 |

| Vanguard Institutional Index Fund | 0.69% | 51,014,842 | $16,752,763,964 |

Data collected on June 27, 2023. Source: CNN Money

Vanguard Total Stock Market Market ETF (VTI)

The Vanguard Total Stock Market ETF is designed to provide investors with broad exposure to the entire U.S. stock market. Investors who choose the Vanguard Total Stock Market ETF can benefit from the potential long-term growth of the overall U.S. stock market. With 5.97% MSFT represents the second highest allocation in the fund, trailing only Apple with 6.50%. VTI also includes a number of so-called “dividend aristocrats”.

- MSFT relative stake: 3.12%

- MSFT shares owned: 231.9 million

- Total value of MSFT owned: $76.2 billion

Vanguard Institutional 500 Index Trust (VFFSX)

The Vanguard Institutional 500 Index is designed to track the performance of the Standard & Poor's 500 Index (S&P 500), one of the most widely followed stock market indices in the United States that tracks the performance of the 500 largest US companies. MSFT is the second largest allocation VFFSX, squeezed behind Apple in the number one spot and Amazon at number three.

- MSFT relative stake: 2.35%

- MSFT shares owned: 174.7 million

- Total value of MSFT owned: $57.4 billion

Vanguard 500 Index Fund (VFINX)

Like Vanguard 500 Index Fund is very similar to the Vanguard Institutional 500 Index Trust – both aim to track their benchmark index, the S&P 500, attempting to replicate the target index by investing all of its assets in the stocks that make up the index with the same approximate weightings. The main difference between VFINX and VFFSX is in their legal structure, as the former is structured as a fund, and the latter as a trust.

- MSFT relative stake: 2.35%

- MSFT shares owned: 174.7 million

- Total value of MSFT owned: $57.4 billion

Top 10 insider stockholders of Microsoft

There are quite a few large holders among former and current Microsoft insiders. By far the biggest individual MSFT stockholders are Bill Gates and Steve Ballmer, the 5th and 7th wealthiest individuals in the world.

| Insider Stockholders | Position | Stake | Shares | Total Value |

|---|---|---|---|---|

| Steve Ballmer | Former CEO | 4.4786% | 333,252,990 | $110,749,966,167 |

| Bill Gates | Founder | 0.5277% | 39,264,670 | $13,048,827,781 |

| Satya Nadella | CEO | 0.0105% | 781,015 | $259,554,715 |

| Bradford Smith | President | 0.0086% | 641,946 | $213,337,914 |

| Judson Althoff | EVP & CCO | 0.0016% | 117,456 | $39,034,152 |

| Christopher Capossela | EVP & CMO | 0.0012% | 90,632 | $30,119,733 |

| John Stanton | Director | 0.0011% | 84,567 | $28,104,151 |

| Charles Scharf | Director | 0.0006% | 43,836 | $14,568,018 |

| Padmasree Warrior | Director | 0.0002% | 13,466 | $4,475,156 |

| Emma Natasha Walmsey | Director | 0.0001% | 9,576 | $3,182,392 |

Data collected on June 27, 2023. Source: Yahoo Finance

Steve Ballmer

Steve Ballmer joined Microsoft in 1980 and played a significant role in the company's growth and success over the years. During his time as CEO from 2000 to 2014, Ballmer led Microsoft through a period of significant expansion and transformation. He played a key role in driving the company's focus on software development and expanding its product portfolio, including the launch of Windows XP, Windows 7, and Windows 8 operating systems. He also oversaw the introduction of the Xbox gaming console and led the expansion of Microsoft's enterprise software and cloud computing services.

- MSFT relative stake: 4.48%

- MSFT shares owned: 333.2 million

- Total value of MSFT owned: $110.7 billion

Bill Gates

Bill Gates is a co-founder of Microsoft. Born in 1955, Gates played a pivotal role in the development of the personal computer revolution. He oversaw the development and launch of groundbreaking software products, including the Microsoft Windows operating system, Microsoft Office suite, and Internet Explorer web browser. Gates stepped down as Microsoft's CEO in 2000 but remained actively involved as the company's Chairman until 2014. He focused his efforts on philanthropy and co-founded the Bill & Melinda Gates Foundation in 2000 with his then-wife Melinda Gates.

- MSFT relative stake: 0.52%

- MSFT shares owned: 39.2 million

- Total value of MSFT owned: $13 billion

Satya Nadella

Satya Nadella is an Indian-American business executive who is currently the CEO of Microsoft. Nadella joined Microsoft in 1992 and has held various leadership positions within the company. Prior to becoming CEO, he served as the Executive Vice President of Microsoft's Cloud and Enterprise division, where he played a crucial role in the development and growth of Microsoft's cloud computing services, including Microsoft Azure. Nadella was also instrumental in helping Microsoft expand its role in the artificial intelligence (AI) space, making it one of the best AI stocks to buy, especially for investors who want to increase their exposure to OpenAI’s ChatGPT.

- MSFT relative stake: 0.01%

- MSFT shares owned: 0.78 million

- Total value of MSFT owned: $259.6 million

Microsoft's voting power

Microsoft has only one class of outstanding shares, with one vote per share. This means that the voting power of each shareholder is equal to their ownership percentage.

The shareholder with the largest voting power is Vanguard, which holds 8.3% of all votes, followed by BlackRock, with 4.5% voting power. Steve Ballmer's voting power is 4.5%, while Bill Gates' voting power is only 0.5%.

However, this does not mean that these shareholders can control Microsoft's decisions or influence its strategy. Microsoft's board of directors is elected by the shareholders and is responsible for overseeing the management and direction of the company.

The board consists of 13 independent directors, who are not affiliated with any shareholder or employee of the company, and one executive director, who is Satya Nadella, the current CEO of Microsoft.

The bottom line: Microsoft is primarily owned by large financial corporations

Microsoft is primarily owned by large financial institutions like BlackRock and Vanguard. These companies are likely seeing the potential for MSFT’s long-term growth, which could be driven by the AI boom that Microsoft has been spearheading thanks to its strong involvement and direct investment in OpenAI, the company behind the ChatGPT chatbot.

For these reasons, Microsoft was included in our list of the best stocks to buy in June 2023. If you want to see how the price of MSFT might move in the future, give our Microsoft stock forecast a try – at the time of writing, the prediction algorithm forecasts that MSFT will surpass $400 in by the end of the year.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.