3 US Crypto Stocks to Watch Today

0

0

Crypto US stocks are in focus today as Coinbase (COIN), Strategy Incorporated (MSTR), and MARA Holdings (MARA) react to major earnings and Bitcoin milestones.

COIN surprised traders by closing up 5.06% despite missing Q1 revenue and EPS expectations. MSTR continues to surge alongside Bitcoin, with its holdings now worth nearly $54 billion. Meanwhile, MARA jumped 7.20% after posting strong revenue growth and outlining a strategic shift toward digital energy infrastructure.

Coinbase (COIN)

Coinbase’s Q1 2025 earnings report, released yesterday, fell short of market expectations. Revenue came in nearly $200 million below forecasts, and EPS dropped to just $0.24 against the anticipated $2.09. Transaction revenue was missed by $70 million, and subscription and service revenue were underdelivered.

Despite these numbers, there were some bright spots—trading volume slightly beat expectations, and USDC balances held in Coinbase products jumped 49% quarter-over-quarter to $12.3 billion.

The company also highlighted long-term growth prospects, including the acquisition of Deribit, regulatory wins in India and Argentina, and a recently dropped SEC case, as reasons to remain optimistic about the future.

COIN Price Analysis. Source: TradingView.

COIN Price Analysis. Source: TradingView.

Despite the bearish financials, COIN stock closed the day up 5.06%, signaling that investors may be focusing on the platform’s broader strategic positioning rather than short-term underperformance.

The stock is down 1.46% in the pre-market, but it has broken through the key resistance level at $206.9—an area it struggled to surpass in recent weeks. If COIN can hold above that level, the next upside target is around $214.77.

However, a failure to maintain this support could cause the stock to slide back toward $194.

Strategy Incorporated (MSTR)

Strategy, formerly MicroStrategy, continues its meteoric rise as Bitcoin breaks back above $100,000. MSTR stock is now up almost 75% in the last month, bolstered by a surge in Bitcoin’s value and growing confidence in the company’s aggressive crypto strategy.

Despite reporting a $4.2 billion net loss in Q1 and facing criticism over its mounting debt, Strategy has remained relentless in accumulating BTC—most recently adding 1,895 coins for $180.3 million.

As a result, the firm’s Bitcoin holdings have reached a record $53.9 billion, up 50.1% from its cost basis, making it the most prominent corporate holder and a key pillar of market sentiment.

MSTR Price Analysis. Source: TradingView.

MSTR Price Analysis. Source: TradingView.

Momentum was carried into the latest session, with MSTR closing yesterday at 5.58% and gaining another 1.81% in the pre-market. The stock broke through recent levels and now eyes the $437 mark as the next potential upside target.

However, this rally remains heavily tied to Bitcoin’s price trajectory; MSTR could test support at $404 if momentum stalls.

A break below that level might trigger a deeper pullback toward $383, making it a key area for bulls to defend in the short term.

MARA Holdings (MARA)

MARA Holdings posted Q1 2025 revenue of $213.9 million, up from $165.2 million in Q1 2024. The growth came from a 77% rise in the average Bitcoin price.

The company produced 525 fewer BTC than last year, mainly due to the halving. Still, block wins rose 81%, and BTC holdings jumped to 47,531, now worth about $3.9 billion.

Despite this, MARA reported a net loss of $533.4 million. That marked a 258% drop in income, driven by lower BTC prices at the quarter’s end.

