Stablecoin Supply Hits $267.4B: What It Means for the Market Cap and Crypto Future

0

0

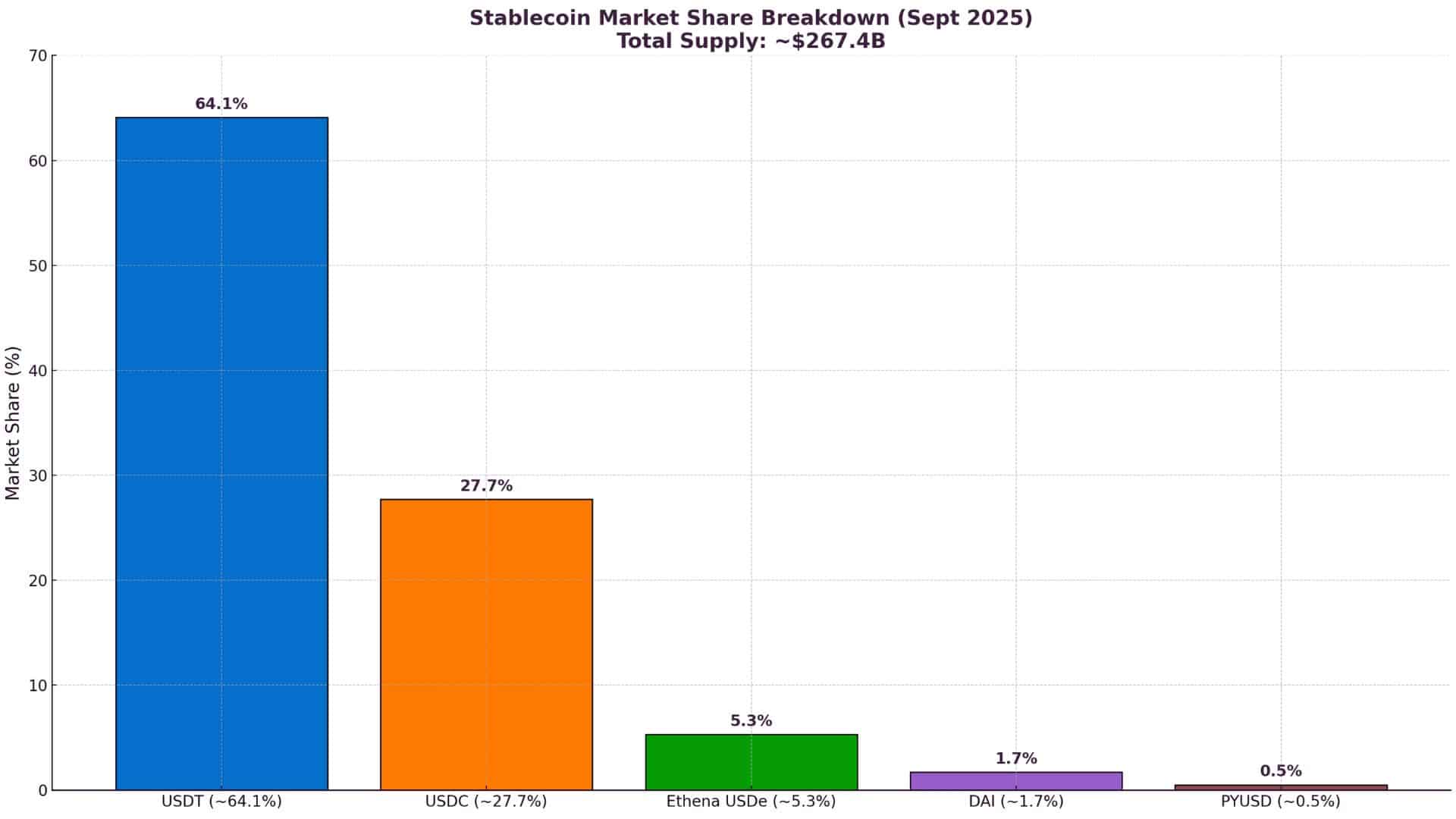

According to updated market data, Stablecoin supply now stands at about $267.4 billion. This surge reflects demand from payments, decentralized finance, and growing institutional confidence. Readers now ask what drives this expansion and how it reshapes the wider stablecoin market cap.

