Crypto Market Liquidations Top $544 Million Ahead of Mt. Gox Repayment

0

0

Crypto market liquidations have once again increased to a massive $538 million, as Bitcoin and altcoins faced yet another selling pressure. BTC BTC $111 135 24h volatility: 0.9% Market cap: $2.22 T Vol. 24h: $69.94 B is down 1.25% on Oct. 16, testing crucial support at $110,000, as Mt. Gox will soon start the repayment to creditors later this month.

Crypto Market Liquidations Rise with Bitcoin Whales Seeing Profit-Booking

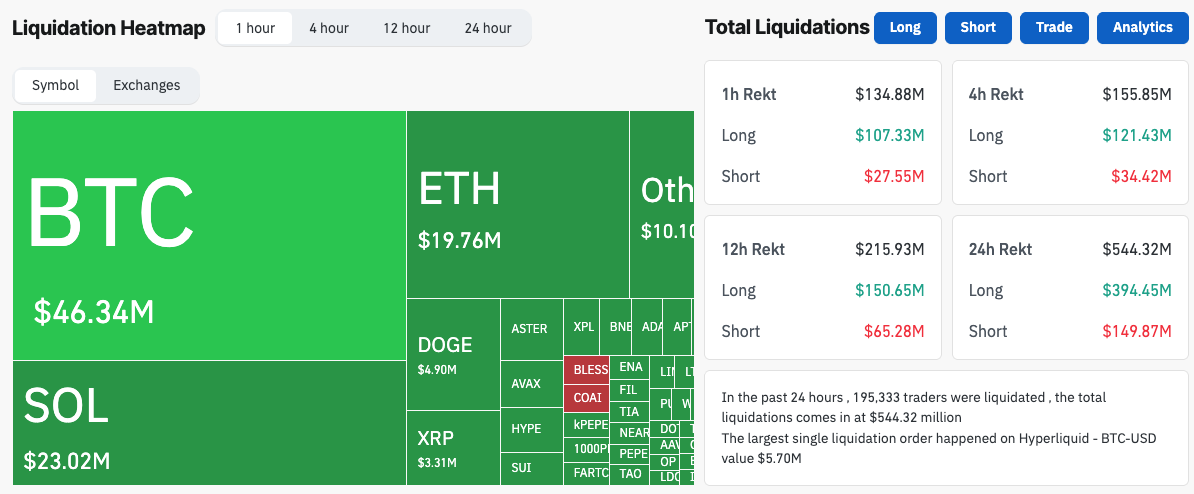

According to the CoinGlass data, the overall crypto market liquidations have soared to $544 million, with $394 million in long liquidations. In the last 24 hours, a total of 195,333 traders have been liquidated, with Ethereum [NC] Crypto market liquidations soar to $544 million | Source: CoinGlass[/caption]

Crypto market liquidations soar to $544 million | Source: CoinGlass[/caption]

