Sui (SUI) Surges Past $1.75B TVL as Stablecoin and BTC Flows Ignite DeFi Growth

0

0

Sui price has just crossed a major DeFi milestone, its Total Value Locked (TVL) soared past $1.75 billion this week, fueled by rising Bitcoin inflows and a surge in stablecoin liquidity. While the broader crypto market stabilizes, SUI is emerging as one of the most dynamic protocols of 2025.

SUI Price and TVL Surge Amid Broader DeFi Revival

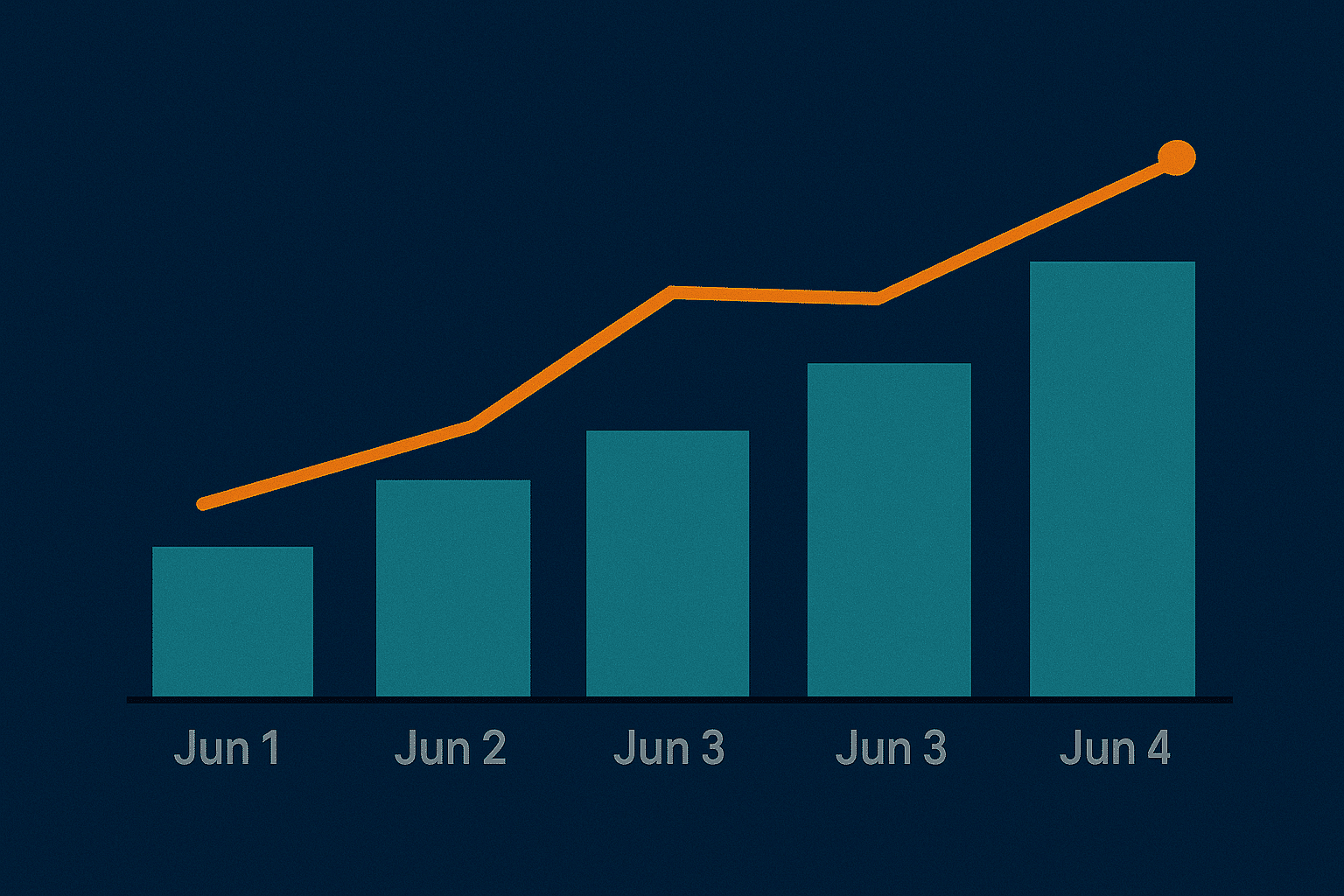

As of June 4, 2025, Sui (SUI) is trading at $3.24, with a 24-hour volume of $680 million and a total market cap of $11.05 billion, according to CoinMarketCap. This follows a notable SUI price rebound from its May consolidation lows below $2.90. The rally has coincided with a sharp increase in protocol usage and DeFi integrations across the Sui blockchain.

