MicroStrategy Is Profitable Enough to Join the S&P 500 – But Will It Happen?

0

0

A new report claims that Strategy is currently eligible to be listed on the S&P 500. The firm’s Q2 profits and unrealized gains make it a genuine candidate, and a listing would trigger $16 billion in new stock sales

Still, Nasdaq reportedly launched a wide campaign of scrutiny into digital asset treasury (DAT) firms today. This hurt Strategy’s stock price and may signal an ongoing hostility from TradFi institutions.

Strategy On the S&P 500?

Strategy has been on a hot streak lately, securing legal breakthroughs and announcing a $450 million BTC purchase this week.

However, it may have a golden opportunity coming up. According to a report from Bloomberg, Strategy may be profitable enough to be included in the S&P 500.

Specifically, the firm’s Q2 2025 Earnings Report posted incredibly bullish figures, like $10 billion in revenue and $14 billion in unrealized gains.

Logically, these figures are more than enough for Strategy to qualify in the S&P 500. Still, a listing isn’t a pure numbers game; the S&P Committee considers subjective judgment alongside hard economic data.

This may seem like a long shot, but there are a few reasons to suggest that the Committee might go for it.

Specifically, it recently added other Web3 firms like Coinbase and Jack Dorsey’s Block Inc. to the list. Stephens Inc, a financial services firm, claimed that Strategy has a better chance of S&P 500 access than other eligible Web3 firms like Robinhood:

“It was a strong statement that they want to build out this industry group when they included Coinbase. They care about building representation of leading companies in the 500. So, if someone is a big player in the space, it’s hard to ignore them,” claimed Melissa Roberts, managing director at Stephens.

If Strategy did get added to the S&P 500, it’d be highly bullish. For example, this listing would automatically cause passive index funds to acquire about $16 billion in shares.

Since this would be unrelated to efforts to buy BTC, it’d prevent further shareholder dilution, a growing concern for Strategy. Moreover, it’d be a huge milestone for TradFi acceptance.

A Bad Sign from Nasdaq

Unfortunately, though, we need to be realistic. There’s plenty of evidence that core financial institutions aren’t quite ready.

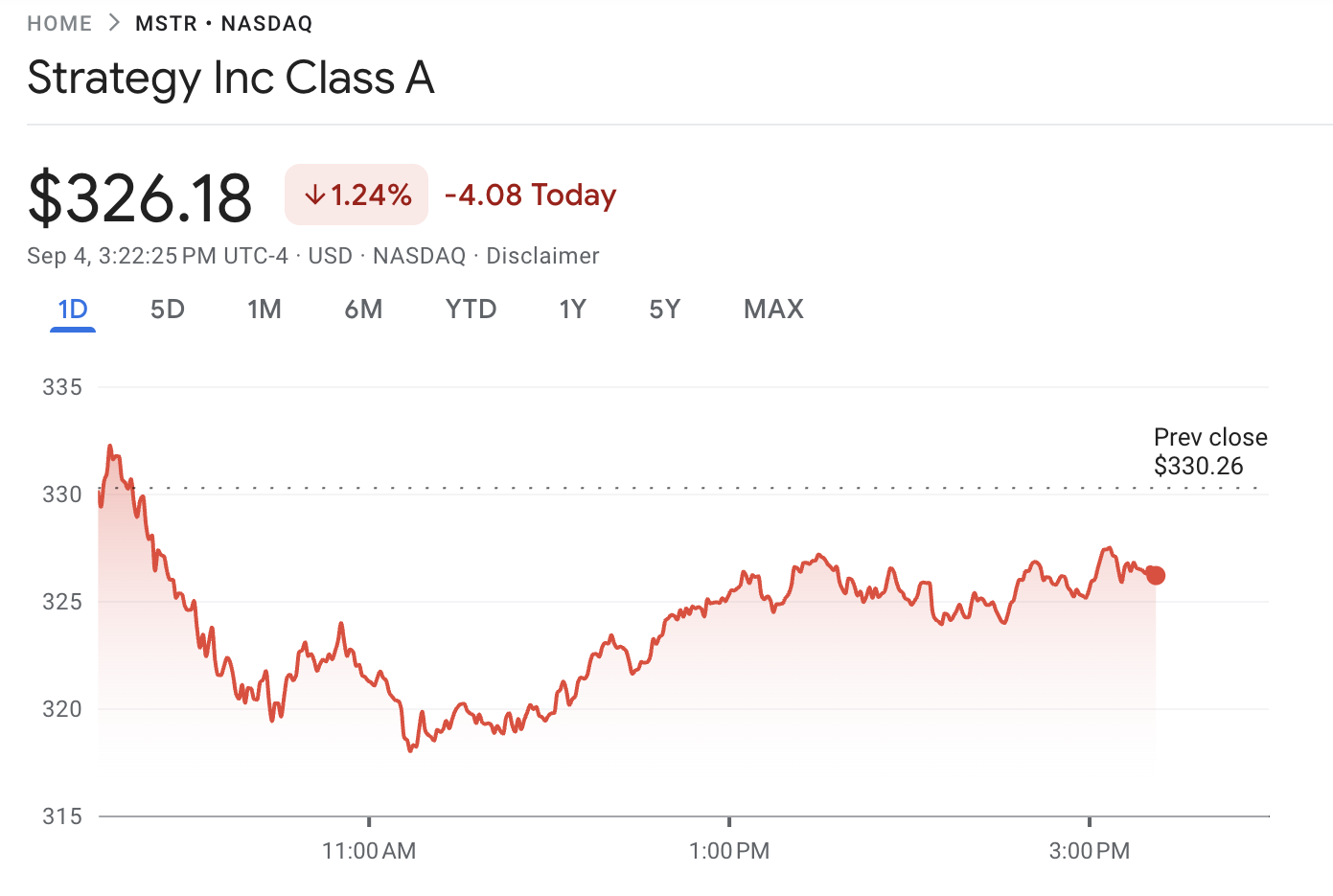

Case in point, the Nasdaq began scrutinizing Strategy and other DAT firms today, looking for signs of economic malfeasance. All the largest DATs fell after the news, although Strategy has mostly recovered:

Strategy Price Performance. Source: Google Finance

Strategy Price Performance. Source: Google Finance

The Nasdaq and S&P 500 committees aren’t directly linked, but this is still a bad omen for Strategy’s chances. Nonetheless, we must remember that the firm is a genuine contender.

A few years ago, Michael Saylor received a lot of mockery for his DAT agenda, but it’s been paying off extraordinarily well.

If Strategy keeps growing like this, it will likely eventually be added to the S&P 500. Major windfalls like this listing won’t materialize out of thin air, but they can benefit a plan already working.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.