Three Key Scenarios for Bitcoin Price in 2025 – Could BTC Hit $175,000?

0

0

Bitcoin may face three potential trend scenarios in the future, with the most optimistic one forecasting a surge to $150,000 to $175,000 within the next 12 months.

This prediction is supported by factors such as a strong influx of institutional capital and positive investor sentiment following the Trump administration’s plans to establish a national Bitcoin reserve.

Positive Forecasts from Experts and Market Signals

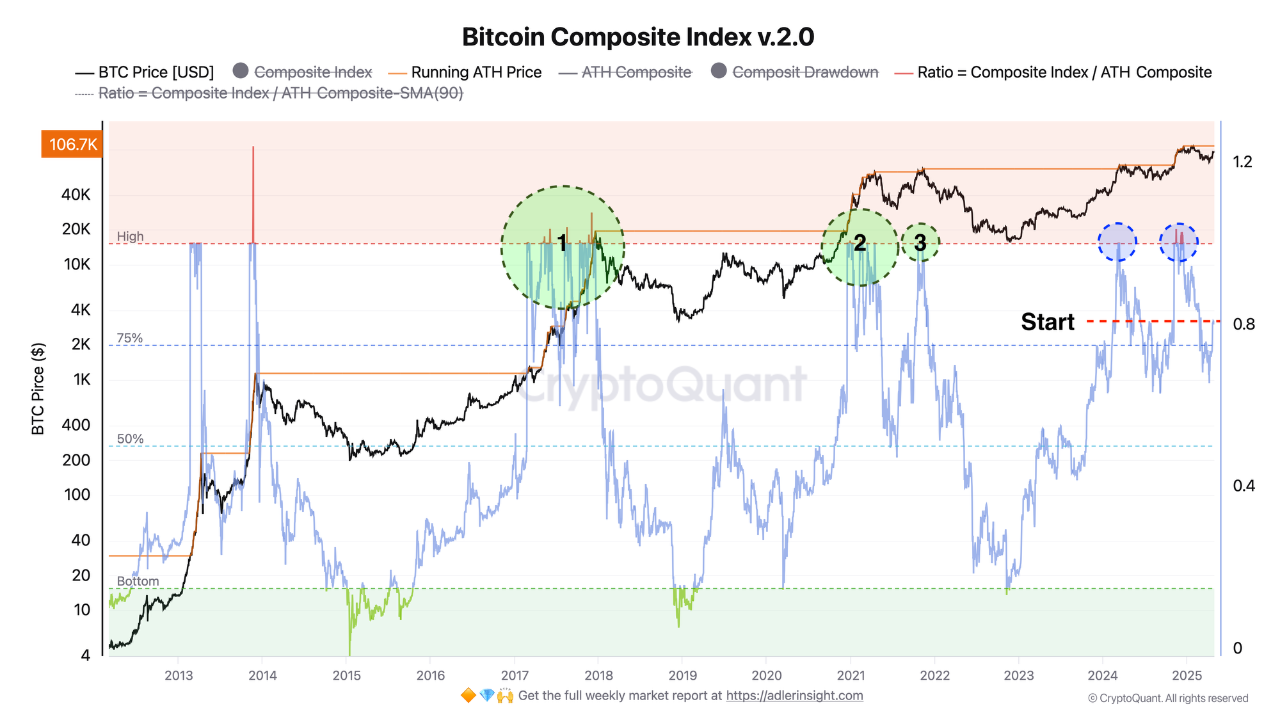

Bitcoin (BTC) is showing promising prospects as numerous positive signals from the market and expert predictions emerge in early May 2025. In an analysis by AxelAdlerJr, as of today, on-chain momentum is in the “starting” phase of a bull run.

Bitcoin Composite Index. Source: AxelAdlerJr

Bitcoin Composite Index. Source: AxelAdlerJr

The Bitcoin Composite Index currently stands at ≈ 0.8 (80%). Based on this indicator, AxelAdlerJr outlined three possible scenarios.

In the most optimistic scenario, BTC’s price could reach $150,000 to $175,000, following the cyclical logic of 2017 and 2021. This would occur if the Bitcoin Composite Index surpasses 1.0 and remains above that level.

If the ratio stays within the 0.8–1.0 range, the market would likely consolidate in a broad corridor between $90,000 and $110,000, indicating that participants are maintaining positions without increasing exposure.

Alternatively, if the ratio drops to 0.75 or below, short-term holders may start taking profits, potentially leading to a price correction to $70,000–$85,000. However, AxelAdlerJr notes that this scenario is less likely than the other two.

