BTC, ETH, XRP Slide as Fed Speech Looms Over Markets

0

0

The crypto market downturn continued on Tuesday as cryptocurrencies and related stocks extended their losses. Traders are preparing for the release of the Federal Reserve’s FOMC meeting minutes on Wednesday and Jerome Powell’s speech at the Jackson Hole symposium on Friday.

Bitcoin dropped 1.30% in 24 hours, falling below $114,000. Ethereum lost 1.10%, dipping below $4,250, while XRP tumbled 3.67%. Cardano’s ADA also fell 4.32%, and the broader crypto market downturn was evident, with a 2.10% decrease in the market.

Crypto-Related Stocks Hit Harder by Market Downturn

Shares of crypto-related companies experienced even steeper declines, reflecting the impact of the crypto market downturn on broader markets. Bitcoin miners, exchanges, and digital asset firms saw significant losses. Marathon Digital Holdings (MARA) closed down 5.7%, Coinbase (COIN) dropped 5.8%, and MicroStrategy (MSTR) ended the day down 7.4%.

The crypto market downturn was much more severe than traditional stock movements, where the Dow ended flat, the S&P 500 decreased by 0.59%, and the Nasdaq fell by about 1.5%. This underlines how digital assets are far more vulnerable to changes in interest rate expectations than traditional equities.

Retail Traders Shift to Bearish Sentiment Amid Market Downturn

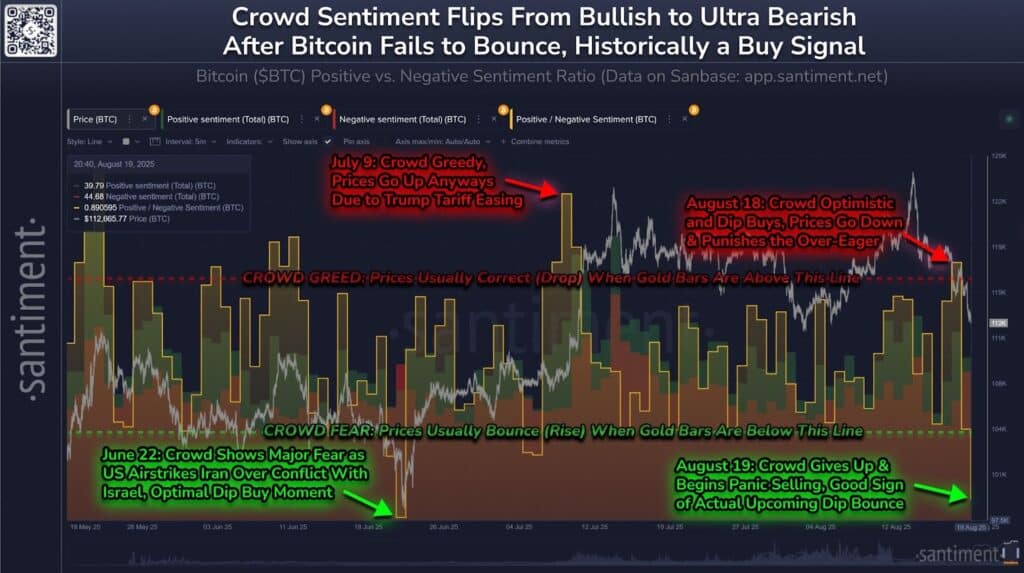

The crypto market downturn also triggered a significant shift in sentiment among retail traders. After Bitcoin failed to recover from a recent dip below $113,000, hitting a 17-day low, retail traders seemed to turn bearish.

Santiment, a blockchain analytics firm, reported the most negative social sentiment in the last 24 hours since June 22. This marked a significant turning point, with traders seemingly less confident in Bitcoin’s recovery.

Fed’s Influence on Crypto Market Downturn

One of the reasons that led the crypto market to collapse is the monetary policy deployed by the Federal Reserve. Traders are hoping to get insight about how the Fed sees inflation and its interest rate direction in future, as the Fed unveils the FOMC meeting minutes.

