Ethereum ETFs Pulled In $175M So Why Is $ETH Still Stuck at $3K?

0

0

This article was first published on The Bit Journal.

Spot Ethereum (ETH) Exchange-Traded Funds (ETFs) recorded around $175 million combined inflow in just two days as at the end of November 2025.

Recent flows were $96.6 million, dominated by BlackRock at $92.6 million and another $78.6 million combined into various ETH ETFs on the following day.

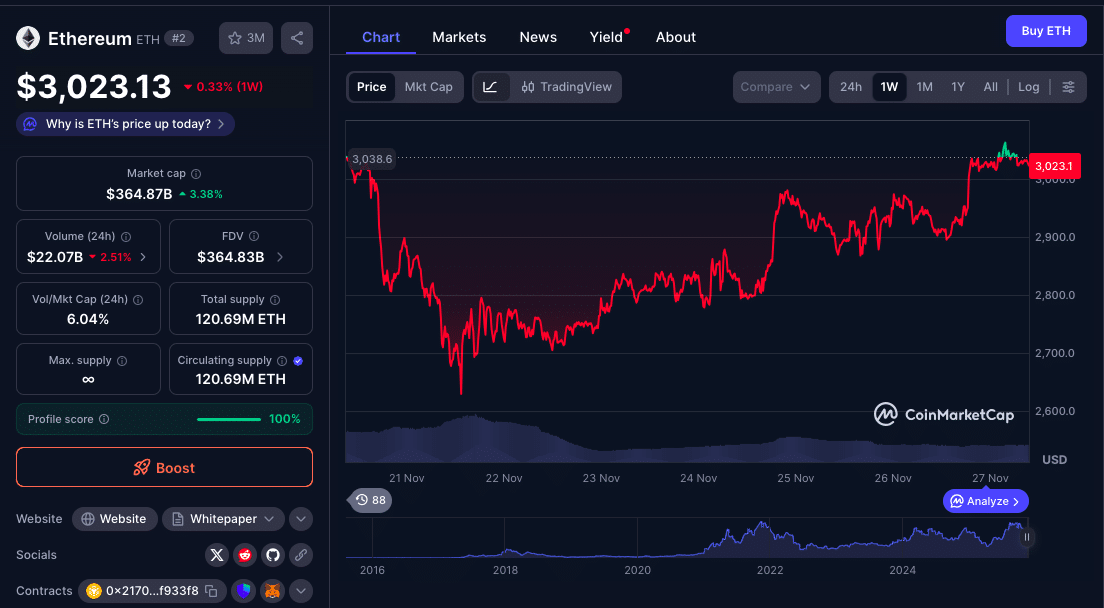

However, even with all that institutional capital coming in, the price of $ETH was lukewarm, skirting around $3,000. This mismatch leads to a simple, urgent question: why isn’t inflow translating into stronger price action?

Latest Ethereum ETF Inflows: What Do the Numbers Reveal?

Reports show that Ethereum ETFs recorded their best inflows in weeks through Nov. 24-25, 2025.

In just a single day, total net inflows were $96.6 million and BlackRock’s ETHA led the way in this regard. The streak continued into the next day, with an additional $78.6 million flowing in.

The Ethereum ETF inflows came after sustained outflows. There were several days of negative flows into Ethereum ETFs with -$261.6 million net outflow on November 20.

These late November flows represent a reversal in suggesting perhaps new institutional interest or strategic re-entry.

Market Conditions and $ETH Price Action

Despite all the new supply being injected through ETFs, price has stayed muted for $ETH.

$ETH reclaimed $2,950 briefly on November 24 as a move to return to its psychological and technical level of $3,000 failed.

However, as at press time, $ETH skirts just a little above $3k.

This is completely opposite to the hopes these inflows may raise. The lackluster price reaction comes during a week of sideways movement across the wider crypto markets, with big assets such as Bitcoin (BTC) holding near critical support levels.

Analysts have speculated this reflects a rift between ETF-driven demand and market sentiment, with macroeconomic overtures weighing as global markets price risk off.

What Non-Price Reacting Inflows May Contribute

The disparity between strong ETF inflows and a range-bound $ETH price may indicate several dynamics. Inflows are cash coming into funds, not necessarily spot-market purchases at the time. Some of the allocations may remain in fund structure.

Many investors could still be in a wait-and-see mode. With so much recent volatility and macro uncertainties, maybe ETF buys may be looked at as “buy-and-hold” and not instant price spikers.

General selling or profit-taking in other parts of crypto may be counteracting the buying pressure. And despite the new money coming on board through ETFs, whale selling or retail exits could be suppressing upward price moves.

In other words, inflows may indicate trust over the long term, or accumulation, but not imply near-term price jumps.

Signals to Watch

Eyes are on several potential catalysts for the event that $ETH’s price does indeed react going forward.

One is more inflows to ETFs. With persistent inflow, the market could have an accumulation-type pressure increase.

Declining exchange supply or rising staking activity might tighten effective supply and help buoy $ETH.

Recent data also points to whale wallets and large holders of $BTC accumulating, while exchange reserves continue to decline.

The larger crypto and macroeconomic environment matters. If global risk sentiment begins to improve, interest-rate visibility, calmer macro backdrop and stronger equities performance, then $ETH may come with a bid.

Alternatively, if the macro headwinds persist, even positive ETF flows may not be enough to push price higher.

Conclusion

The recent $175 million inflow in Ethereum ETFs provide a clear indication that institutional interest for Ethereum is still alive.

But the absence of price strength also reflects a more complex reality, one where an influx of capital doesn’t always directly translate to prices rising, not in a market reframed by macro factors, sentiment swings and layered supply-demand dynamics.

For the time being though, the Ethereum ETF inflows might be more of a base-building type as opposed to a price driver.

Glossary

Spot ETF: An ETF that purchases the fundamental asset (e.g. ETH) rather than derivatives hedging it in an exchange traded fund structure. Inflows represent the capital coming into those funds.

Net Inflow / Net Outflow: The flow of new money in or out of a fund over a specified period, typically in USD terms.

Whales: Some big holder of a cryptocurrency, typically large traders or funds, that can move the market.

Exchange Supply: Total cryptocurrency stored on exchanges. Low exchange supply can be accumulation or staking, which also reduces the trading sell side.

Staking: Locking up a cryptocurrency (such as $ETH) to aid in network operations (validation), and often receiving a yield taking those tokens out of circulation.

Frequently Asked Questions About Ethereum ETF Inflows

Does $ETH price increase the moment ETFs start flowing in?

No. Inflow depicts capital going into funds but that doesn’t always represent spot buying or immediate market demand. While the response of price depends on several factors such as wider demand and supply, sentiment and macro environment.

Why did $ETH remain weak despite strong inflows?

That’s because investors could be buying for the long haul rather than selling, or other market headwinds such as macroeconomic uncertainty or profit-taking, could neutralize the inflow.

Is this inflow trend sustainable?

That will depend on whether the institutional interest continues, whether on-chain supply becomes more scarce (perhaps through staking or accumulation), and broader market conditions remain supportive.

What should investors watch next?

Subsequent ETF flow data, exchange supply levels, staking growth, whale activity and macro trend.

References

Read More: Ethereum ETFs Pulled In $175M So Why Is $ETH Still Stuck at $3K?">Ethereum ETFs Pulled In $175M So Why Is $ETH Still Stuck at $3K?

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.