4

3

The Big Idea

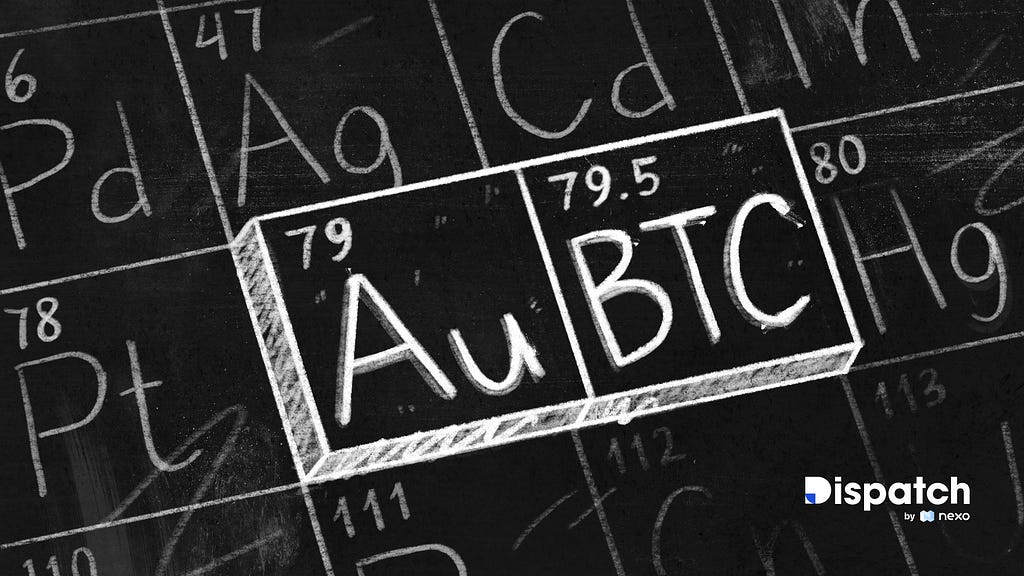

Bitcoin and crypto continue to win new converts.

Over the weekend, reports surfaced that Morgan Stanley was considering allocating directly to Bitcoin via its $150B investment unit. The crypto industry also learned that Deutsche Bank had started a digital assets custody business. That was followed this week by Blackrock CIO Rick Reider saying that the firm is “dabbling” in Bitcoin.

In Dispatch #22, we asked for your prophecy in whether you think Tesla’s BTC allocation is what paves the way for more large-cap companies to invest in Bitcoin. An overwhelming 52% of you answered affirmatively with 10/10 and we can’t help but be proud of the bullish community that has formed around Nexo.

Meanwhile, while some long-standing goldbugs (cough Schiff cough) can’t give up their perma-hatred of BTC, others are interested in having fun and getting rich. Jeffrey Gundlach, a long-time gold bull and head of DoubleLine Capital, tweeted his (changing) take on Bitcoin.

We think Jeffrey’s assessment is certainly headed in the right direction, although we’d go even farther, as you can see in the video below.

While $75K and $100K are very feasible targets for Bitcoin, caution is advised as it’s likely to be a bumpy ride to such high prices. While the markets never do what everyone expects them to, it’s hard to argue with them right now. Bitcoin is comfortably over $50,000 and well on its way to a $1T total market cap. The market cap of crypto as a whole is over $1.5T.

In short, this is an asset class that can no longer be ignored. But tread carefully and always DYOR.

The Latest In…

The Coinbase IPO doesn’t only matter for Coinbase execs and investors. It is one of the key mainstream financial events related to crypto happening this year. As such, many are wondering what the valuation of the company is likely to be. While the numbers are still fluctuating, recent private market sales suggest a total market cap north of $77B. Pre-IPO contracts on FTX are trading even higher. Speaking of unignorable, this is something that Wall Street has to pay attention to, too.

The Latest In the Nexo Universe…

The NEXO Token just hit $2, the Exchange is live, a Community hub is up and running, the NEXO Governance Vote is coming your way — it’s been a busy first month and a half of 2021. So much so that we’ve only just uploaded our 2020 ‘Year in Review’ video. Watching it now, last year’s milestones may as well have been last century’s. We should consider introducing a new Nexo-time vs standard time metric to account for this. In the meantime though, keep staying ahead with us for more milestones.

The Latest In…

At the end of last week, Miami Mayor Francis Suarez announced that the Miami city commissioners had voted to begin researching the cryptocurrency industry, as well as starting an education campaign in three languages for citizens. Crypto Valley in Switzerland, meanwhile, has started accepting BTC and ETH for tax payments.

The Latest In…

BIG news on the DeFi front this week. A major question of this cycle has been whether these institutions that are coming into Bitcoin now have any interest in exploring anything else in crypto — specifically DeFi. At least one firm thinks the answer is “yes.” Bitwise has just announced a new DeFi index fund for accredited investors featuring 10 tokens including AAVE, UNI, MKR, and more. This provides a much easier path than currently available for this category of investor to access the space, so it will be interesting to see how popular the product is.

The Latest In…

CBDCs continue to be one of the most important background stories in the crypto industry. This week they got the FUD treatment courtesy of Reuters in an op-ed that argued that they would end cash (probably true) and encourage nefarious types from the shadow economy to join the crypto space. Meanwhile, over in the beautiful Bahamas, Mastercard has launched a prepaid card for the country’s “Sand Dollar” — the world’s first fully-functional CBDC.

The Week’s Most Interesting Data Story

We’ve been tracking the rise of NFTs for some time now. We mentioned the artists and celebs who were coming to the space and that only continued this week with Tyga and DJ 3LAU announcing NFT projects. Logan Paul discussed NBA Top Shot on his podcast and Gary Vaynerchuk discussed NFTs on TV. Still, the biggest news was when 250+ year-old auction house Christie’s announced it was putting Beeple NFTs up for bidding. What do you think — is this market frothy or is it just getting the recognition it deserves?

Hot Topics

MicroStrategy announced a fresh $600M debt offering this week, again with the express intention to use the proceeds to buy more Bitcoin. Pomp summed it up perfectly.

Not content to let Saylor gobble up all the coins, The Motley Fool announced their own modest treasury allocation.

The hunt for a US Bitcoin ETF continues, with NYDIG being the latest party to submit their proposal. In the Great White North, however, Canada has now approved not one but two such ETFs.

Our Take

Originally published at https://nexo.io.

Do check out our earlier blog posts, share them with your friends and let them too be part of the Nexo success story!

Question? Visit your Help Center.

Interested in Nexo? Get in touch:

Telegram | Twitter | Facebook | Reddit | LinkedIn | Email

Dispatch #23: Crypto Industry Hits $1.5T as More Recognize Bitcoin > Gold was originally published in Nexo on Medium, where people are continuing the conversation by highlighting and responding to this story.

4

3

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.