LIBRA token jumps 80% after Circle freezes $57M linked to founders

0

0

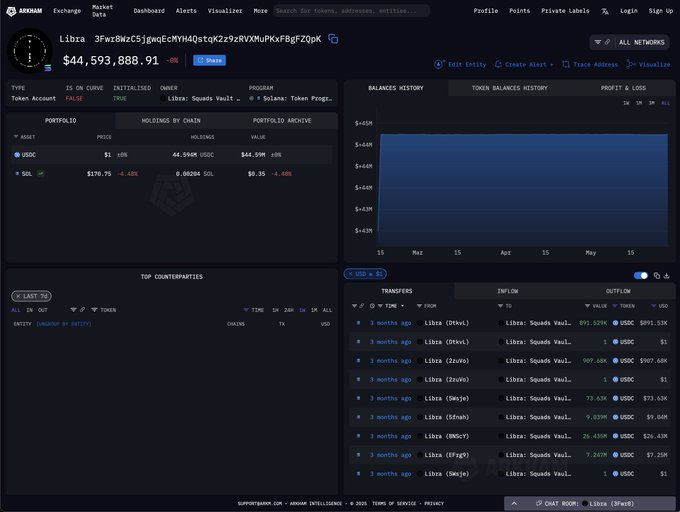

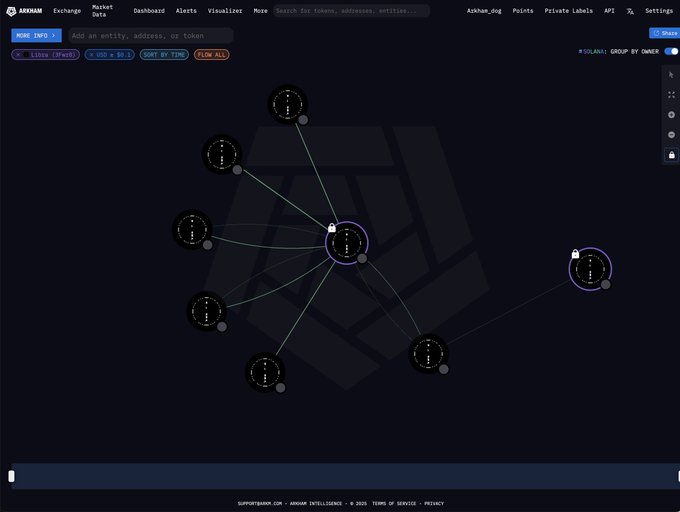

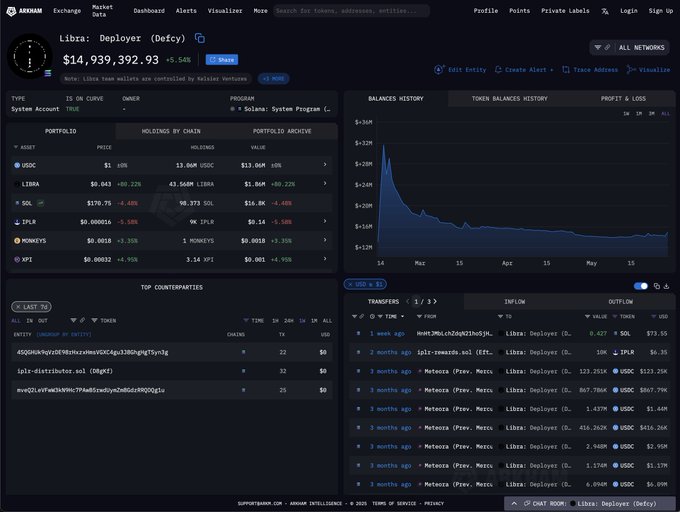

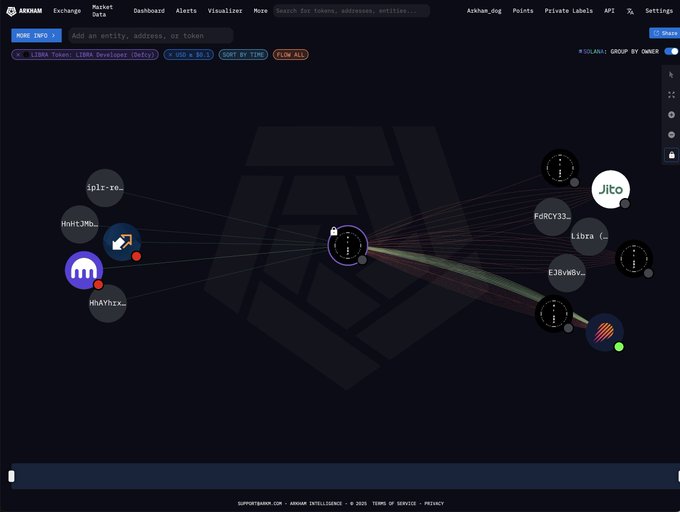

In a striking development in the meme crypto sector, stablecoin giant Circle has frozen two wallets linked to the team behind the LIBRA token, locking USDC worth $57.65 million.

