$192M SOL hits Coinbase Prime while $50M heads to Galaxy Digital

0

0

This Article Was First Published on The Bit Journal/ Forward Industries has transferred 993,058 SOL valued at approximately $192 million to Coinbase Prime, alongside an additional $50 million sent to Galaxy Digital. The high scale transfers have caused speculation in the market concerning portfolio restructuring by the key holders due to the current Solana rebound.

Forward Industries, which has a history of purchasing Solana at $232 per token, seems to be rebalancing the exposure months after the acquisition of Solana at $1.38 billion. Analysts say the move could be a strategic treasury readjustment and not an exit outright at a time when the Solana revival is still gaining momentum after weeks of volatility.

Institutional Accumulation Reinforces Solana Rebound Strength

Solana Strategies (NASDAQ: STKE) has adopted a different approach of increasing its hold through acquisition of 88,433 SOL at a price of 193.93 on average. The acquisition also involved 79,000 locked tokens of the Solana Foundation, increasing the total amount to 523,433 SOL owned by the firm.

This build-up points to further institutional belief in the long-term prospects of Solana, which further supports the opinion that the Solana recovery is cemented by solid interest among investors.

The difference in the behavior of Forward Industries and Solana Strategies highlights a division in institutional mood one chewing on the short-term caution, the other exhibiting long-term belief. This form of divergence is the precursor to the significant directional movements as the large owners reprice the next Solana rebound and possible new price cycle.

Technical Indicators Signal Renewed Uptrend Ahead

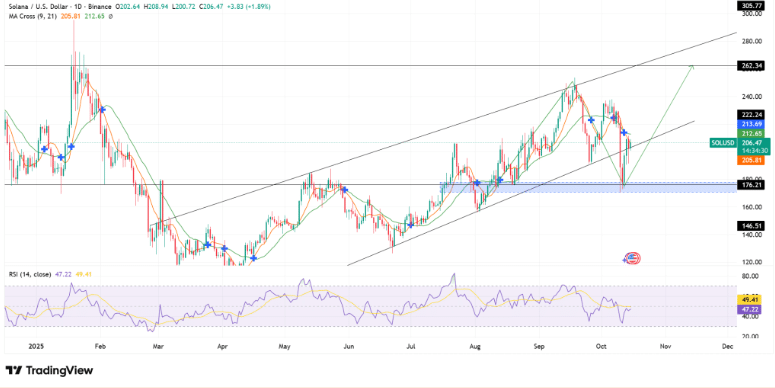

The solana rebound indicators have gained momentum following the appearance of the token on the $176 demand zone which has returned to the its upward channel. At press time, SOL traded near $206, marking a gradual return of bullish momentum.

Relative Strength Index (RSI) was 49.41 which indicated a revival in the purchasing force after slightly falling into the oversold area. Moreover, the 9-day Moving Average also just surpassed the 21-day MA, which suggests the initial signs of a possible bullish swing within the overall Solana rebound story.

Derivatives Market Signals Strengthening Bullish Sentiment

In case Solana continues the momentum and overcomes the resistance at 222, analysts estimate the next positive point at the range of 262, which might prove the further extension of the Solana recovery and the beginning of a more significant recovery process.

