0

0

This article was first published on The Bit Journal.

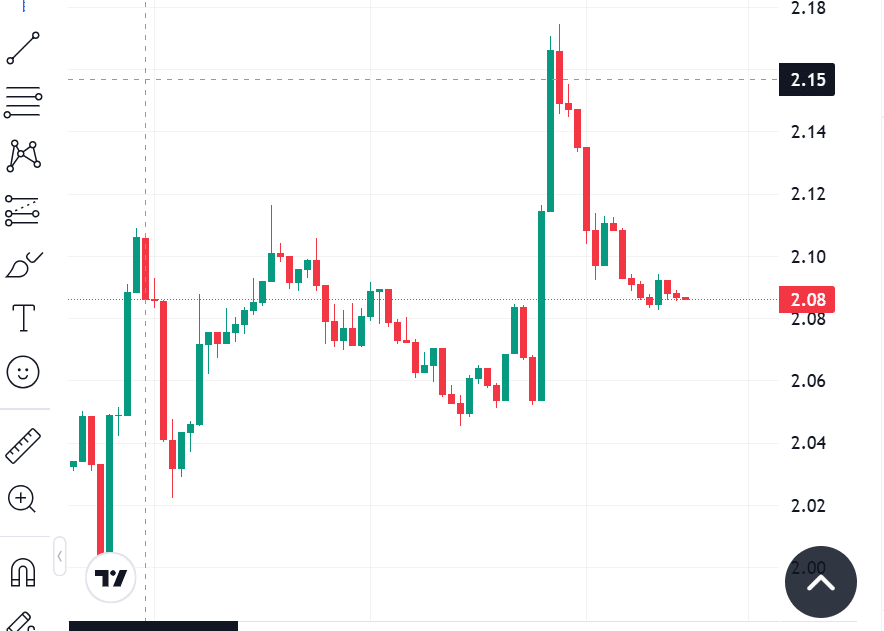

XRP just gave traders a reality check as the token briefly pushed to a high near 2.17 but failed to hold above the 2.12 breakout zone, and sellers quickly stepped in. The rejection has turned what looked like a clean breakout into a potential bull trap, with short-term sentiment tilting back toward caution.

At the time of writing, XRP trades around 2.09, up about 1.7% over the past 24 hours. The daily range sits between 2.05 and 2.17, with a 24 hour trading volume close to 3.69 billion dollars. XRP holds the number 4 spot by market capitalization at roughly 125.96 billion dollars, with about 60.33 billion tokens in circulation and a maximum supply of 100 billion.

Technically, the failed move above 2.12 matters. That level has acted as a short-term breakout line, and the quick reversal suggests that buyers are not yet strong enough to absorb profit-taking at higher prices. Some analyses describe XRP as trading in a kind of no man’s land near 2.11, where the next decisive move may choose between another leg higher or a deeper pullback.

The 24 hour high at 2.17 now behaves as nearby resistance, while the 2.00 region has turned into an important psychological and technical support zone. A daily close back below 2.00 would signal that the latest rally is losing steam, and it could open the door to a retest of lower levels. On the upside, a firm break and close above 2.17 would show that the current sell pressure has been absorbed.

On the one hand, the raw numbers still look impressive. A market cap above 125 billion dollars and multi-billion dollar daily volume keep XRP firmly in the large cap category, with deep liquidity compared with most altcoins. Global crypto market capitalization currently sits near 3.16 trillion dollars, with total 24 hour volume around 147 billion dollars, which means XRP commands a meaningful slice of overall activity.

On the other hand, the token still trades below its all time high near 3.84, set in January 2018. That gap keeps longer-term holders watching for fresh catalysts. Some technical outlooks still see room for a medium-term advance toward the 2.70 region if resistance breaks cleanly, but that scenario depends on buyers defending support and reclaiming the 2.12 area with conviction.

The current move feels less like full-scale fear and more like basic profit-taking. After a strong multi-month advance, many traders use round numbers such as 2.00 and local highs such as 2.17 as convenient levels to lock in gains. When too many players try to take profit in the same area, overhead supply increases and the chart prints exactly the kind of failed breakout that XRP just showed.

At the same time, the broader market environment remains relatively constructive. Overall, crypto capitalization is rising, and liquidity conditions across majors such as bitcoin and ether still support active trading. For XRP, the question is not simply whether buyers appear, but whether they appear in size at or above the 2.00 line so that the recent rejection turns into consolidation instead of a trend reversal.

In the near term, attention focuses on three zones. First, the 2.00 area as immediate support. Second, the 2.12 to 2.17 band, where the recent breakout failed, as short term resistance. Third, the longer horizon region around 2.70 that some analysts highlight as a possible next wave target if momentum returns.

If XRP grinds sideways above 2.00 while volume dries up, that behavior would suggest healthy consolidation. A sharp spike in volume on a move below 2.00, in contrast, would signal that the current wave of selling is more than simple profit taking. As always with volatile digital assets, position sizing, risk limits, and independent research remain essential. This article provides information and context, not personal investment advice.

XRP’s failed breakout above 2.12 sends a clear message. Buyers are present, but they face determined sellers every time price approaches the recent highs near 2.17. The token still enjoys deep liquidity, a large market cap, and strong brand recognition in the large cap segment, yet the chart demands respect.

If support near 2.00 holds, XRP can regroup for another attempt at higher levels in the coming sessions. If that floor gives way on heavy volume, the market will likely reprice expectations and look for lower support. For now, XRP remains in a balancing act between an attractive long term story and very real short term sell pressure.

Q1. Is XRP still in an uptrend after the failed 2.12 breakout?

XRP remains in a broader uptrend compared with past bear market lows, but the failure above 2.12 shows that the short term trend is fragile. The market now waits to see whether 2.00 can hold as support.

Q2. Why is the 2.12 level important for XRP?

The 2.12 area acted as a breakout line. Price briefly moved above it toward 2.17 and then reversed. That behavior often signals that traders who bought the breakout are reducing risk or taking profit.

Q3. How strong is XRP liquidity right now?

XRP records daily trading volume in the multi billion dollar range and holds a market capitalization above 125 billion dollars, which points to strong liquidity relative to most altcoins.

Resistance

A price zone where supply usually increases and buying interest cools. Breaks above resistance can signal renewed strength, while failed attempts often trigger profit taking.

Market capitalization

The total value of a digital asset, calculated by multiplying the current price by the circulating supply of tokens.

Volume

The total value of an asset traded over a specific period, such as 24 hours. Higher volume usually indicates stronger participation and more reliable price moves.

All time high (ATH)

The highest recorded price for an asset since it began trading on public markets.

Circulating supply

The number of tokens that are currently available and moving in the market, excluding locked or reserved balances.

Read More: XRP Slips After Failed 2.12 Breakout as Sell Pressure Returns to the Market">XRP Slips After Failed 2.12 Breakout as Sell Pressure Returns to the Market

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.