Altcoin Season Delay Extends as Bitcoin’s Dominance Rises to 57%

0

0

The wait for an Altcoin Season was seemingly coming to an end towards the end of June, but the crash that followed extended the wait.

The changing market trends are now exhibiting a longer delay in the arrival of the altcoin season as Bitcoin’s dominance grows.

Bitcoin’s Dominance Is Breaking Out

The arrival of an Altcoin Season highly depends on Bitcoin’s domination (BTC.D), which is moving in the opposite direction from what’s expected. Following the recent decline of the crypto market, BTC’s dominance grew immensely.

As a result, it broke out of the symmetrical triangle it had been moving in for the last three months. A symmetrical triangle pattern forms when price action converges between upward and downward trendlines, creating a narrowing range. Once the pattern completes, it indicates a potential breakout direction.

The pattern suggests a 4.33% increase in Bitcoin’s domination following the breakout, and by the looks of it, BTC is making it happen. As of date, BTC.D has grown to 57.07% from 55.49% and could hit 57.90% if these conditions persist.

Read More: 12 Best Altcoin Exchanges for Crypto Trading in July 2024

Bitcoin Dominance. Source: TradingView

Bitcoin Dominance. Source: TradingView

Generally, when the market declines, Bitcoin’s domination grows. Since most altcoins follow BTC’s cues, the crypto king’s drawdown affects the crypto market directly. According to an exclusive comment to BeInCrypto from Julio Moreno, Head of Research at Cryptoquant, this could take place again.

“Bitcoin prices are again hovering at key support levels, with risks of this correction extending further according to valuation metrics. The MVRV ratio has fallen below its 365-day moving average, a condition that in previous cycles has signaled an extension of the price decline (COVID crash in March 2020 and May 2021) or the start of a bear market (November 2021). Investors should monitor these valuation metrics to assess the possibility of a price bounce or a further correction,” Moreno told BeInCrypto.

This signals an extended delay in the arrival of Altcoin Season.

The Suffering Continues

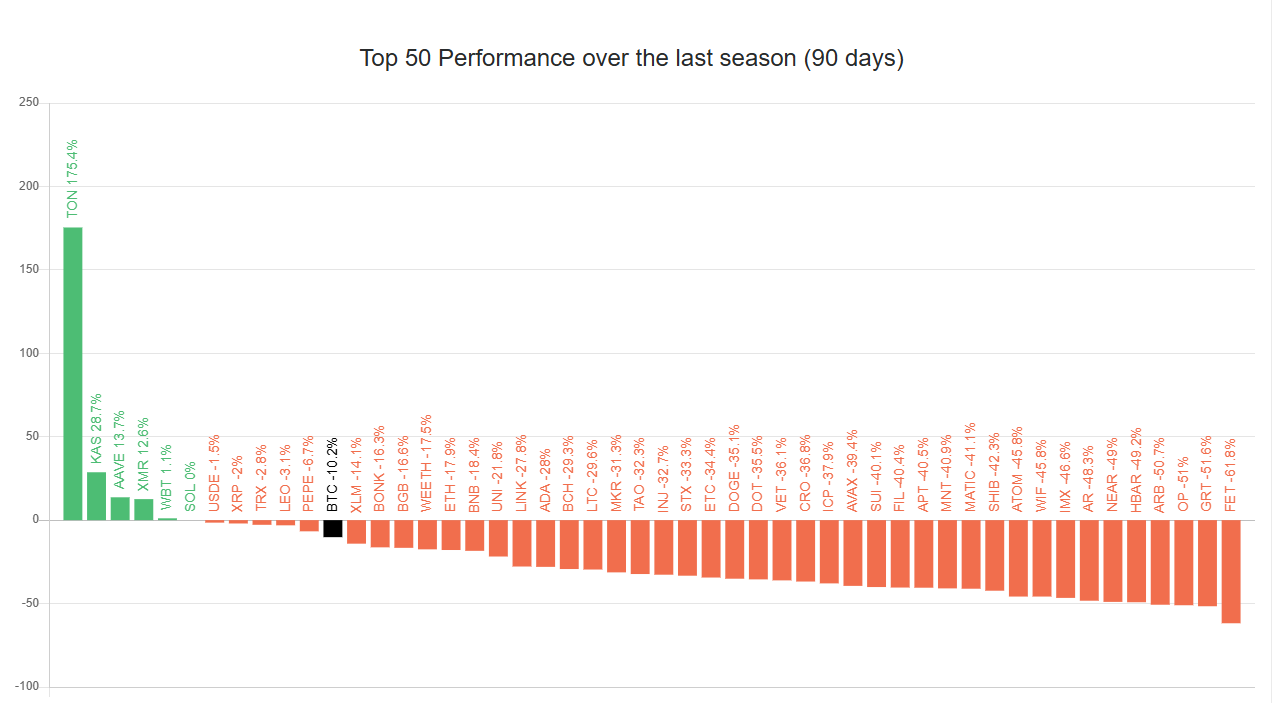

According to the Altcoin Season index, the market is currently witnessing a Bitcoin season. For this to change, at least 75%, i.e., 38 of the top 50 altcoins, excluding stablecoins, would need to outperform BTC over the last season (90 days).

This is far from happening since, at the moment, only 5 of the top 50 crypto assets have been in the green over the past season. The rest, 90% of the cryptocurrencies, are bearing losses.

Read More: Which Are the Best Altcoins To Invest in July 2024?

Top 50 Crypto Assets’ Performance. Source: BlockchainCenter

Top 50 Crypto Assets’ Performance. Source: BlockchainCenter

Thus, at present, let alone in an altseason, recovery from altcoins is a matter of concern. Consequently, August will most likely not witness an Altcoin Season.

0

0

Administra todas tus criptomonedas, NFT y DeFi desde un solo lugar

Administra todas tus criptomonedas, NFT y DeFi desde un solo lugarPara comenzar, conecta de forma segura el portafolio que estés utilizando.