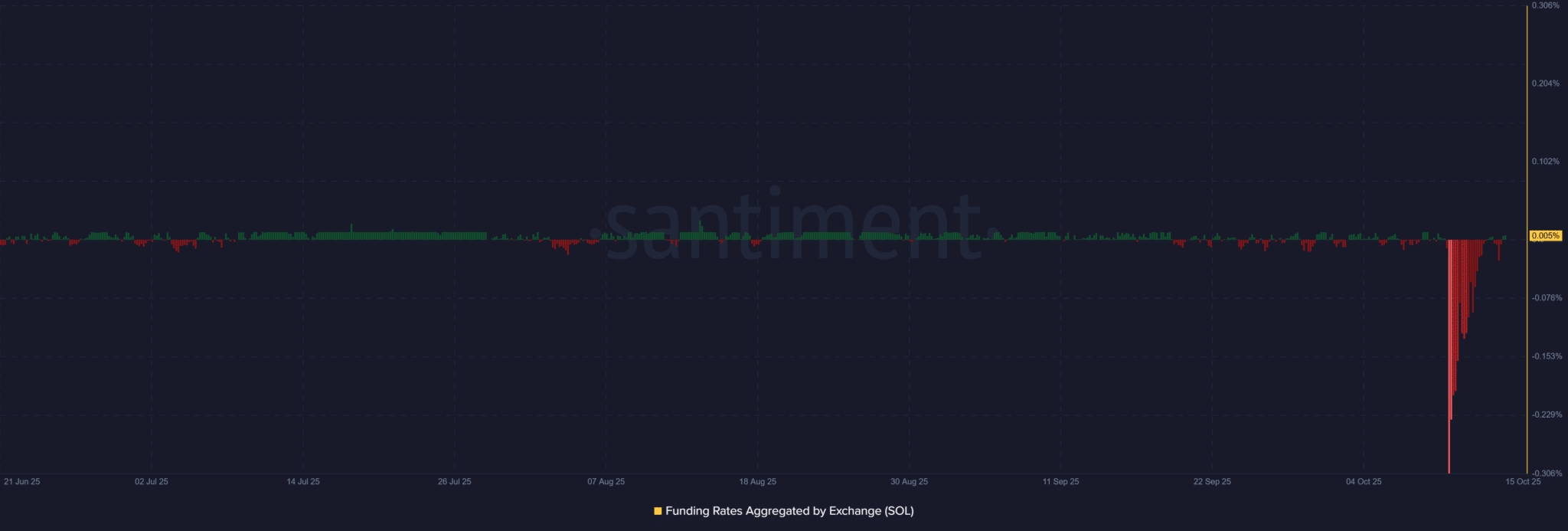

The Solana aggregated Funding Rate at the derivatives markets stood at +0.005 in the derivatives markets, which means that a larger number of traders are entering into long positions.

Positive funding rates are typically an indicator of growing sentiment, with the traders more willing to pay upside exposure to premiums becoming another sign that the Solana rebound is getting buy-in among leveraged traders.

Accumulation Phase Suggests Upcoming Bullish Cycle

Such a reversal of over-biased positioning, alongside the consistent price action above 200, indicates the resurgence of optimism across the future Solana markets.

The transfers of Forward Industries indicate treasury amendment whereas the accumulation of Solana Strategies reflects the institutional confidence.

As technical indicators become more positive, funding rates are steady, and more investors take an interest, it seems that the Solana rebound will be entering a new accumulation phase, which can be the precursor of the next significant price wave on strategic optimism grounds.

Conclusion

Based on the latest research, Solana appears to be entering a renewed phase of institutional confidence and market recovery. As technical indicators improve, funding rates grow, and constant on-chain accumulation continue, the Solana recovery is performing well, which could ultimately lead to its second significant bullish cycle.

Follow us on Twitter and LinkedIn, and join our Telegram channel to be instantly informed about breaking news!

Summary

Forward Industries’ $192 million Solana transfer to Coinbase Prime and Galaxy Digital suggests a treasury reshuffle, while Solana Strategies expanded holdings with 88,433 SOL, signaling institutional confidence. As Solana rebounds above 200, positive funding rates and the rising of technical indicators, the market mood is improving, pointing to a new possible bullish cycle as a result of strategic accumulation.

Glossary of Key Terms

Solana Rebound: Price recovery phase after market decline.

Forward Industries: Firm rebalancing its Solana holdings.

Solana Strategies: NASDAQ-listed company increasing Solana exposure.

Institutional Accumulation: Large investors buying more of an asset.

Demand Zone: Price level where buyers step in strongly.

Moving Average (MA): Indicator showing trend direction over time.

RSI (Relative Strength Index): Measures momentum and overbought/oversold levels.

Funding Rate: Derivatives metric showing trader sentiment.

Accumulation Phase: Period when investors steadily buy before a rally.

Frequently Asked Questions about Solana Rebound

1. Why did Forward Industries move Solana?

It likely rebalanced its treasury, not exited the market.

2. What does Solana Strategies’ buy show?

Strong institutional confidence in Solana’s long-term growth.

3. Is Solana recovering now?

Yes, it’s rebounding above $200 with bullish indicators.

4. What means Solana’s positive Funding Rate?

It shows rising long positions and improving trader confidence.

Read More: $192M SOL hits Coinbase Prime while $50M heads to Galaxy Digital">$192M SOL hits Coinbase Prime while $50M heads to Galaxy Digital

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.