OKX Partners With Standard Chartered to Launch Regulated Institutional Crypto Custody

0

0

This Article Was First Published on The Bit Journal.

According to reports, institutional crypto custody is gaining new momentum through a partnership between OKX and Standard Chartered. This collaboration brings regulated banking standards into crypto trading, providing European institutions with a secure, transparent way to manage assets. It represents a key shift toward trust and regulatory alignment in the institutional market.

Partnership Overview

Standard Chartered will handle custody for OKX’s institutional clients in Europe. Client assets will stay protected under the bank while OKX manages trading. This separation strengthens compliance and limits counterparty risk.

A key feature is collateral mirroring, which lets institutions trade on OKX using mirrored balances without moving funds. It improves speed, boosts security, and keeps assets safe during volatile market swings.

Why This Matters

Institutions entering crypto markets have consistently sought stronger oversight and bank-level protection. This partnership delivers both. According to an official source, Standard Chartered has established a regulated digital asset custody business in Luxembourg to comply with the EU’s MiCA framework. This expansion gives OKX a reliable foundation for serving institutional clients in a highly regulated environment.

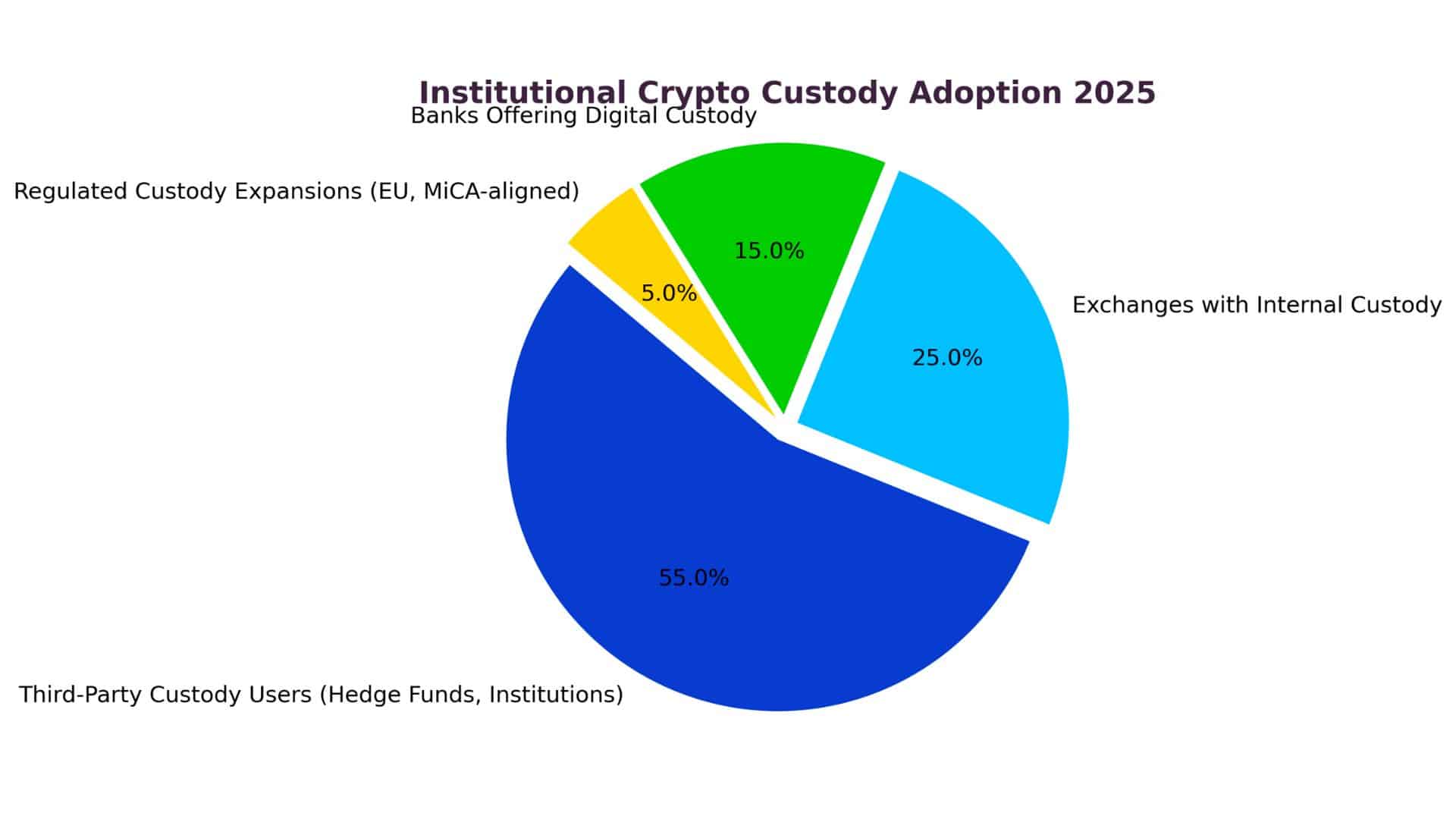

The collaboration also signals growing maturity in crypto markets. As major banks enter the digital asset space, they bring credibility that can attract pension funds, hedge funds, and asset managers previously hesitant about custody risks. For OKX, this partnership strengthens its institutional arm and bridges traditional finance with blockchain operations.

Institutional Confidence Rising

Surveys show that nearly 80% of hedge funds prefer independent custodians when handling digital assets. With Standard Chartered’s backing, OKX can meet that expectation by offering a model familiar to institutional investors. This version of institutional crypto custody aligns with how large firms already manage traditional assets, reducing the learning curve and easing compliance reviews.

Other financial giants are following a similar route. Deutsche Börse’s Clearstream recently launched custody for Bitcoin and Ethereum, while BNY Mellon continues to expand token custody solutions. Together, these efforts signal that regulated institutional crypto custody is becoming the backbone of the digital economy.