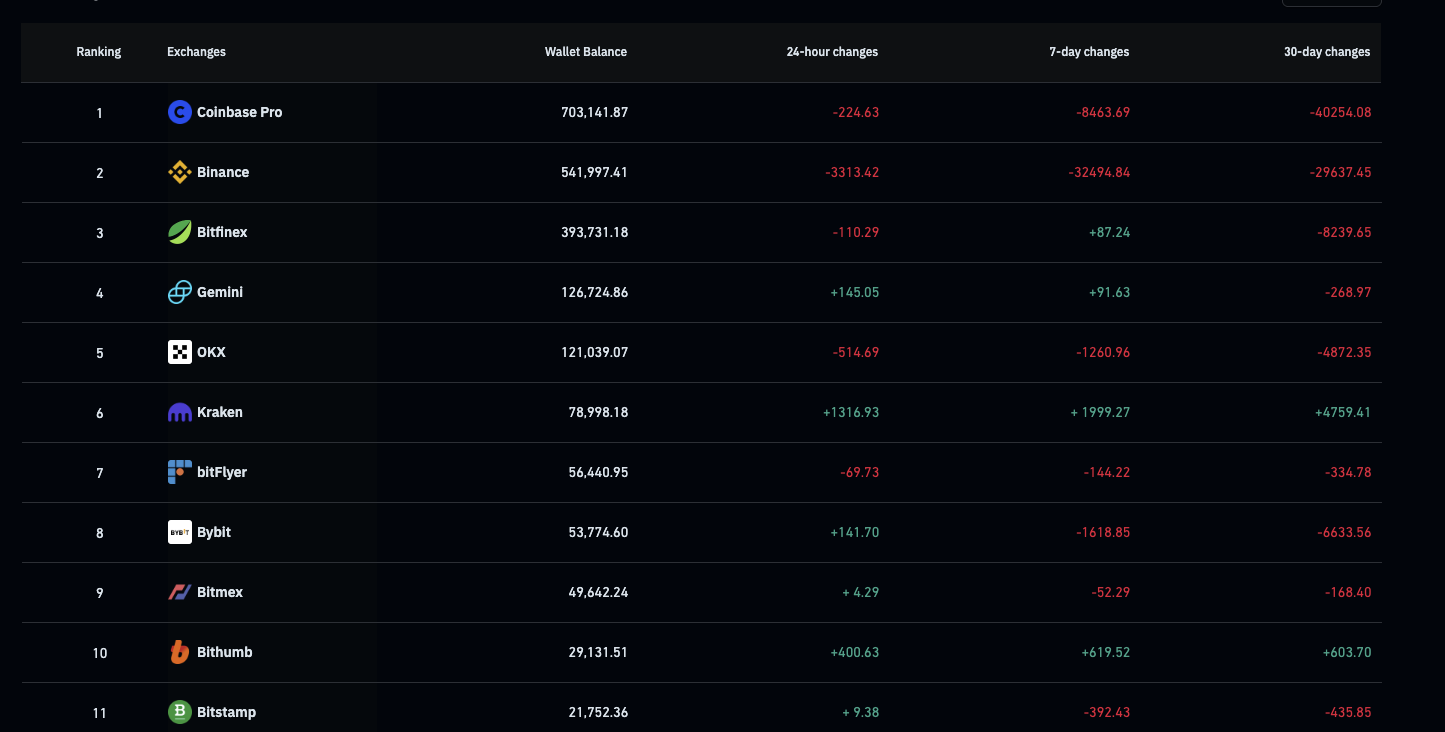

On-chain signals further bolster the bullish outlook. According to Coinglass, over the past 7 days, approximately 42,525.89 Bitcoins were withdrawn from centralized exchanges (CEX), reducing the supply on exchanges to a 7-year low of about 2.48 million BTC.

The trend of Bitcoin withdrawals from exchanges is often seen as a positive sign, as it indicates investor accumulation and reduced selling pressure, paving the way for price growth.

