Spot Ethereum ETF Inflows Shoot to $461 Million

0

0

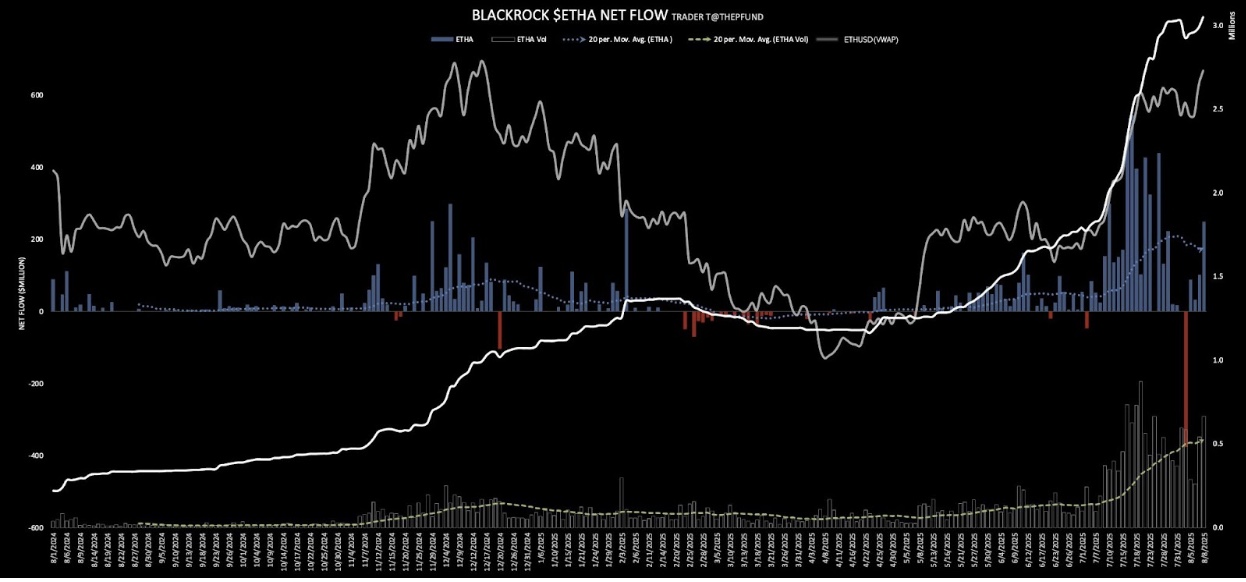

Inflows into spot Ethereum ETFs shot up to more than $460 million on Friday, August 8, as ETH price reclaimed the $4,000 level once again for the first time since December 2024. BlackRock iShares Ethereum Trust (ETHA) led the most inflows at $254.7 million.

BlackRock’s ETHA Dominates Ethereum ETF Inflows

As said, the BlackRock Ether ETF (ETHA) dominated the net inflows across all US Ethereum ETF issuers. During Friday’s trading session, ETHA purchased a total of 62,936 ETH, worth a staggering $254 million, with both inflows and trading volume surpassing the 20-day moving average. The ETF saw $1.7 billion in total trading volume during the session.

As per the data from Farside Investors, the net inflows into BlackRock’s ETHA since inception have reached closer to $10 billion. Following these strong inflows, the ETHA share price surged 5% on Friday, closing at $30.79. The share has gained a massive 47% over the past month, as the inflows jumped from $5 billion straight up to $10 billion. Apart from BlackRock, Fidelity’s FETH also contributed $132 million in inflows.

ETH Price Rally Triggers Short Liquidations

The recent ETH price rally past $4,000 yesterday led to major short liquidations. “It puts a smile on my face to see ETH shorts get smoked today. Stop betting against BTC and ETH – you will be run over,” noted Eric Trump.

Blackrock Ethereum ETF inflows | Source: Trader T

On Friday, roughly $105 million worth of Ether (ETH) short positions were liquidated, accounting for about 53% of the total $199.61 million in short liquidations across the crypto market. The liquidations came as ETH crossed the $4,000 mark for the first time since December 2024. Speaking on the current development, popular analyst Michael van de Poppe writes:

“Wild move of $ETH. It has swept the high and it is a little too risky to be buying $ETH at these highs. It’s setting up for a big breakout towards ATHs, but I think it’s wiser to allocate funds within the $ETH ecosystem as it should yield a higher return”.

https://twitter.com/CryptoMichNL/status/1954091190086705623

Crypto market analysts believe that Ethereum rally could set the stage for a broader altcoins season moving ahead. Apart from ETH other, altcoins have also shown strength with XRP, ADA, SOL, DOGE, gaining 5-10% yesterday.

The post Spot Ethereum ETF Inflows Shoot to $461 Million appeared first on Coinspeaker.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.