What to Expect From Solana (SOL) in June?

0

0

Solana (SOL) experienced a strong rally at the beginning of May but lost momentum as the month progressed, resulting in a period of consolidation. After reaching an early high, Solana’s price fluctuated within a narrow range.

However, despite the sideways movement, investors continued to accumulate Solana in anticipation of a possible breakout. As the altcoin ended May relatively stable, there are significant factors that could influence its price action in June.

Solana Needs Institutional Support

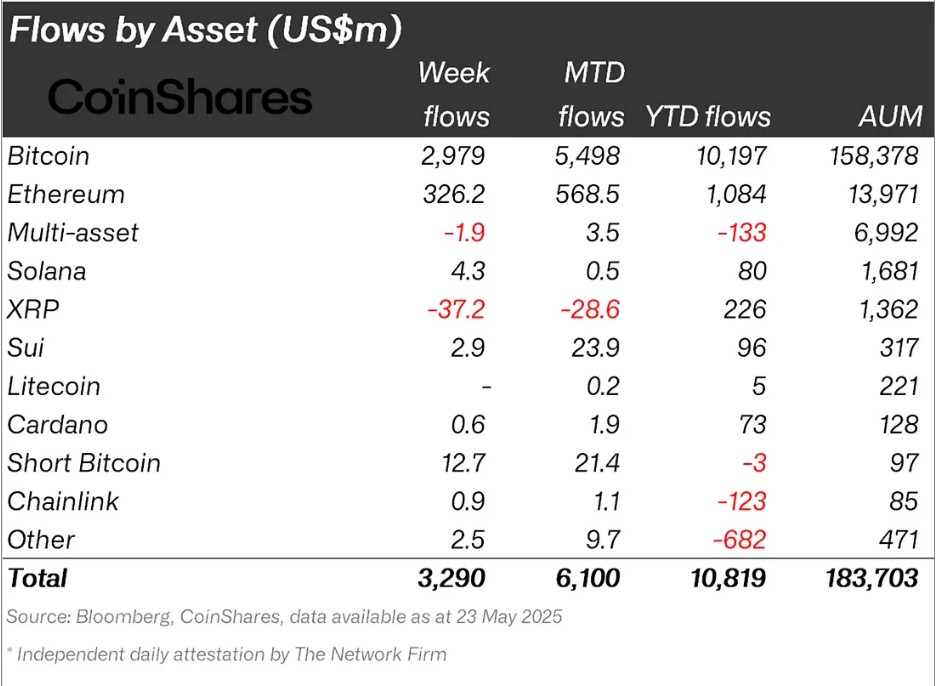

In May, institutional interest in Solana was notably low. The market was overshadowed by the rise of SUI, a newer blockchain that presented more opportunities for developers and gained considerable traction. While SUI saw inflows of $23.9 million, Solana only attracted a meager $0.5 million, making it one of the least favored blockchains for institutional investors.

This inflow was even lower than Cardano ($1.9 million) and Chainlink ($1.1 million) for the same period, showing that Solana’s institutional interest has waned. As a result, institutions are likely to continue focusing on other blockchain projects in the coming months. The lack of these investors’ participation may lead to Solana losing out on large-scale inflows, potentially affecting its long-term growth.

