Solana Price Eyes $200 After 50% Rebound, Whale Accumulation

0

0

Solana (SOL) price has drawn attention after a sharp 50% recovery from its recent low. Market data and technical charts suggest continued bullish potential as large investors accumulate the asset.

Analysts and traders are now observing the $200 price zone as a possible target for Solana price by the end of May.

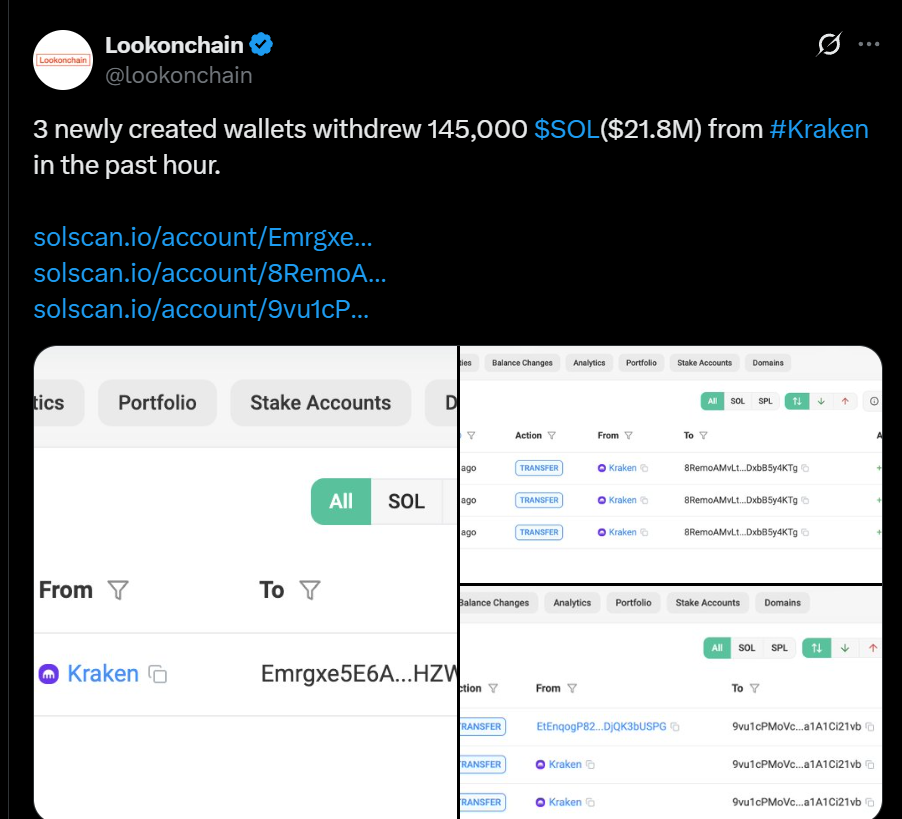

Whale Activity Signals Accumulation Trend

Large-scale accumulation of SOL has emerged as a key development. According to on-chain tracking, three newly created wallets withdrew a combined 145,000 SOL (worth approximately $21.8 million) from Kraken within a few hours.

When investors withdraw increasing assets, it demonstrates their rising confidence regarding the performance expectations of those assets.

Whales, alongside institutional investors, often shift their large investments from exchange to secure off-site storage before pursuing long-term appreciation.

Solana Price Technical Breakout Validated Bullish Momentum

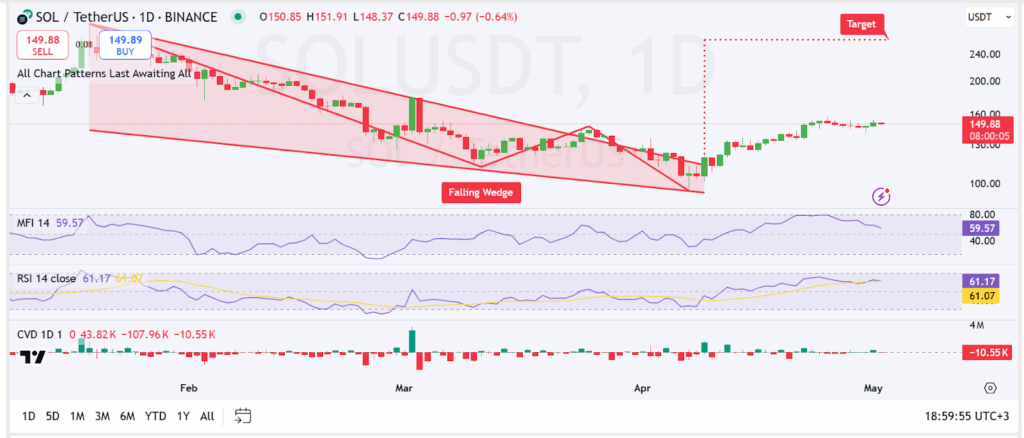

The daily SOL/USDT chart presented a breakout from a falling wedge formation. It is a bullish reversal pattern that typically precedes upward price movement.

