0

0

The latest US GDP report delivered a strong economic signal—but for crypto markets, especially altcoins, it may be bad news.

Data released on December 23 showed the US economy growing faster than expected in Q3, reinforcing the idea that monetary conditions may stay tighter for longer. While Bitcoin remains relatively resilient, broader crypto markets are flashing warning signs.

The US economy expanded at an annualized rate of 4.3% in Q3, well above the market forecast of 3.3% and higher than the previous 3.8% reading.

At the same time, core PCE inflation rose to 2.9%, up from 2.6%, remaining sticky above the Federal Reserve’s 2% target.

Also, Real personal consumption expenditures jumped 3.5%, far exceeding expectations of 2.7%.

In simple terms, Americans are still spending aggressively, and inflation pressures have not cooled enough for policymakers to declare victory.

Stronger-than-expected growth reduces the urgency for interest-rate cuts.

Combined with recent CPI data and still-elevated inflation expectations from the University of Michigan survey, the GDP report strengthens the case for higher-for-longer rates in 2026.

For risk assets like crypto, that matters because:

This environment historically pressures altcoins more than Bitcoin.

Market reaction following the GDP release reflected this dynamic.

Bitcoin remained relatively stable near $87,800, down modestly on the day but still holding key structural levels. Its market cap stayed above $1.75 trillion, showing limited panic selling.

Altcoins, however, underperformed sharply:

This divergence highlights Bitcoin’s role as a liquidity sink during macro uncertainty.

Momentum indicators reinforce the concern.

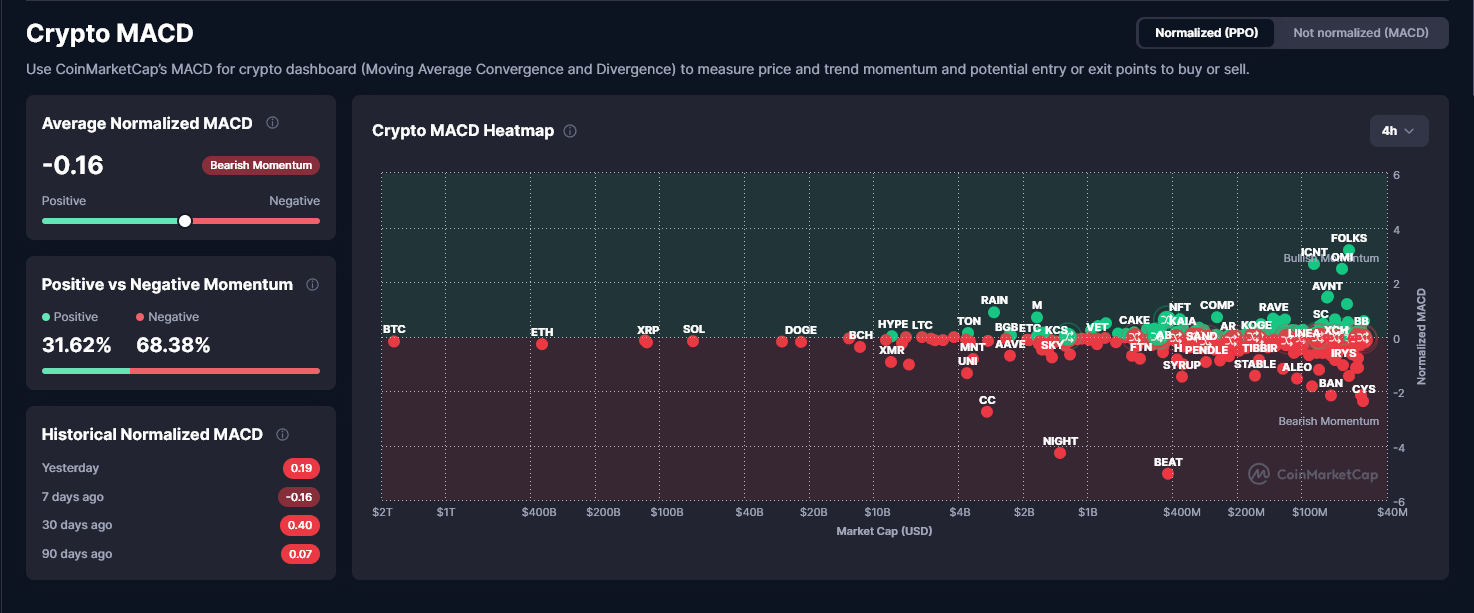

According to CoinMarketCap’s normalized MACD, 68% of tracked crypto assets are now in negative momentum. The average market MACD sits at –0.16, firmly in bearish territory.

Most assets below the $10 billion market-cap range remain deeply negative.

When momentum weakens across the market, capital tends to retreat toward fewer, more liquid assets—again favoring Bitcoin over altcoins.

Average Crypto MACD. Source: CoinMarketCap

Average Crypto MACD. Source: CoinMarketCap

Altcoins rely heavily on cheap liquidity, retail inflows, and risk-on sentiment. Strong GDP growth combined with persistent inflation reduces all three.

With US consumers still spending but facing higher costs, disposable income for speculative investment may shrink in early 2026.

Institutions, meanwhile, remain cautious amid Bank of Japan risks and global rate uncertainty. That combination creates a difficult environment for altcoins to sustain rallies.

The GDP report does not signal an immediate crypto crash. However, it raises the probability of prolonged consolidation or downside pressure, particularly outside Bitcoin.

If macro conditions remain unchanged:

Overall, strong US economic data is no longer bullish—it is a liquidity warning.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.