Bitcoin Supply on Exchanges. Source: Coinglass

Bitcoin Supply on Exchanges. Source: Coinglass

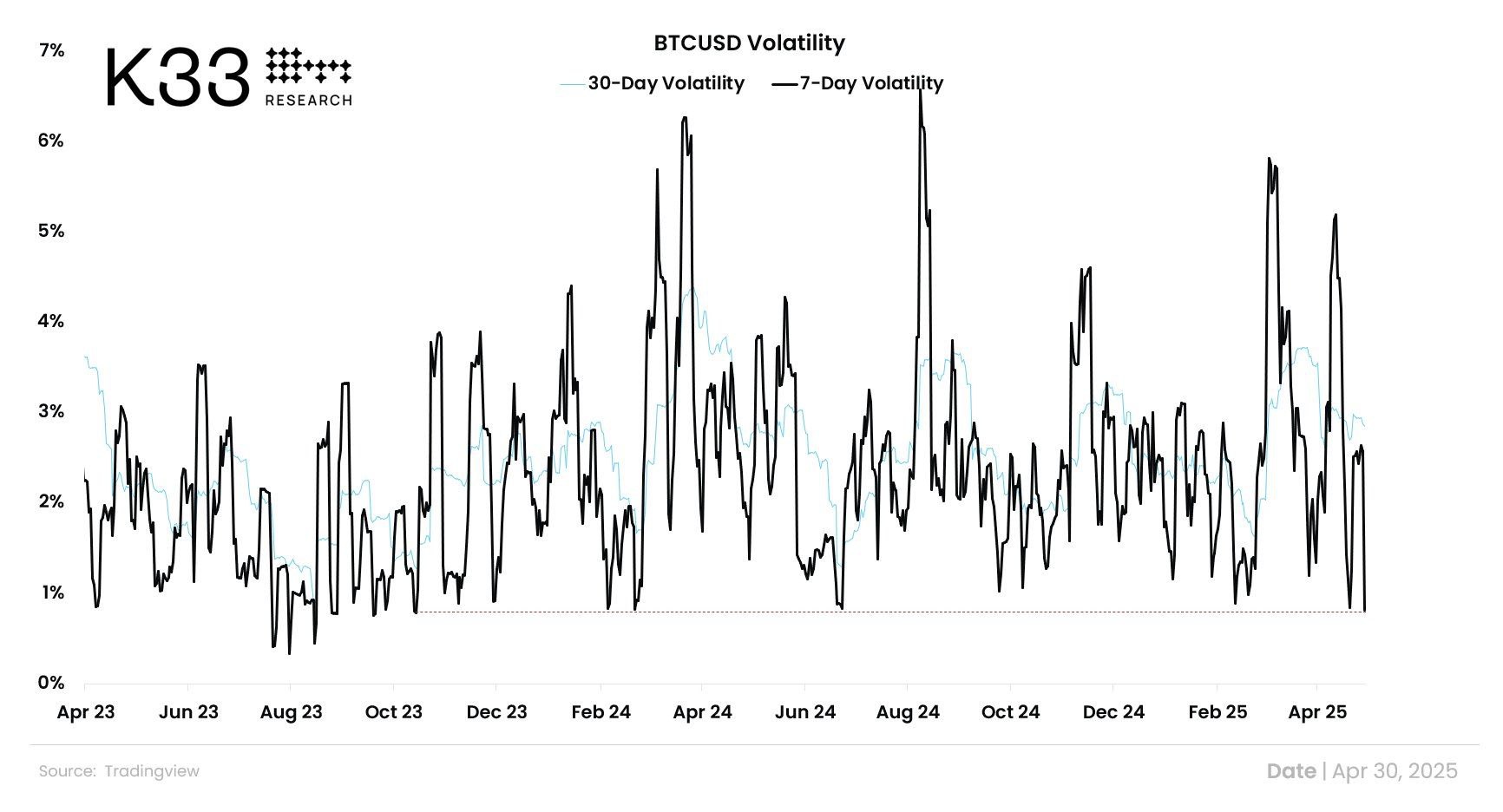

Bitcoin’s 7-day volatility has also hit its lowest level in 563 days. Low volatility typically signals a period of accumulation before a price breakout, as observed during past major rallies, such as in 2020 before Bitcoin peaked at $69,000.

BTC/USD Volatility. Source: cryptounfolded

BTC/USD Volatility. Source: cryptounfolded

Technical Analysis and Key Price Levels

Technical analysis also supports Bitcoin’s bullish scenario. According to a post on X by Ali, Bitcoin’s key support levels are at $93,198 and $83,444, indicating strong consolidation above these thresholds.

If Bitcoin sustains above $93,198, the likelihood of continuing its upward trend to reach the $150,000 target becomes highly feasible.

“The most critical support levels for #Bitcoin $BTC are $93,198 and $83,444. Key zones to watch if momentum shifts,” Ali shared.

