What Binance’s $400 Million Compensation Really Means for Traders

0

0

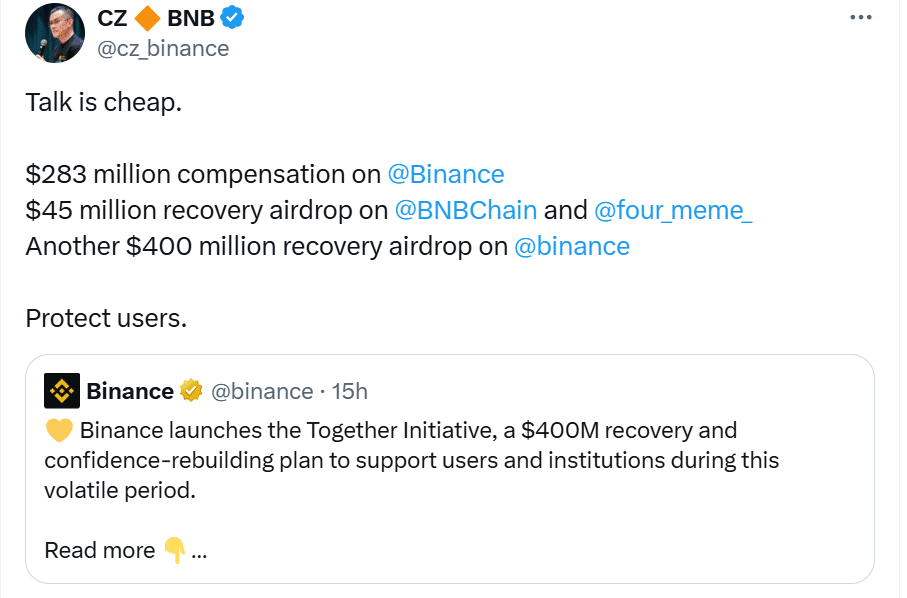

Last Friday’s brutal sell-off triggered more than $19 billion in forced liquidations, laying bare cracks in exchange infrastructure, risk models, and user trust. In response, Binance has unveiled a sweeping $400 million “Together Initiative” intended to soften the blow for users and institutions alike, and perhaps reassert its standing in the crypto world.

What Binance is Offering

The initiative divides into two parts: retail compensation and institutional liquidity support.

For everyday traders, Binance is earmarking $300 million in token vouchers, meant for those who were liquidated on margin or futures between October 10 and 11. Eligibility kicks in for users who lost at least $50, and whose losses represented a meaningful share of their net holdings.

Payouts will vary, some will see just a few dollars, others could receive up to $6,000. The company says it will complete disbursements within 96 hours.

On the institutional side, Binance allocates an additional $100 million in low-interest loans to ecosystem players or VIP clients who are squeezed by liquidity challenges. These funds are intended to help firms survive further turbulence without being forced into fire sales.

Binance is careful to stress that it does not admit legal liability for user losses. The company frames the package as a goodwill measure aimed at “rebuilding confidence” in a shaken market.

Why This Step Matters (and What’s at Stake)

1. Trust vs. Precedent

In crypto, reputations carry weight. Exchanges that respond to crises effectively gain a kind of informal insurance; users are likelier to stay put when things get rough. But there is also danger: if bailouts become expected, leverage-hungry traders may take undue risks in the belief they will be cushioned again.

2. Technical Failures Under the Microscope

Some losses stemmed not just from volatile markets but also from alleged system glitches, delayed order execution, and data pegs on certain tokens (USDE, BNSOL, WBETH). In public posts, Binance’s Yi He (co-founder and head of support) said users with verifiable losses linked to platform issues should reach out for a “case review.” “When we fall short, we take responsibility,” she wrote.

By contrasting this with past events (e.g. exchange downtimes in crowded sessions), one sees how critical resilience and transparency are when volatility spikes.

3. Regulatory and Structural Signals

This could slide from a gesture into a regulatory flashpoint. Is this compensation a financial product? Does it expose Binance to disclosures or consumer protection obligations? Regulators may view this as part of the implicit promise exchanges offer. The move also underscores how centralized platforms must balance scale and risk architecture as scrutiny increases globally.

Market Reactions and Critiques

The relief package draws mixed responses. Some traders applaud Binance for stepping up, calling it a stabilizing signal during panic. Others are scathing: “A voucher for $4 to $6K for users who lost everything is kinda a joke,” wrote one critic. Another observed that internal pricing oracles were culpable in mispricings that cascaded losses.

Still, the scale of the response itself, $728 million total across post-crash measures and ecosystem support, is larger than nearly any single countermeasure by a top exchange in prior history.

Understanding the Metrics: Liquidations, Leverage and Risk

-

Forced Liquidations happen when leveraged positions fall below maintenance margin, triggering automatic closure.

-

The liquidation amount is often magnified, small price moves in volatile assets can crush overleveraged accounts.

-

Leverage ratios (e.g. 5×, 10×, 50×) amplify risk; the higher the leverage, the thinner the margin cushion.

-

Relative loss ratio (loss amount/total account value) helps screen who really got wiped, many qualifying for reimbursement lost a large share of their holdings.

Traders should note: the deeper the “drawdown bucket” a user falls into, the larger the potential compensation allocation, up to the cap.

Conclusion

Binance’s $400 million Together Initiative is an audacious gamble: it stakes capital, reputation, and expectations. In one stroke, it signals capability and intent, but also invites critique and fresh regulatory scrutiny. Whether it restores confidence or exposes more vulnerabilities depends on execution, fairness, and how the broader industry reacts.

If you like, I can prep a side-by-side with past crash compensations (FTX, KuCoin, etc.), or track how journalists and regulators in the U.S. respond over the coming days.

Frequently Asked Questions

Q: Who qualifies for compensation?

Traders who incurred forced liquidations between October 10–11, with losses ≥ $50, and where liquidation losses represented a meaningful share of net account value (as per internal snapshots).

Q: When will payouts occur?

Binance aims to distribute voucher compensation within 96 hours after verification.

Q: Are all losses eligible?

No. Losses due to market swings or unrealized positions are disqualified. Only those tied to system faults or forced liquidations meeting criteria are considered.

Q: What are low-interest loans for institutions?

A separate $100 million fund designed to help institutional clients and ecosystem projects facing liquidity stress, intended to prevent forced deleveraging of large players.

Glossary of Key Terms

Forced Liquidation

Automatic closure of a leveraged position when margin falls below required levels.

Drawdown Ratio

Loss amount divided by total account value; shows severity of damage relative to portfolio size.

Token Voucher

Credit or voucher in exchange tokens given as compensation rather than direct cash.

Low-Interest Loan Fund

Pool of capital lent to eligible clients under favorable terms to relieve liquidity pressure.

System Glitch / Depeg

Technical failure or pricing error (e.g. stablecoin falling off peg) caused by faulty oracles, delays, or data feed discrepancies.

Read More: What Binance’s $400 Million Compensation Really Means for Traders">What Binance’s $400 Million Compensation Really Means for Traders

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.