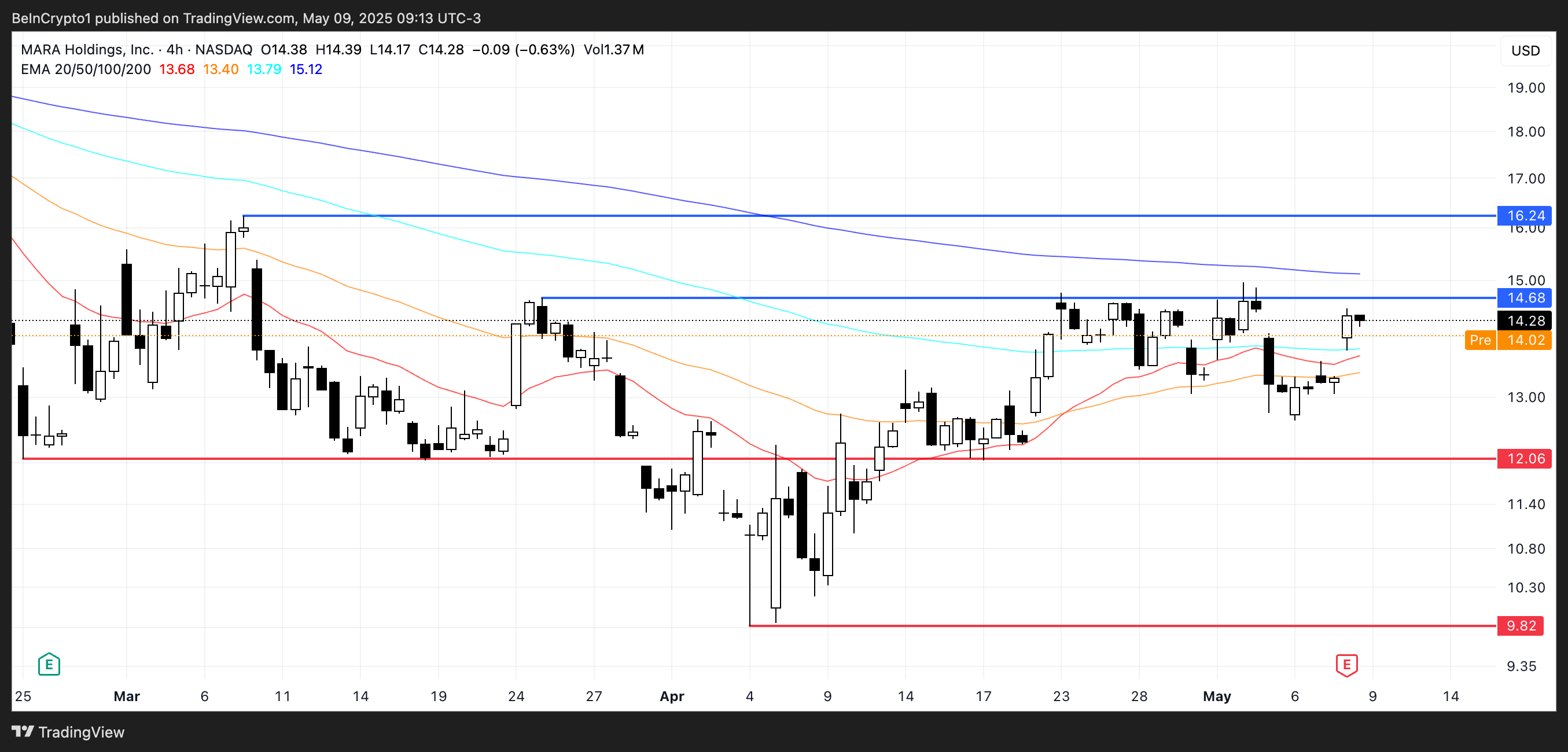

MARA Price Analysis. Source: TradingView.

MARA Price Analysis. Source: TradingView.

MARA is shifting its focus to become a vertically integrated digital energy and infrastructure company. It’s investing in low-cost, renewable energy, including a 114 MW wind farm in Texas.

The stock closed yesterday up 7.20%, showing strong investor interest. However, it’s down 1.68% in pre-market trading.

MARA is nearing key resistance at $14.68. If that breaks, it could climb to $16.24. If the trend reverses, support lies at $12.06; a drop below that could send it to $9.82.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.