Why Did USDf Stablecoin Depeg to $0.995 if It’s Supposed To Be 117% Backed?

0

0

Key Insights:

- DWF-backed stablecoin USDf slipped under $0.995 on July 8, despite advertising 116.98% collateralization.

- 96% of its reserves are held off-chain, and minting includes volatile tokens like DOLO, raising major risk flags.

- Experts are comparing it to sUSDe’s collapse and warning of spillovers into Ethereum DeFi and Curve markets.

The USDf stablecoin, backed by DWF Labs, briefly fell below $0.995 on July 8. That’s not supposed to happen. The team behind it claims the token is 117% backed, meaning there should be more than enough assets to keep its price stable at $1.

But the stablecoin depeg happened anyway, and that raises some serious questions.

Most of USDf’s Backing Isn’t Even On the Blockchain

The chatter around USDf suggests 96% of its reserves are held off-chain. That means the funds are kept with third-party companies, not in wallets anyone can check. Only 4% is visible on-chain.

The problem? We don’t really know what makes up that 96%. They say it’s a mix of stablecoins and crypto, but there’s no breakdown. And since the USDf stablecoin can be created using tokens like DOLO, which is small and thinly traded, the risk of bad backing is very real.

You can mint up to $50 million USDf using DOLO, even though DOLO’s total market value is only $14.2 million. That kind of setup helped trigger the stablecoin depeg.

This Looks a Lot Like sUSDe, And That Didn’t End Well

People are already comparing the USDf stablecoin to sUSDe, another token that lost its peg earlier this year. Both projects rely on complicated strategies involving centralized exchanges and liquidity pools. The idea is to earn yield while keeping the token stable.

But these setups are hard to track. And unlike stablecoins backed by cash or short-term bonds, there’s no easy way to check if everything is safe.

DWF Labs and Falcon Finance have mentioned having an insurance fund and arbitrage systems, but there’s no open access to those tools. That makes the USDf stablecoin just as hard to trust as sUSDe — maybe even more so.

DeFi Apps Like Curve Are Now at Risk

The USDf stablecoin is already being used in Curve’s LlamaLend lending markets. It’s also going through a vote to start receiving CRV token rewards. That means if the stablecoin depeg happens again, or if trust in it falls, other DeFi apps may take a hit too.

It doesn’t help that the token has a 7-day redemption delay for some users. That lag makes it harder for traders to fix the price when it starts dropping.

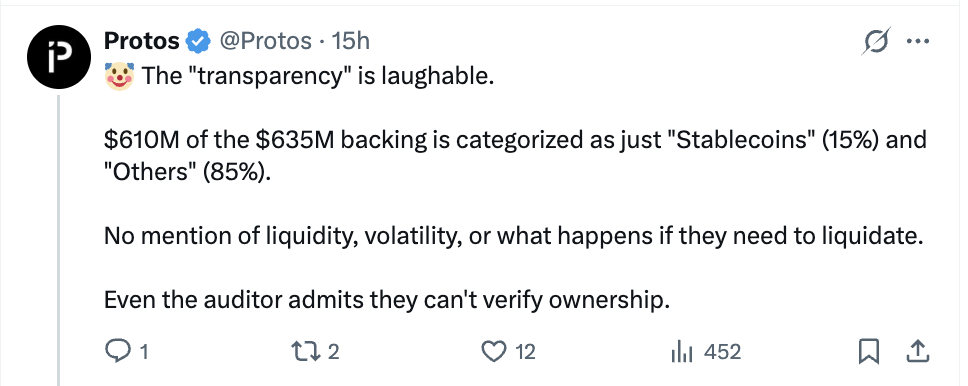

Stablecoin Depeg Raises Questions About Real Backing

This latest stablecoin depeg shows why simple claims like “117% backed” aren’t enough. If most of the reserves are off-chain and the minting rules allow risky tokens, then the peg will always be shaky.

DWF Labs might say the situation is under control, but without showing exactly what’s backing USDf and how it’s being managed, users are left guessing.

The USDf stablecoin has bounced back for now. But its structure, off-chain reserves, unknown strategies, and high-risk minting make another stablecoin depeg possible.

Until Falcon Finance or DWF Labs bring more of the USDf reserve on-chain and reduce the risk of volatile assets like DOLO, trust in this project will remain low.

In a market already nervous after sUSDe, this was a warning sign, and next time, the recovery might not come as quickly.

The post Why Did USDf Stablecoin Depeg to $0.995 if It’s Supposed To Be 117% Backed? appeared first on The Coin Republic.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.