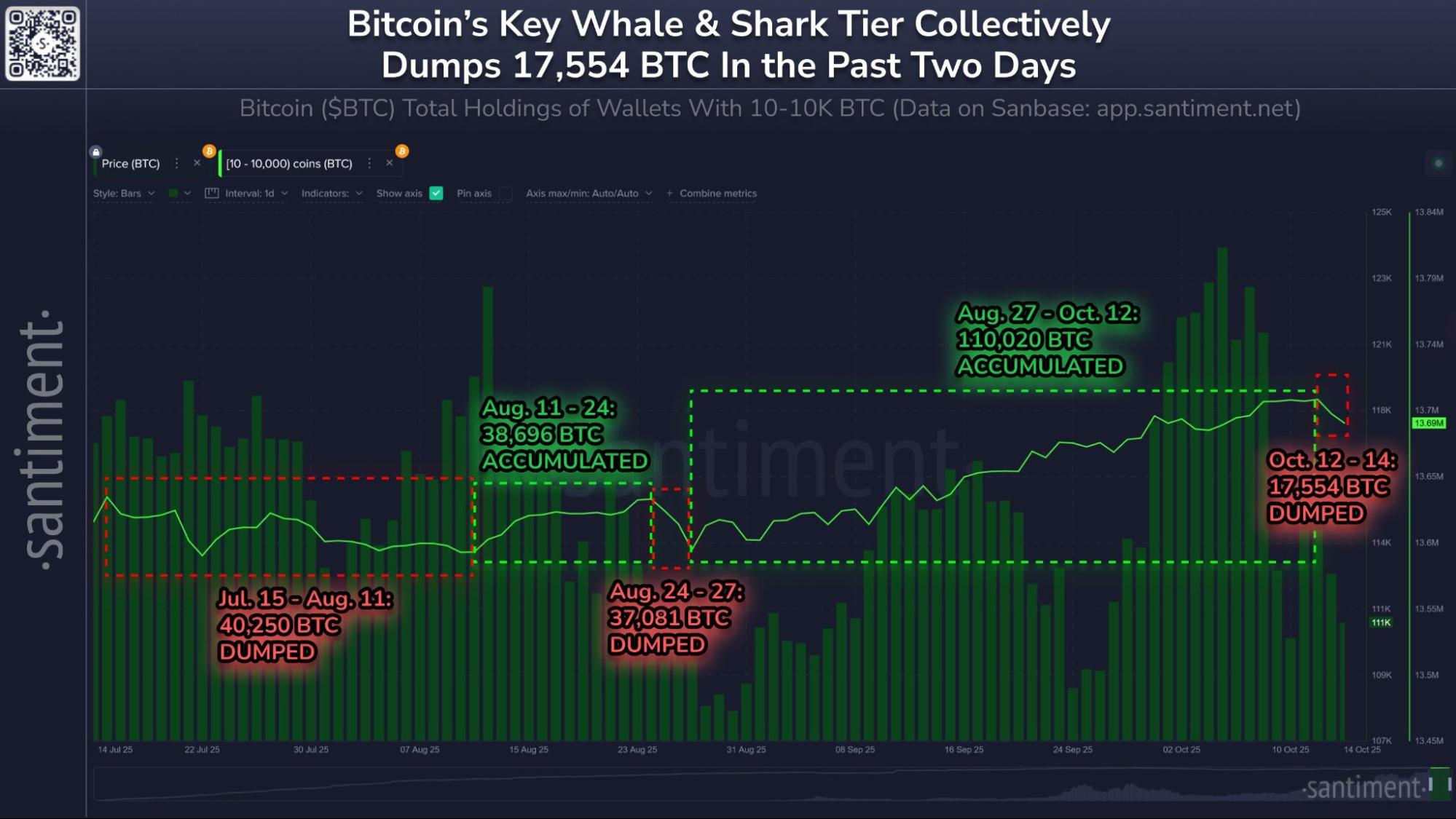

Furthermore, blockchain analytics firm Santiment reported that Bitcoin’s key whale cohort has shown early signs of profit-taking. Wallets holding between 10 and 10,000 BTC, which collectively control 68.68% of the total supply, have offloaded 17,554 BTC in recent days.

Despite the minor sell-off, these large holders have accumulated 318,610 BTC since the beginning of 2025. This shows that the overall institutional and whale confidence remains intact.

Bitcoin whale profit-booking | Source: Sanitment

Apart from Bitcoin, altcoins are also contributing to the crypto market liquidations today. Ethereum price is testing crucial support at $4,000 as bulls and bears lock horns.

Other altcoins like XRP XRP $2.44 24h volatility: 2.3% Market cap: $146.09 B Vol. 24h: $5.45 B , Solana SOL $195.4 24h volatility: 3.7% Market cap: $106.82 B Vol. 24h: $9.58 B , Dogecoin DOGE $0.20 24h volatility: 1.7% Market cap: $30.06 B Vol. 24h: $2.95 B , and Cardano ADA $0.68 24h volatility: 2.5% Market cap: $24.71 B Vol. 24h: $1.35 B are down by 2-4% during this crypto market volatility. This shows that volatility is likely to continue ahead of some of the key macro events, like Fed rate cuts, etc.

Mt. Gox Faces Repayment Deadline Ahead

The long-dormant Mt. Gox wallets have shown on-chain activity for the first time in seven months. This has reignited market concerns ahead of a key repayment deadline.

Blockchain data from Arkham indicates that the defunct exchange still holds roughly 34,000 BTC earmarked for creditor repayments. The recent movement comes as the court-approved repayment extension nears its expiration on Oct. 31, 2025.

The extension was granted earlier this year after some creditors faced procedural and technical delays in completing repayment steps. With the deadline approaching, market participants are increasingly wary of potential sell-side pressure.

According to CryptoQuant analyst Mignolet, if the Mt. Gox trustee is unable to obtain another extension, the remaining funds, worth $3.88 billion as of the current BTC price, will soon enter the market.

“When the extension was announced, action must be taken by October 31…If there is no further extension, these 34,000 bitcoins will eventually enter the market, which could clearly become a catalyst for creating FUD once again,” wrote Mignolet.

The post Crypto Market Liquidations Top $544 Million Ahead of Mt. Gox Repayment appeared first on Coinspeaker.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.