Chainlink Price Plummets 4% as Analyst Says a Deeper Drop to $16 Will Be a ‘Gift’

0

0

Highlights:

- Chainlink price is trading at $20, marking a 4% decrease in the past day.

- LINK holders are realising profits according to on-chain metrics, increasing the selling pressure.

- Ali Martinez says a dip to $16 support zone will be a gift for the LINK price, reaching a total of $100.

The Chainlink price is struggling in the red, down 4% to $20. Meanwhile, the daily trading volume has surged 0.07%, rekindling market activity. Chainlink price has displayed strong performance despite market fluctuations. Recently, the network’s integration into high-profile ecosystems and partnerships, such as Solstice, has kept the project in the spotlight. The adoption of decentralised applications demonstrates the strength of Chainlink’s market position.

Solstice (@Solsticefi) has adopted Chainlink CCIP and Data Streams on @solana as its official oracle infrastructure to unlock institutional-grade interoperability and sub-second, tamper-proof market data to power its newly launched $150M+ TVL stablecoin, USX.… pic.twitter.com/QrJJMOMPjz

— Chainlink (@chainlink) September 24, 2025

On-Chain Metrics Show LINK Realized Profit

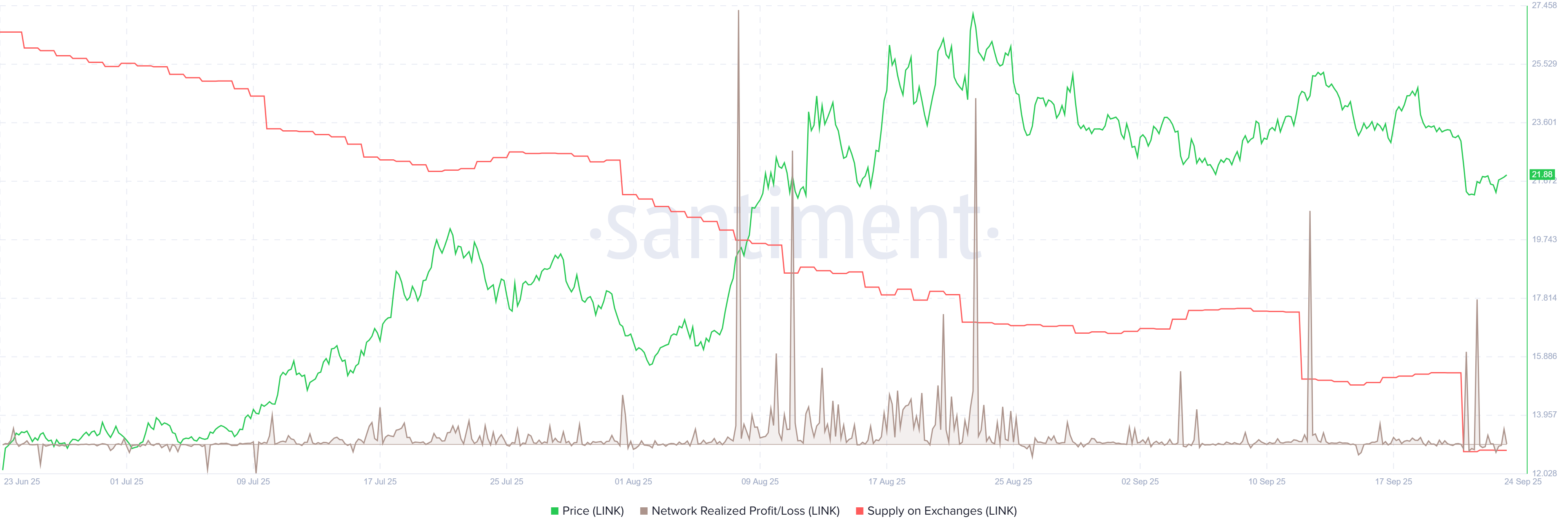

Chainlink holders are booking some profits following price dips this week, as Santiments’ Network Realized Profit/Loss (NPL) metric indicates.