Why Stablecoin Supply Keeps Rising

Institutions Backing Stablecoins

Institutions show greater trust in stablecoins after more explicit rules in the US and Europe. Analysts highlight that regulated reserves and regular audits have contributed to the adoption. A recent survey confirmed that “regulatory clarity has strengthened institutional comfort, which directly supports Stablecoin supply growth.”

Also Read: $1 Trillion Stablecoin Market by 2026? Why Experts Say It’s Within Reach

Role of DeFi and Payments

Stablecoins move across borders in seconds at a lower cost than banks. Businesses and individuals use them for remittances and global trade. In DeFi, stablecoins serve as collateral and liquidity, driving the total stablecoin market cap higher.

Stablecoin Market Cap: The Numbers

| Metric | Value |

|---|---|

| Stablecoin supply | ~$267.4 billion |

| USDT market share | ~64.1% |

| USDC supply | ~$74.2 billion (~27.7%) |

| Ethena USDe | ~$14.1 billion (~5.3%) |

| DAI supply | ~$4.6 billion (~1.7%) |

| PYUSD supply | ~$1.4 billion (~0.5%) |

The stablecoin market cap has climbed steadily, reflecting stronger trust in dollar-backed tokens. USDT remains the largest, but its dominance has eased as USDC and new entrants gain ground. Synthetic stablecoins, such as Ethena’s USDe, now account for billions, although their inclusion varies across trackers.

Expert Quotes and Market Sentiment

Experts highlight both adoption and caution. EY-Parthenon noted that the GENIUS Act provided regulators with a more transparent framework, enabling institutions to adopt stablecoins more quickly and efficiently.

A Fireblocks survey found that 90% of financial institutions now use stablecoins, showing how deeply they are embedding into finance. Analysts at Morningstar added that more explicit rules cut costs and boost confidence, pushing supply and market cap higher.

What Readers Should Watch

- Policy moves: New laws may expand adoption or tighten controls.

- USDT vs USDC balance: Market share shifts matter for liquidity and trading.

- Stablecoin market cap stability: Growth depends on audits, reserves, and trust.

- Synthetic growth: Rapid expansion could add strength or risks depending on backing.

Conclusion

Based on the latest research, the Stablecoin supply has reached about $267.4 billion. This reflects institutional trust, DeFi growth, and the increasing use of global payments. The stablecoin market cap exhibits similar resilience, with USDT still leading but losing market share to its rivals.

For crypto readers, the message is clear: stablecoins now serve as a core measure of digital finance health. Watching regulation, adoption, and competition will reveal where supply goes next.

Also Read: Bitwise Files for First Stablecoin and Tokenization ETF With SEC

Summary:

Stablecoin supply has reached about $267.4 billion, driven by cross-border payments, DeFi activity, and rising institutional trust. The stablecoin market cap reflects the same momentum, with USDT leading but slowly losing ground to USDC and newer entrants, such as Ethena’s USDe. Stablecoins now stand as a vital benchmark of crypto market health. Their future depends on regulation, transparent reserves, and continued global adoption.

Glossary of Key Terms

Stablecoin: A digital token tied to a stable asset like USD.

Stablecoin supply: The total value of stablecoins in circulation.

Stablecoin market cap: The total dollar value of all circulating stablecoins.

DeFi: Blockchain-based financial apps for lending, trading, and investing.

Synthetic stablecoins: Tokens designed to mimic stable value with non-fiat reserves.

FAQs about Stablecoin Supply

Q: What is the current Stablecoin supply?

A: The latest verified amount is ~$267.4 billion.

Q: Which stablecoin leads the market?

A: USDT leads with ~64.1%, though USDC continues to gain share.

Q: How does the stablecoin market cap differ from the supply?

A: They often align, as both track the value of stablecoins in circulation.

Q: Why is regulation necessary?

A: Clear rules attract institutions and boost confidence in growth.

Read More: Stablecoin Supply Hits $267.4B: What It Means for the Market Cap and Crypto Future">Stablecoin Supply Hits $267.4B: What It Means for the Market Cap and Crypto Future

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.