Solana Institutional Data. Source: Coinshares

Solana Institutional Data. Source: Coinshares

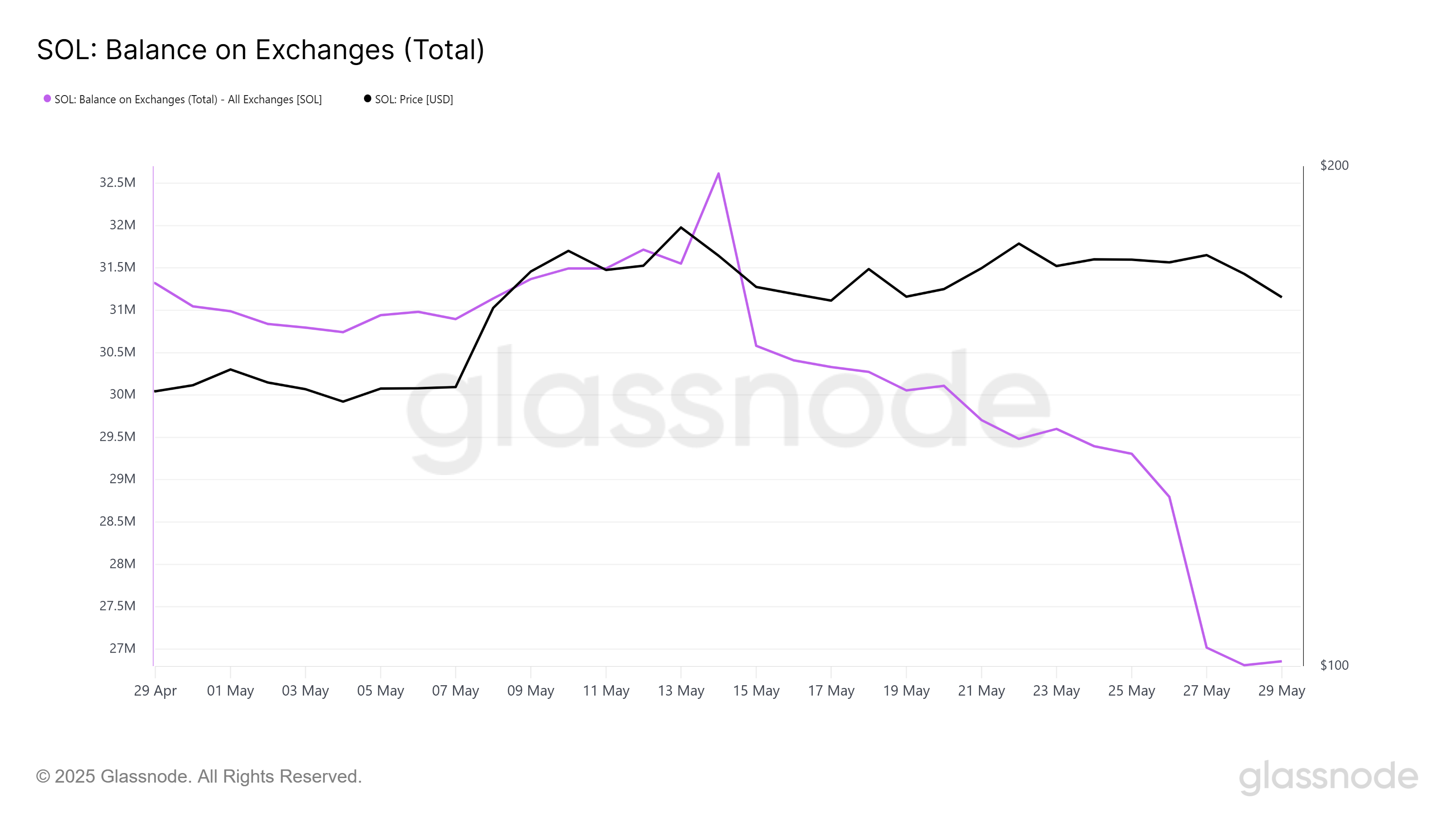

While Solana’s institutional interest has declined, retail investors and whales still seem confident in its future potential. The balance on exchanges shows a reduction of 4.13 million SOL, worth over $677 million, over the past month. This trend indicates that both small retail investors and large whales believe that Solana is undervalued at current levels.

The ongoing accumulation of SOL also prevents the altcoin from noting sharp declines, even amid broader market fluctuations. This conviction from investors signals that Solana price may not face significant drops in June, even if there is bearish sentiment in the broader crypto market.

Solana Exchange Balance. Source: Glassnode

Solana Exchange Balance. Source: Glassnode

SOL Price Could Register Gains In June

At the time of writing, Solana’s price stands at $164, marking an 11.5% increase from the beginning of May but a 12% drop from the month’s high. Given the mixed signals from both institutional flows and retail accumulation, Solana is expected to remain range-bound through June. It will likely continue to oscillate between support at $161 and resistance at $178, with key levels needing a strong push from the broader market to break higher.

If Solana manages to breach the $178 resistance and secure a position above it, the price could rise toward $188. This move would be supported by the upcoming Golden Cross pattern, where the 50-day EMA crosses over the 200-day EMA. The crossover signals bullish momentum, and if confirmed, it could bring Solana closer to multi-month highs.

Solana Price Analysis.. Source: TradingView

Solana Price Analysis.. Source: TradingView

However, investors must note that historically, June has proven to be a bearish month for Solana. Data from Cryptorank shows that over the past five years, the monthly ROI has ranged from negative to positive. But the median ROI sits at -8.97%.

Solana Monthly Returns. Source: Cryptorank

Solana Monthly Returns. Source: Cryptorank

Thus, if history repeats itself and broader market cues turn negative or investors decide to take profits, Solana may experience a downturn. A drop below the $161 support would raise concerns, potentially sending the price to $150 or even $144. This scenario would invalidate the bullish thesis and could indicate losses ahead for SOL holders.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.