Memecoin protocol raises $5.5m — this VC calls it Ethereum’s Ordinals moment

0

0

GM, Tim here.

Here’s what caught my DeFi-eye recently:

- What are Heroglyphs, and how do they help Ethereum?

- Why the DoJ just shut down crypto mixer Samourai Wallet.

- The lessons learned from Renzo’s $56m ezETH depeg.

$5.5m Heroglyphs hype

DeFi users are spending big on Heroglyphs, a buzzy new project that aims to align crypto memecoin trading and Ethereum decentralisation.

The Heroglyph protocol will give Ethereum users who run their own validators — or solo stakers — the ability to exclusively mint a new special kind of token.

The idea is that these exclusive tokens will become the hot new way for speculators to create memecoins.

If successful, the demand for Heroglyphs should incentivise more solo staking, making the Ethereum network more decentralised. Centralisation of Ethereum’s validators is an ever-present worry among its users and developers.

According to Mechanism Capital co-founder Andrew Kang, Heroglyphs could be Ethereum’s “Ordinals moment.” Ordinals tokens exploded on the Bitcoin network last year, and are collectively valued at over $2.1 billion.

Ethereum is interesting here

— Andrew Kang (@Rewkang) April 27, 2024

It could soon have its Ordinals moment

So far, the Heroglyph protocol has released a whitepaper outlining how the protocol works. It also launched a website that lets users mint several NFTs of varying cost.

What these NFTs will do isn’t yet known. But that hasn’t stopped speculators from spending almost $5.5 million on them since they started minting on April 26.

Samourai Wallet founders arrested

The news sent shockwaves throughout DeFi: Authorities arrested two co-founders of Samourai Wallet amid US Department of Justice charges including conspiracy to commit money laundering.

Samourai Wallet, a combined Bitcoin wallet and crypto mixer, has a long history of not only facilitating private transactions, but actively welcoming those flouting US sanctions.

“Welcome new Russian oligarch Samourai Wallet users,” the project’s X account posted last June.

The US has previously come down hard on those accused of helping nations it has sanctioned. Just ask Virgil Griffith, an Ethereum developer sentenced to over five years in prison for advising North Korea on how to use cryptocurrency and blockchain technology, which the nation state uses to evade sanctions.

However, going after crypto mixers like Samourai Wallet isn’t a good way to prevent illegal transactions, Mikko Ohtamaa, a security researcher and CEO of DeFi trading protocol Trading Strategy, told DL News.

“The most effective place to stop money laundering is centralised on and off ramps,” he said, referring to centralised crypto exchanges.

Renzo’s ezETH depegs

Those looping deposits of Renzo’s ezETH restaking token just lost $56 million after the announcement of the protocol’s REZ token triggered a liquidation cascade.

Investors were left disappointed after Renzo revealed ezETH holders are set to receive 5% of the total REZ supply, compared with 2.5% for participants in Binance’s launchpool.

This discrepancy has caused frustration among ezETH users, who feel that their four-month commitment to holding ezETH merits a greater reward than what is being offered to those participating in Binance’s seven-day launchpool.

The incident also highlights the problems with launching liquid staking or restaking tokens without giving users the ability to redeem them for the backing Ether.

It’s not the first time ezETH loopers have been hit in recent weeks. On April 11, an unexpected code change on Blast-based protocol Pac Finance triggered $26 million worth of liquidations.

