Here Is Why Ethereum Price Could Rally to $3000

0

0

Highlights:

- The price of Ethereum rallies 6%, trading at $2,600, with a 147% surge in volume.

- Ethereum leads the Real-World Assets (RWA) revolution, with a total RWA value of $7.54 billion, including $131.1 billion in stablecoins.

- Technical indicators indicate a bullish outlook, with a potential breakout above $2,679 targeting $3,000.

As of July 3, the Ethereum price rallied 6% to $ 2,600, as the crypto market shows signs of life. Its daily trading volume has notably increased by 147% to $1.6 billion, indicating heightened investor confidence and market activity. The ETH token has increased by 6.5% over the past week, despite a 12% decline in the last month. Meanwhile, the short positions are at multi-year levels, which keeps the ETH price under pressure in the short-term perspective. The fundamentals, however, are becoming increasingly bullish. If the bulls develop momentum, the price can surpass the critical resistance points, triggering a significant price surge to $3,000.

Institutional Shorts on $ETH Hit Multi-Year Highs

Heavy short positioning is keeping $ETH price suppressed…

But here’s the twist:

If bulls gain momentum, a short squeeze could send ETH flying past key levels.The setup is there. All it needs is a spark.#Ethereum pic.twitter.com/W1c7KLwRnh

— Bitcoinsensus (@Bitcoinsensus) July 3, 2025

Ethereum Price Poised For Upside Movement

To start with, Ethereum is driving the revolution of Real-World Assets (RWA), with a total RWA value currently staggering at $7.54 billion. The asset breakdown depicts that the largest share was in stablecoins, at $131.1 billion, followed by US Treasury debt at $5.6 billion, and commodities at $1.6 billion. These figures illustrate the dominant position of Ethereum in the emerging decentralized finance market and its progress toward reshaping the global financial system.

$ETH Total RWA Value + $7,540,000,000.

Stablecoin market cap + $131,100,000.

Ethereum is leading the RWA revolution. pic.twitter.com/hsbxC0myVM

— Ted (@TedPillows) July 3, 2025

In the 12-hour chart outlook, the ETH/USD continues its consolidation phase, with the altcoin oscillating between the $2,384 and $2,679 levels. If this channel serves as an accumulation period, then a breakout above the $2,679 level may signal further upside, potentially reaching the $3,000 mark.

The RSI (Relative Strength Index) is at 61.86, which means that there is some way to go before there are signs of overbought conditions. The MACD indicator, on the other hand, indicates a bullish crossover; hence, there is a chance of further bullish trends in the next few days. This group of technical indicators, combined with the growing liquidity in the market, suggests that Ethereum is poised to break out of its current range.

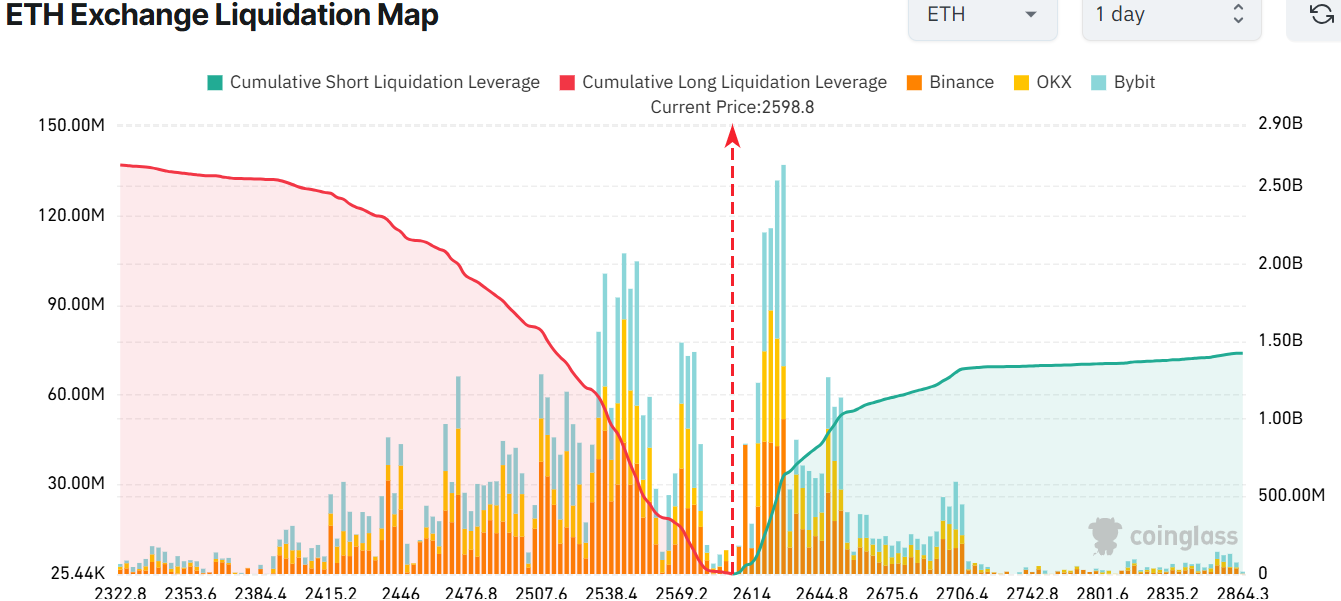

Furthermore, the short squeeze potential and liquidation map indicate that a potential price breakout is forthcoming. As the liquidation map indicates, long liquidations have outperformed short liquidations, with $2.63 billion in long liquidations and only $1.42 million in short liquidations. This imbalance implies that a breakout in price may prompt the shorts to close their positions, thereby pushing the prices up further.

ETH Price Prediction: Is It Too Late to Buy Ethereum?

The Ethereum price could rally to higher levels if the $2600 mark is broken. Moreover, the bullish technical indicators call for traders to buy more ETH. With immediate support at $2,507 holding strong, the bulls could ignite a short-term rally towards the $2,600-$2,725 resistance levels.

If the momentum persists, ETH could reach $2800 by mid-July. However, in the long term, with Ethereum leading the RWA revolution, the $3000 mark won’t be off the table by Q4. Provided the crypto market sustains the conviction and the macro conditions don’t turn sour. In the meantime, traders should closely monitor the potential RSI overbought conditions and volume. If these indicators flip bearish, traders may need to re-evaluate their approach to ETH.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.