Ethereum Records Strongest Run Since 2024 As Crypto Inflows Hit $286 Million

0

0

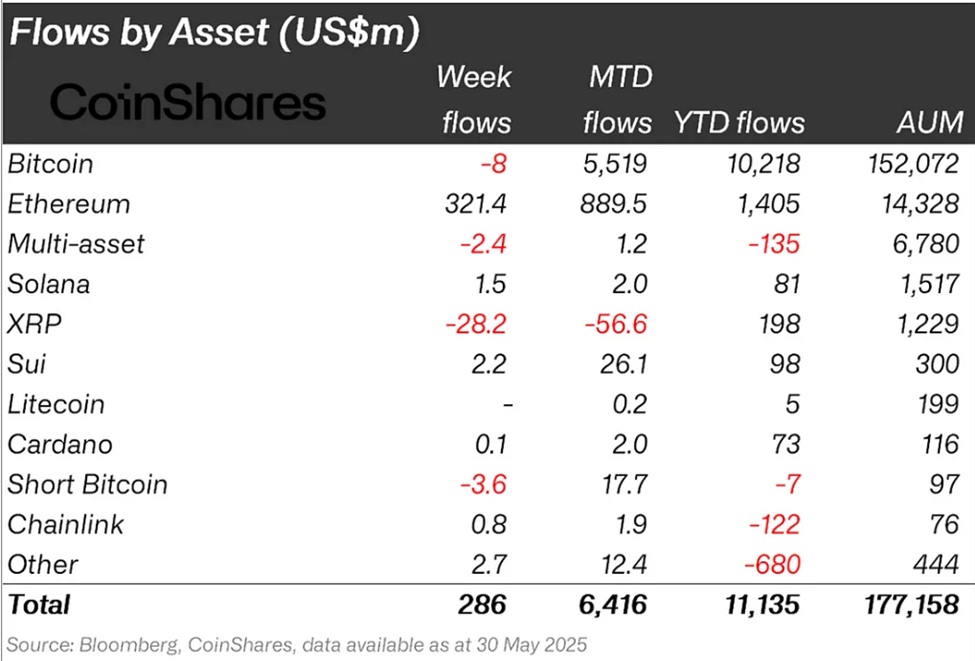

Ethereum (ETH) investment products recorded their strongest six-week inflow streak since December 2024. With this influx, crypto inflows reached $286 million last week.

The fresh capital brings the seven-week inflow total to a remarkable $10.9 billion, signaling renewed investor optimism despite macroeconomic uncertainty and regulatory tensions in the US.

Ethereum Dominates Crypto Inflows

According to the latest CoinShares report, Ethereum accounted for $321 million of last week’s crypto inflows. With this, the second-largest altcoin on market cap metrics achieved the largest single-week gain in 2025.

It comes amid growing investor confidence in the smart contract giant. This momentum follows six consecutive weeks of inflows totaling $1.19 billion.

While Ethereum surged, Bitcoin’s trajectory wavered. The pioneer crypto initially saw strong inflows early in the week, but sentiment turned after a federal court ruled US tariffs illegal, contributing to macro-driven volatility.

“The President’s assertion of tariff-making authority in the instant case, unbounded as it is by any limitation in duration or scope, exceeds any tariff authority delegated to the President under IEEPA,” the judges determined.

Bitcoin products ended the week with $8 million in outflows, marking the first decline following six weeks of inflows that brought in $9.6 billion. Other altcoins showed mixed results. XRP suffered its second consecutive week of outflows, losing $28.2 million.

According to Butterfill, this hints at a weakening investor narrative amid ongoing regulatory ambiguity.

Crypto inflows last week. Source: CoinShares

Crypto inflows last week. Source: CoinShares

Regionally, the US remained the largest contributor to inflows with $199 million, but market interest is visibly diversifying. Hong Kong posted its strongest inflows ($54.8 million) since its exchange-traded products (ETPs) launched just over a year ago.

Despite the impressive inflow streak launched, total assets under management (AuM) for crypto investment products fell to $177 billion. This indicates a correction, down from a peak of $187 billion, with the CoinShares report citing short-term price weakness across major tokens.

Notably, last week’s inflows followed a record-setting period. Two weeks ago, crypto inflows hit $3.3 billion, the highest yearly total. As BeInCrypto reported, this came amid fears of US market fragility after Moody’s downgraded the outlook on US credit.

ETH Logs Best Streak Since 2024 Amid Pectra Momentum and ETF Hopes

Optimism may still be riding high after the successful Ethereum Pectra upgrade in May, which improved staking efficiency and long-term scalability.

BeInCrypto recently reported that the Pectra Upgrade saw Ethereum lead inflows with $205 million during the week ending May 17, with the fork driving a change in sentiment.

“Ethereum was the standout performer, with US$205m in inflows last week and $575 million YTD, indicating renewed investor optimism following the successful Pectra upgrade and the appointment of new co-executive director Tomasz Stańczak,” Butterfill wrote at the time.

Institutional interest also seems to be rising, with reports surfacing that BlackRock is preparing for the US SEC (Securities and Exchange Commission) to approve a spot Ethereum staking ETF within the next two weeks.

“BlackRock is reportedly pressuring the SEC to approve the ETH staking ETF within the next two weeks. If it happens, Ethereum could teleport straight to $12,000,” noted Coinvo, a crypto trader and founder.

Such a development could significantly boost mainstream adoption. Adding further fuel to Ethereum’s bullish narrative is the plummeting exchange supply. On-chain data reveals Ethereum exchange balances are now at their lowest levels in seven years,

“ETH supply shock incoming. Exchange balances of Ethereum are collapsing—now at their lowest levels in 7 years,” Coin Bureau noted.

Ethereum supply on exchanges. Source: Glassnode

Ethereum supply on exchanges. Source: Glassnode

This suggests a tightening liquid supply as long-term holders accumulate.

With Ethereum leading inflows, institutional appetite rising, and exchange supply drying up, the setup suggests a potential breakout scenario. However, this may be contingent on regulatory tailwinds aligning.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.