The increased interest rates would minimize cash flow, which would restrain the rally on speculative moves on cryptocurrencies. The reduction in the price of the crypto market is a sign of apprehension that the Fed will continue with the increased rate longer than anticipated and counteract the liquidity and proliferation of digital assets.

Sticky Inflation and Its Effect on the Crypto Market Downturn

Even with indicators of cooling inflation, there is yet to be price pressures that are high. Producer price index has remained higher than anticipated, indicating that there is still inflation, a factor that makes it difficult to decrease the monetary policy.

Such inflation fears have added to the drop in the crypto market since higher interest rates present a bleaker outlook on the cryptocurrencies. This extended stretch of high rates and high inflation affects the speculative assets such as Bitcoin and Ethereum in the most.

Tariffs and Corporate Concerns Add to Crypto Market Downturn

Alongside inflation concerns, the U.S. economy faces the delayed effects of tariffs. Companies have been absorbing the additional costs of tariffs to protect their market share, but this strategy is becoming unsustainable.

| Month | Minimum Price | Average Price | Maximum Price | Potential ROI |

|---|---|---|---|---|

| August | $115,653.89 | $118,723.85 | $121,793.80 |

5.9%

|

| September | $120,802.55 | $126,253.78 | $131,705 |

14.5%

|

| October | $113,622.08 | $120,904.28 | $128,186.47 |

11.4%

|

| November | $105,735.25 | $111,599.15 | $117,463.04 |

2.1%

|

| December | $101,450.15 | $118,653.57 | $135,856.99 |

18.1%

|

Analysts warn that tariff costs will likely be passed down to consumers, pushing inflation higher. This could further complicate the Fed’s approach and extend the crypto market downturn, as inflation pressures drive the Fed to keep rates high.

Jerome Powell’s Speech and Its Potential Impact on the Crypto Market Downturn

The next speech by Jerome Powell at the Jackson Hole symposium may become a momentous event in the crypto investment market. It is believed that by giving directions on how the Federal Reserve would operate with regard to interest rates, inflation, and economic growth, the Fed chair will be able to offer a guide.

A hawkish approach would further increase the bearish position in the crypto market since increased rates would further weaken the available liquidity and expect growth in digital assets. On the other hand, the dovish position may indicate the return to the bullish position, which will provide a short-term relief to the decline experienced in the crypto market.