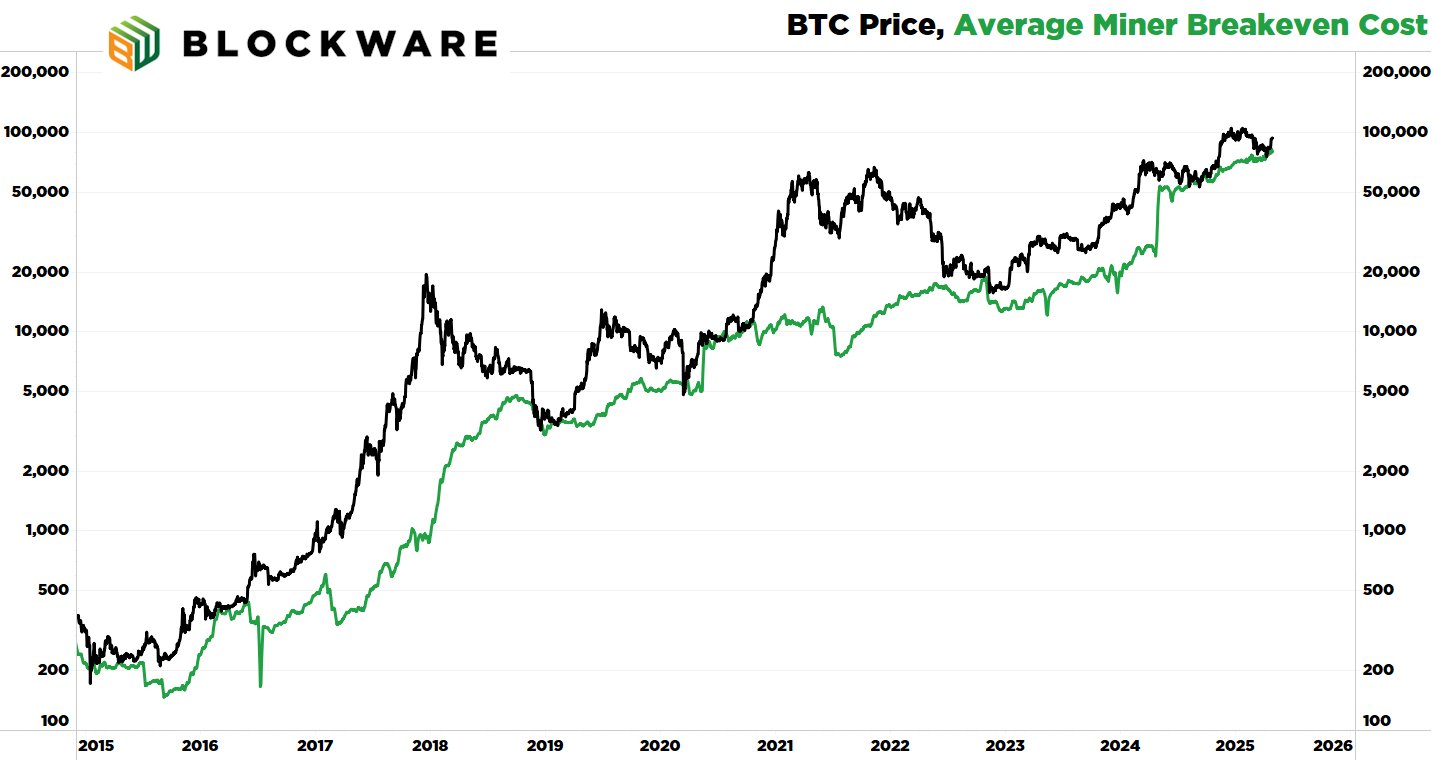

Moreover, Breedlove22, a well-known analyst, shared on X about three indicators signaling optimism for Bitcoin. The first is the Average Miner Cost of Production. According to Breedlove22, this metric is at a bottom, suggesting a significant bull market may be on the horizon.

Average Miner Cost of Production. Source: Breedlove22

Average Miner Cost of Production. Source: Breedlove22

The second indicator is the supply held by long-term holders, which measures Bitcoin unmoved on-chain for at least 155 days. Breedlove22 noted that over the past 30 days, long-term holders have acquired an additional ~150,000 BTC.

“Bitcoin is running out of sellers in the $80,000 to $100,000 range,” Breedlove22 stated.

Lastly, and most importantly, is USD liquidity, which effectively represents the “demand” side of the equation. More dollars in the system mean more potential bidders.

“And it’s not just USD liquidity that’s increasing – liquidity of all fiat currencies is on the rise, and Bitcoin is a global asset,” Breedlove22 added.

Echoing Breedlove22’s perspective, another X user shared that BTC’s valuation based on hash rate is at a support level, suggesting that a local bottom may have been reached.

BTC Hash Rate. Source: Giovann35084111

BTC Hash Rate. Source: Giovann35084111

In the optimistic scenario, Bitcoin is poised for a significant opportunity to reach $150,000 to $175,000. However, investors should also prepare for risks such as short-term price corrections.

With strong support levels at $93,198 and $83,444, Bitcoin has a solid foundation for continued growth, but caution remains essential.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.