Chainlink Price 5% as Bulls Target $23, If the $17 Technical Barrier Gives Way

0

0

Highlights:

- Chainlink’s price has increased 5% to $15, as trading volume spikes about 130%.

- LINK technical indicators suggest further upside, potentially obliterating the $17 barrier.

- Chainlink Exchange Outflow has experienced a great surge, an indication that a significant amount of the asset has flowed out of these platforms.

The Chainlink price like most cryptos today, has exploded past resistance keys, surging 5% to $15.86. The bullish outlook is accompanied by the rising trading volume which as spiked by over 130% to $894M. This recent increase shows increase trading activity in the LINK market.

However, the crypto market seems to be cooling off. This is evident as Bitcoin has slightly retraced from the $103K mark, currently exchanging hands at $102K. However, the recent cooling off is needed in the market to allow the bulls to sweep through liquidity before igniting a potential leg up.

Chainlink Price Outlook

The Chainlink daily chart outlook indicates a consolidation phase, which may act as an accumulation period. Meanwhile, the bulls have flipped the 50-day MA at $13 into immediate support, giving the bulls the forefront toward $17 immediate resistance.

If this support level holds steady, a potential rally towards $17 could be imminent. Moreover, if the market sentiment flips to be positive and increases buying pressure, further upside would be plausible. In such a case, Chainlink’s price could target the $$19, $21, and $23 levels would be the next reach.

The LINK technical indicators still uphold a bullish outlook. This is manifested by the Relative Strength Index’s position at 64.55. This shows that the buying activities are soaring in the LINK market. Moreover, there is still more room for the upside before LINK is considered overbought.

On the other side of the fence, the LINK MACD momentum indicator shows a bullish convergence. This is reinforced by the blue MACD line crossing above the orange signal line. This shows that the raiders in the LINK market are at liberty to buy more LINK tokens unless the MACD changes.

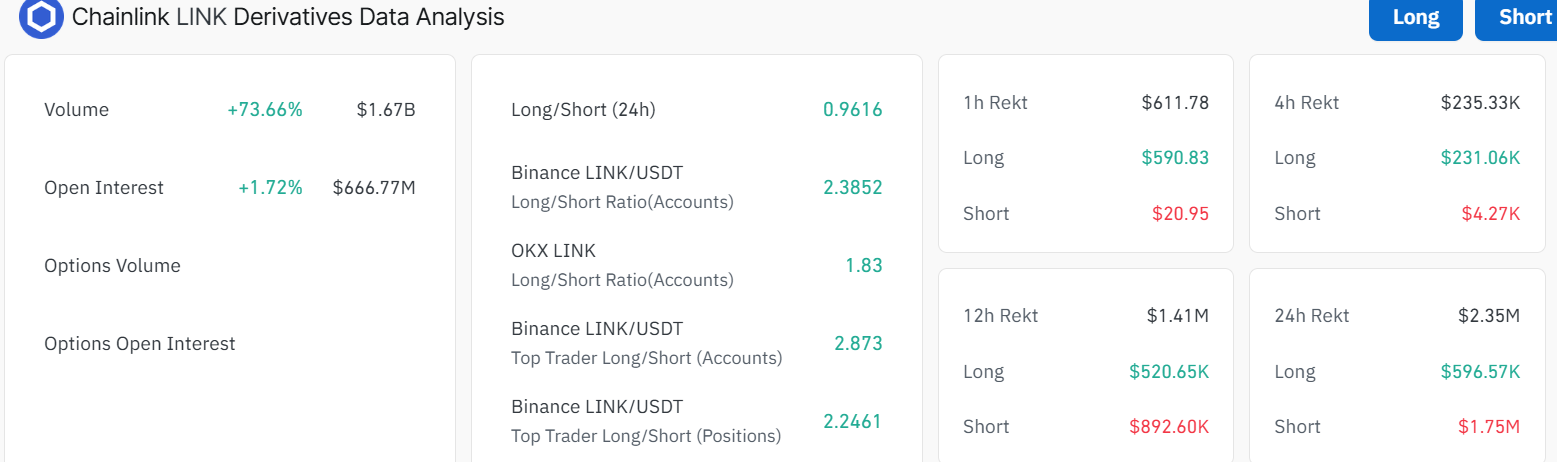

LINK Derivatives Data

According to on-chain metrics, the LINK derivatives data upholds a positive outlook. The LINK’s volume has soared 73% to $1.67B, while the open interest has skyrocketed 1.72% to $666.77M. This clearly indicates that there is increased flow of money into the market, as trading activities and investor confidence bolsters.

Meanwhile, according to Ali Martinex X’s post on May 8, over 3.32 million LINK flowed out of the exchanges.

Over 3.32 million #Chainlink $LINK have flowed out of exchanges in the past 24 hours, as shown by on-chain data from @santimentfeed! pic.twitter.com/s7vgJUAMGp

— Ali (@ali_charts) May 8, 2025

As indicated in Ali’s graph, the Chainlink Exchange Outflow also experienced a great surge, an indication that a significant amount of the asset has flowed out of these platforms. In terms of cash at the current rate, this figure equates to a staggering $ 50.91 million. Considering the extent to which that is involved, whales are likely to have caused these outflows.

It is noticeable from the chart that after the large outflow spike, the Chainlink price has experienced a sharp recovery rally. That may mean that the withdrawals matched new buying by whales who anticipated the run.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.