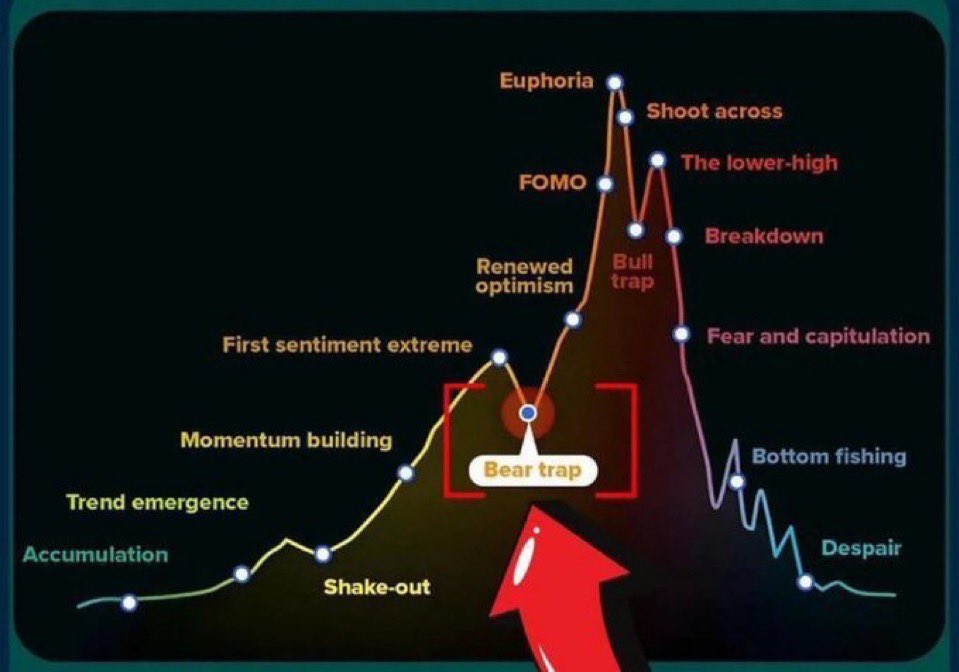

History Shows Market Rebounds After Crypto Market Downturns

Despite the current crypto market downturn, history suggests that market corrections are common during bull cycles. Bitcoin has experienced significant pullbacks in the past, including a 36% drop in 2017 and a 23% drop in 2021, only to surge to new all-time highs afterward.

This pattern suggests that the current downturn could be a short-term correction, and Bitcoin may rebound once the market adjusts to current conditions. The length and depth of the downturn remain uncertain, with some analysts predicting Bitcoin could drop to $90,000 before rebounding.

Crypto Market Downturn and Investor Sentiment

With the crypto market struggling more than ever, investor optimism begins to wane. Ahead of the Jerome Powell speech at the Jackson Hole or FOMC meetings minutes, traders are left wondering how these actions will form the future aspects of the market.

The market’s sensitivity to changes in monetary policy means any indications from the Fed could significantly impact the crypto market. These signals about interest rates and inflation could either deepen the downtrend or trigger a slight upturn.

Conclusion

Crypto investors are faced with a tough situation because of minimal devaluation in crypto markets imposed by a force of inflation, interest rate hikes, and tariff issues. Cryptocurrency trading has become more cautious and all cryptocurrency-related stocks have been affected even more than other equities.

Market expectations depend on the results of the next FOMC minutes and the Powell speech at the Jackson District. The crypto market is likely to keep going down at least in the near-term, but history has shown that subsequent market crashes have paved way to future recovery.

Also read Ethereum Price Nears Key CME Gap at $4.1K–$4.26K

Summary

The crypto market recession can be explained by fear regarding Federal Reserve policy, inflation and Low interest rate. Cryptocurrencies such as Bitcoin, Ethereum, etc. have lost much value, and investors are getting more bearish.

The decay has impacted crypto stocks with Coinbase and Marathon Digital Holdings also tumbling.Jerome Powell ‘s speech at Jackson Hole and comments on the FOMC minutes are important to the market’s feelings. These occasions may favor either a recovery or continue the loss to the crypto market.

Frequently Asked Questions (FAQs):

1. What is contributing to the current crypto market downturn?

The crypto market downturn is mainly due to concerns over higher interest rates, inflation, and the uncertainty surrounding the Federal Reserve’s policy decisions.

2. How does the Federal Reserve’s policy impact the cryptocurrency market?

The Fed’s decisions on interest rates and inflation control directly influence the liquidity in the market, which heavily impacts speculative assets like cryptocurrencies.

3. Can Bitcoin recover from its recent decline?

While Bitcoin has experienced a significant drop, history suggests that market corrections in a bull cycle often lead to rebounds, and Bitcoin could recover once market conditions stabilize.

4. How will Jerome Powell’s Jackson Hole speech affect the crypto market?

Jerome Powell’s speech may provide clarity on the Fed’s future monetary policy, which could either deepen the crypto market downturn or offer a spark for a recovery.

Appendix: Glossary of Key Terms

FOMC (Federal Open Market Committee): A branch of the Federal Reserve that sets monetary policy, including interest rates.

Liquidity: The ease with which an asset can be bought or sold without affecting its price.

Bearish Sentiment: Investor outlook anticipating a market decline.

Tariffs: Taxes imposed on imported goods, influencing market prices.

Hawkish: A monetary policy stance favoring higher interest rates to curb inflation.

Dovish: A policy stance favoring lower interest rates to stimulate economic growth.

Panic Selling: Selling assets in fear of further declines, often in a market downturn.

References

CoinDesk – coindesk.com

Cointelegraph – cointelegraph.com

Read More: BTC, ETH, XRP Slide as Fed Speech Looms Over Markets">BTC, ETH, XRP Slide as Fed Speech Looms Over Markets

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.