The move follows a court order and has sparked various debates within the crypto world.

Critiques highlight centralization and control concerns in stablecoins like the USD Coin.

Meanwhile, LIBRA exploded following the announcement, soaring from a daily low of $0.02357 to $0.04265 before cooling.

That represented a sharp 81% upsurge within minutes.

Circle locks $57M amid LIBRA controversy

The US District Court for the Southern District of NY ordered the freeze following Burwick Law’s legal request.

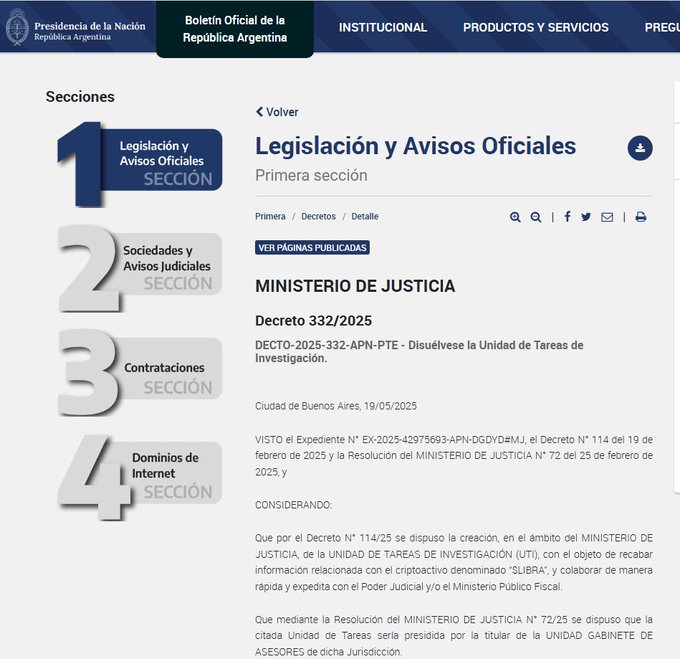

The LIBRA meme asset has been among the hottest topics in crypto due to its connection to the Argentine President, who faces legal investigation due to his earlier endorsement of the project.

Javier Milei advertised LIBRA as a vehicle for financial freedom, propelling the meme’s market cap to $4.6 billion.

However, the opposite happened as the token crashed to a $162 million market capitalization shortly, leaving investors with losses of $250 million.

Meanwhile, the latest asset freeze comes after the president closed offices investigating the LIBRA scandal recently.

Now, the court has scheduled a hearing next month, June 9.

While neither Circle nor the LIBRA team issued an official statement about the asset freeze, the move indicates possible illegal activities linked to the asset’s rapid rise and fall.

Ethereum founder Vitalik Buterin warned about politicians using meme assets to raise funds for their benefit while hurting innocent investors.

Did the Argentine use LIBRA for illegal fundraising?

Were their insiders who leveraged political promotion to maximize their returns?

While the latest freeze could be the first step toward answering these questions, the move has triggered various debates, with centralization dominating.

Circle’s asset lock raises centralization concerns

The firm has attracted controversies due to USDC features that allow Circle to confiscate, freeze, or block funds whenever ordered by regulators or lawmakers.

The latest decision following a court order.

Such features are against the crypto ethos of decentralization and operating without anyone’s control.

Thus, many view the freeze as a confirmation that not all digital assets are immune to control.

While currencies like Bitcoin and Ethereum boast massive decentralization, stablecoins seem to operate within traditional oversights.

One X user stated:

Circle flexing that freeze button like it’s a game, but $57M USDC just got caught in regulatory frost – centralization strikes again.

LIBRA price action

The meme crypto trades at $0.02761 after sliding from its recent peak.

Meanwhile, the faded daily trading volume signals a weak uptrend, hinting at substantial dips in the upcoming hours.

With the intensifying legal scrutiny and prevailing broad-based corrections, LIBRA might erase its latest gains in the near term.

The post LIBRA token jumps 80% after Circle freezes $57M linked to founders appeared first on Invezz

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.