Ethereum Under Pressure? Exchange Inflows Spike as ETF Demand Slows

0

0

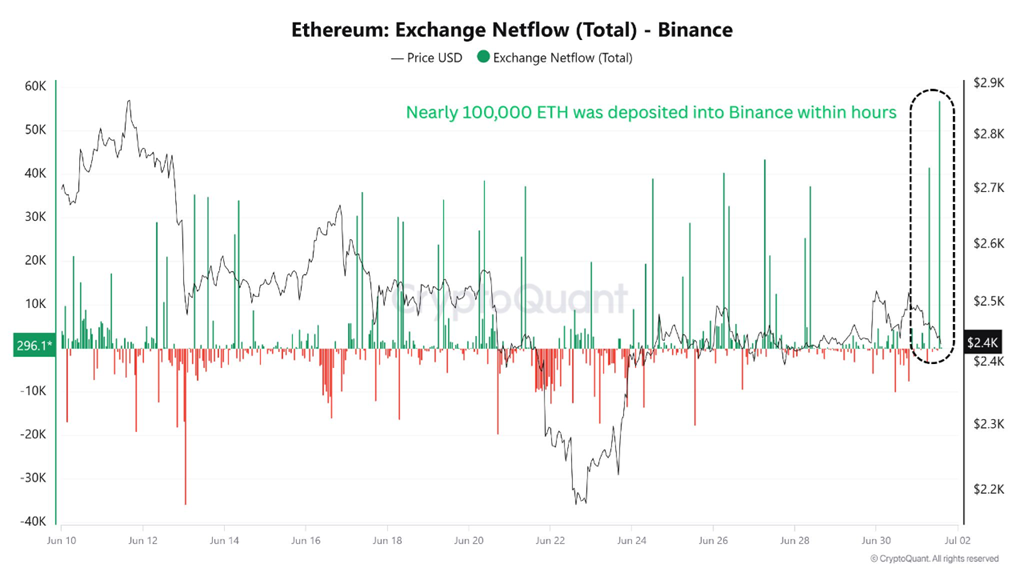

Ethereum inflows into centralized exchanges surged sharply in early July, which could worry investors hoping for an ETH recovery.

Below are on-chain signs suggesting that many whales might be looking to sell, just as ETH ETF inflows show signs of slowing.

Ethereum Moves to Exchanges — What Do Analysts Say?

According to data from CryptoQuant, on July 1, 2025, nearly 100,000 ETH, worth about $250 million, were deposited into Binance. This marks the highest single-day inflow to the exchange over the past month.

Ethereum Exchange Netflow – Binance. Source: CryptoQuant.

Ethereum Exchange Netflow – Binance. Source: CryptoQuant.

Compared to recent price behavior, large daily inflows often lead to ETH price corrections or keep the price trading within a tight sideways range.

In addition, an on-chain observer noted that over the past three weeks, a large entity withdrew 95,313 ETH from staking contracts using two wallet addresses. The entity then transferred 68,182 ETH (about $165 million) to centralized exchanges such as HTX, OKX, and Bybit.

With an average staking price around $2,878 per ETH and the current price near $2,431, this entity has suffered a roughly $42.6 million loss. This action suggests a stop-loss strategy or portfolio restructuring, which adds to market selling pressure.

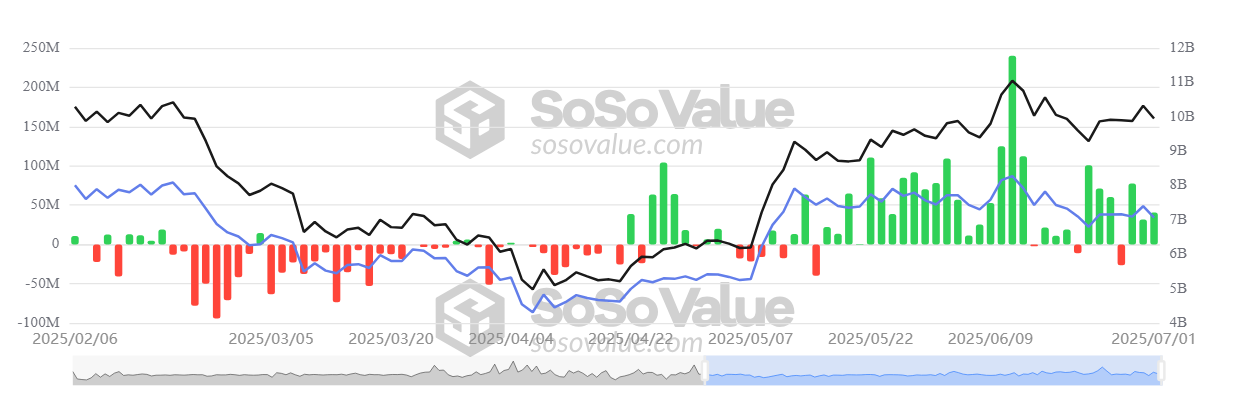

Meanwhile, data from Sosovalue shows that while net inflows into spot ETH ETFs in the US remain positive, they are slowing down.

Total Ethereum Spot ETF Net Inflow. Source: SoSoValue

Total Ethereum Spot ETF Net Inflow. Source: SoSoValue

Specifically, the net flow of these ETH ETFs dropped from over $240 million on June 11 to just over $40 million on July 1. This reflects a slowdown in ETF buying momentum.

All these data points combined could weigh ETH’s price during the first week of July. At the same time, statistics from Coinglass indicate that Q3 has historically been ETH’s weakest quarter, with an average return of just 0.59%.

“The long-term bullish outlook for Ethereum remains intact, depending on an improvement in broader macroeconomic conditions. However, Ethereum could face a slight short-term pullback,” analyst Amr Taha from CryptoQuant noted.

Experts Show Consensus on ETH’s Long-term Upside Potential

It seems that experts widely agree on ETH’s long-term potential.

MEXC Research noted that Ethereum is staging a strong recovery, thanks to validator upgrades that improve staking efficiency and clearer stablecoin regulations brought by the GENIUS Act.

“With risk appetite slowly returning to the market, along with stabilizing geopolitical situation and improved global liquidity, ETH looks well-positioned for further gains in the coming weeks. If current momentum persists and macro conditions remain favorable, a move towards $3,000 and potentially $3,300 seems increasingly plausible. Conversely, a black swan event may trigger a break below $2,350 and cause a steeper decline towards $2,100,” MEXC Research told BeInCrypto.

Meanwhile, Ryan Lee, Chief Analyst at Bitget, also emphasized core factors such as clearer regulatory signals through the GENIUS Act and strong on-chain activity that could drive ETH’s price higher.

“Ethereum is gaining notable momentum, buoyed by its validator backbone upgrade, which has improved staking efficiency and contributed to reduced ETH supply… In the near term, Ethereum may test the $2,800–$3,000 range by mid-July,” Ryan Lee told BeInCrypto.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.