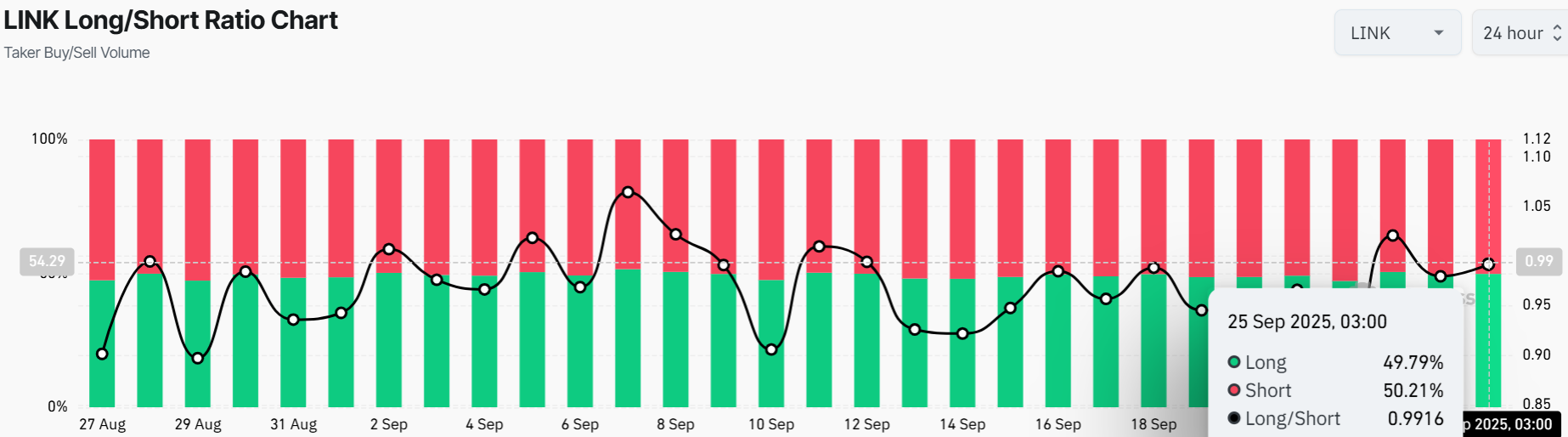

According to the metric, there is a great spike on Monday and Tuesday. This suggests that holders are selling their bags for a profit. This naturally adds to the selling pressure and may cause further downside in the Chainlink price. Additionally, LINK’s long/short ratio shows that a balance of almost 50% of market participants is currently long and short. The ratio at the time of writing is 0.99, meaning sentiment is neutral.

Market players indicate that they have booked profits, suggesting they foresee an upward price movement in LINK. Meanwhile, traders should be cautious, as the shorts take the lion’s share of 50%, while the longs have taken the rest, at 49.79%.

Chainlink Price Moves Into Consolidation

On the 1-day chart, Chainlink price is trading near the lower boundary line of the consolidation channel. Furthermore, LINK has dropped approximately 23% to its current price levels, as analysts anticipate further downside.

Notably, the 50-day Moving Average sits at $23.35, while its 200-day moving average is at $16.80, indicating that LINK has been in a long-term uptrend recently. However, the bulls need to overcome the $23 resistance mark to continue with the bullish trend.

With the recent pullback, the Chainlink technical indicators, including the RSI and MACD, show a bearish outlook. The RSI currently sits at 37.57, showing oversold conditions. However, if the bulls ignite a buy-back strategy, a rally above the 50-mean level would rekindle the bullish momentum.

On the other hand, the MACD indicator sits firmly below the orange signal line, marking a bearish divergence. Moreover, the red histograms are cautioning traders of a potential downside if the MACD remains unchanged.

LINK Price Outlook: Is It Time to Buy?

Looking ahead, the $23 resistance (200-day SMA) is the next big test after the Chainlink price. If LINK smashes through, it could surge toward the $27-$30 psychological level. However, a drop below the $20 level could see the asset drop to $16 safety net. Meanwhile, according to Ali Martinez, a drop to $16 would be a gift to the Chainlink price. In that, a breakout will see the bulls target $100.

A dip to $16 on Chainlink $LINK would be a gift. This triangle breakout setup targets $100! pic.twitter.com/s69oqbMniB

— Ali (@ali_charts) September 25, 2025

In the meantime, traders should keep an eye on the $23 resistance zone, as a breakout will see Chainlink price surge to higher levels.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.