The wedge pattern, formed over several weeks, resolved to the upside. It was supported by increasing Solana price and buying interest.

The breakout above the wedge’s resistance line has held, and SOL was consolidating around the $149–$150 area earlier today. however, at the time of writing it was priced lower, at $144.07.

Initial behavior suggested that the price was building a base for another potential leg upward. But current move may change things for the coin.

The technical target from the pattern’s breakout projected a price move toward $240. However, the intermediate resistance near $200 remained a key level to monitor.

Indicators Supported Continued Uptrend

Market momentum indicators strengthened the confirmation of existing bullish trends. The Relative Strength Index showed 61.17 at press time.

It indicated a moderate strength in an upward direction. The Money Flow Index (MFI) at 59.57 indicated a rise in buying interest, which wasn’t extreme.

A negative –10.55K reading from Cumulative Volume Delta (CVD) did not threaten the current price structure. The uptrend remained intact, with price forming higher highs and higher lows. Market analysts suggested that the price could retreat to the $145 support zone before initiating an upward trend.

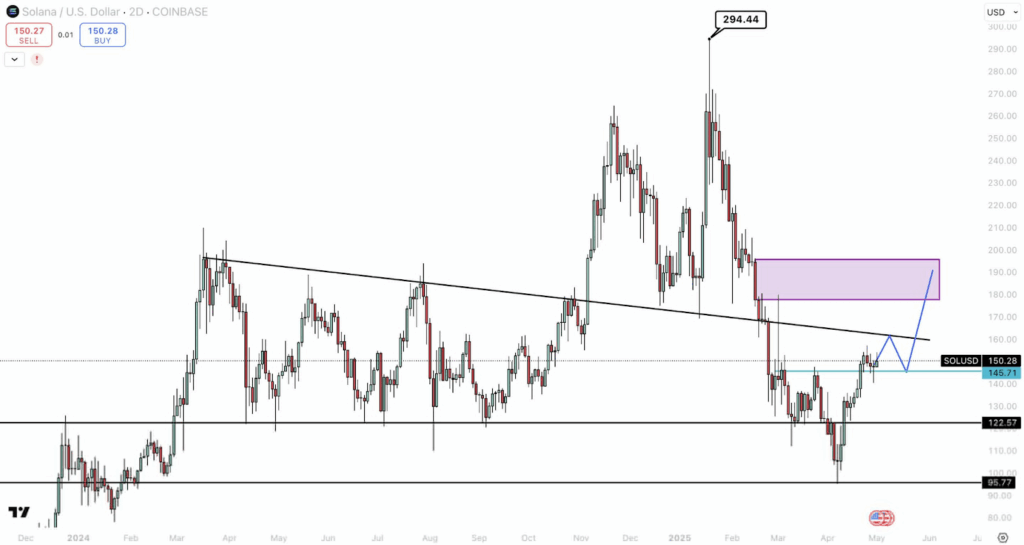

Market Outlook and Solana Price Projections

Market analyst Gerlaenco_ showed SOL gained more than 50% from its $95.77 bottom through the chart evaluation. The market showed bearish to bullish potential because SOL’s upward movement followed a breakout from descending resistance patterns.

The following resistance area extends from $175 to $185. SOL approaching a breakthrough of this resistance zone creates potential for investors to set $200 as an attainable short-term price target.

According to technical analysis, the price can move towards $240 when market conditions remain strong for continuation.

The market trended towards higher prices because recent whale behavior and recovery have supported existing momentum. Price validation beyond $175 in combination with increasing trading volume must develop to keep the price uptrend active.

Solana Ranked Third in Weekly Blockchain Transaction Activity

The blockchain network Solana achieved the position of third place regarding total transaction counts. The data from Top7ICO showed that the platform processed 702 million deals during the previous week on May 2, 2025.

Solana maintains its popularity through decentralized applications and trading platforms. They generate this robust trading volume.

There is high user participation on the network through its 4.32 million average daily active users. The persistent user and developer participation confirms that Solana provides both fast transaction speeds and large-scale network adoption to its users.

Solana has also obtained the top position in fully diluted market capitalization value among all listed blockchains. $90.1 billion is its total worth.

The post Solana Price Eyes $200 After 50% Rebound, Whale Accumulation appeared first on The Coin Republic.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.