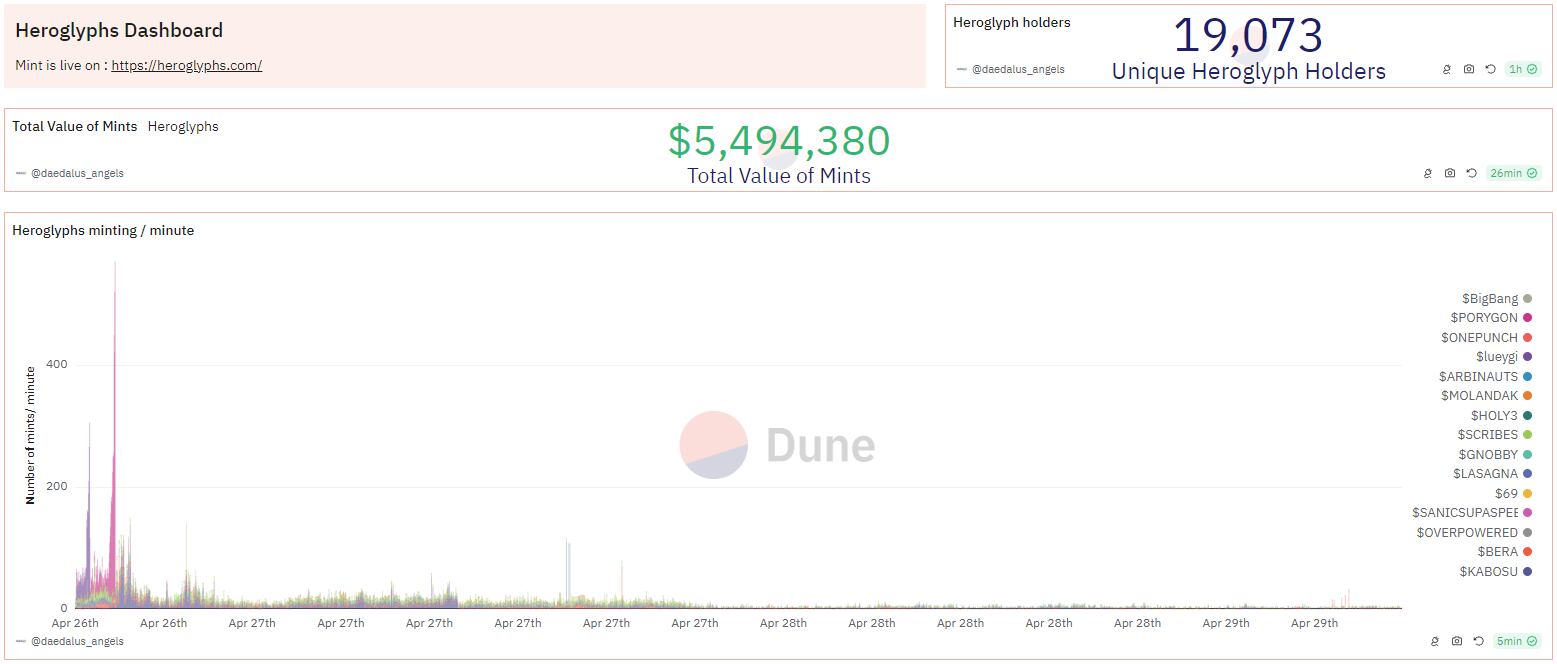

Data of the week — Heroglyphs breakdown

Looking for the latest updates on Heroglyphs? Check out the breakdown of which NFTs are getting minted with Daedalus’s Dune dashboard.

This week in DeFi governance

VOTE: Arbitrum DAO decides recipients for its long term incentives pilot program

VOTE: HAI to distribute its first round of community rewards

VOTE: Aave to run a Cantina security competition ahead of its v3.1 upgrade

Post of the week

Ethereum co-founder Vitalik Buterin explains Binius: A way of making cryptography proof systems binary.

BInius: highly efficient proofs over binary fieldshttps://t.co/lHAGXbgI9r pic.twitter.com/3Xx4zIAm1b

— vitalik.eth (@VitalikButerin) April 29, 2024

What we’re watching…

Today the @eigenfoundation introduces EIGEN, based on research by @eigen_labs, alongside a Season 1 Stakedrop.

— EigenLayer (@eigenlayer) April 29, 2024

EIGEN is the Universal Intersubjective Work Token, complementing ETH as the Universal Objective Work Token in EigenLayer.

See the full Eigen Foundation announcement: https://t.co/ZxswOiwWyR

Restaking protocol EigenLayer just announced its EIGEN token, along with an airdrop for early depositors.

Got a tip about DeFi? Reach out at tim@dlnews.com.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.