Market Impact

This partnership is reshaping how institutions view crypto platforms. By keeping custody and trading separate, OKX and Standard Chartered combine security with speed. The setup attracts larger investors and supports future global regulation. It also positions OKX as one of the few exchanges offering fully regulated institutional crypto custody in Europe.

Conclusion

Based on the latest research, institutional crypto custody drives a significant shift in how large investors manage digital assets. OKX and Standard Chartered combine secure bank storage with fast exchange access, building genuine trust and clear accountability. Their model strengthens transparency and reshapes institutional participation in crypto across global markets.

Summary

OKX and Standard Chartered have joined forces to deliver regulated institutional crypto custody in Europe. The partnership blends collateral mirroring, secure storage, and exchange access under MiCA standards. It strengthens institutional confidence in digital assets and sets a new benchmark for safe, compliant crypto trading.

Glossary of Key Terms

- Institutional crypto custody: Secure management of crypto assets under regulated supervision.

- Collateral mirroring: A Technique allowing custodial assets to be mirrored for trading.

- MiCA: EU regulation overseeing crypto asset operations.

- Counterparty risk: Risk of a trading partner failing to meet obligations.

FAQs About Institutional Crypto Custody

Q: Why is this partnership important for institutions?

A: It offers secure, regulated custody combined with efficient trading access.

Q: How does collateral mirroring improve efficiency?

A: It allows institutions to trade without moving assets, saving time and reducing risk.

Q: Will this model expand to other regions?

A: Yes. Similar partnerships are expected in Asia and the Middle East as regulations evolve.

Q: How does this partnership help banks enter crypto?

A: It lets them trade securely with regulated custody and trusted oversight, reducing risk while keeping assets safe.

Read More: OKX Partners With Standard Chartered to Launch Regulated Institutional Crypto Custody">OKX Partners With Standard Chartered to Launch Regulated Institutional Crypto Custody

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.