Sui’s TVL now stands at $1.76 billion, placing it among the top-performing Layer 1 ecosystems. According to DefiLlama, this jump in TVL was accompanied by record daily transaction counts and increased user wallet creation, suggesting real usage, not just speculative interest.

What’s Driving SUI’s DeFi Boom?

A combination of Bitcoin bridge activity, stablecoin deposits, and DeFi protocol launches largely drives the TVL boost. Analysts believe this could mark a longer-term structural shift.

“Users are not just speculating, they’re locking up value,” said Anisha Patel, DeFi analyst at NodeMetrics. “Stablecoin flows into the Sui ecosystem have grown by more than 28% in the past month alone. That’s a clear signal of sticky liquidity.”

Moreover, the launch of native apps featuring zero-knowledge login and sponsored transaction capabilities has improved accessibility, making it easier for non-technical users to interact with DeFi tools. This user-friendly evolution could be critical in onboarding the next million users.

SUI Price Table

| Date | Opening Price | Closing Price | Daily Volume | % Change |

|---|---|---|---|---|

| June 1 | $2.91 | $3.05 | $580M | +4.81% |

| June 2 | $3.05 | $3.11 | $620M | +1.96% |

| June 3 | $3.11 | $3.19 | $670M | +2.57% |

| June 4 | $3.19 | $3.24 | $680M | +1.56% |

Technical Analysis: Bullish Structure Taking Shape

The SUI price is currently forming a bullish continuation pattern on the daily chart. The 50-day EMA has crossed above the 100-day EMA, often a strong mid-term signal of upward momentum. The RSI sits around 61, suggesting bullish but not yet overheated conditions.

If the SUI price breaks the $3.30 resistance cleanly, analysts expect a push toward $3.60 in the coming weeks. Downside support is seen at around $3.00, with a stronger technical footing at $2.82.

“The fact that SUI is moving on real fundamentals, not just memetic hype, makes this rally structurally healthier,” said blockchain strategist Elijah Grant.

Ecosystem Highlights: Real-World Utility Rising

Its commitment to real-world usability separates Sui from many Layer 1 competitors. The platform’s architecture, designed for dynamic on-chain objects and fast parallel execution, is well-suited for gaming, finance, and identity.

Recent launches within the Sui ecosystem include:

-

Bluemove and Cetus Protocol, leading DEXs, are showing consistent volume growth.

-

Bitcoin-Sui Bridge, allowing BTC holders to participate in DeFi lending and farming.

-

New stablecoin vaults with competitive APYs are attracting liquidity from USDC and USDT holders.

These developments suggest that Sui price is building not just infrastructure, but utility, a critical ingredient for sustained blockchain adoption.

Conclusion: SUI’s Ascent Signals a Broader DeFi Renaissance

While Bitcoin and Ethereum continue to dominate headlines, Sui price is quietly writing its own growth story. Crossing the $1.75 billion TVL mark is more than a numerical milestone, it signals increasing trust, traction, and technological maturity.

If this trajectory holds, SUI could position itself as a dominant Layer 1 not just in 2025, but in the next cycle entirely.

With expanding use cases, technical innovation, and genuine user engagement, Sui isn’t just rallying, it’s building.

FAQs

What caused the recent TVL surge on Sui?

The increase was driven by higher stablecoin deposits, Bitcoin bridging, and a wave of DeFi protocols launching on the network.

Is Sui (SUI) a good investment in 2025?

SUI has strong fundamentals, growing adoption, and DeFi traction. However, as with all crypto assets, it remains volatile and should be approached with risk management.

What is the current SUI price?

As of June 4, 2025, SUI price is trading at $3.24, up over 10% from the start of the month.

What makes Sui different from other Layer 1 blockchains?

Sui offers fast parallel execution, native asset handling, and user-friendly innovations like zero-knowledge login — all aimed at improving real-world usability.

Glossary of Key Terms

TVL (Total Value Locked): The total amount of assets deposited in a blockchain’s DeFi ecosystem.

Zero-Knowledge Login: A privacy-focused login method that verifies identity without revealing sensitive user data.

Sponsored Transactions: A feature allowing users to interact with the blockchain without needing native tokens to pay gas fees.

DeFi: Decentralized Finance — blockchain-based financial services like lending, trading, and staking.

SUI Token: The native token of the Sui blockchain, used for gas fees, staking, and governance.

Sources and References

cryptooasis.ae+1coingecko.com+1

Read More: Sui (SUI) Surges Past $1.75B TVL as Stablecoin and BTC Flows Ignite DeFi Growth">Sui (SUI) Surges Past $1.75B TVL as Stablecoin and BTC Flows Ignite DeFi Growth

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.