ADA to BTC? Cardano Treasury Diversification Sparks DeFi Revival Debate

0

0

Cardano founder and Ethereum co-founder Charles Hoskinson has proposed the creation of a sovereign wealth fund backed by the ADA treasury to boost the blockchain’s presence in decentralized finance (DeFi).

According to Hoskinson, between 5 and 10% of the on-chain treasury worth about 1.2 billion dollars should be exchanged into harder assets like Bitcoin or stablecoins. The proposal will help reinforce the financial basis of Cardano and introduce stability in the DeFi ecosystem.

Charles Hoskinson Compares ADA to Norway’s GPFG

State-backed entities are normally termed as sovereign wealth funds. Charles Hoskinson made a comparison to the Government Pension Fund Global (GPFG) of Norway, a government-owned fund that doubled in value to nearly 2 trillion in 2019 to 2024.

Whereas the fund in Norway was founded on the oil revenues, today the fund earns majorly in global equities and government bonds. Charles Hoskinson sees a similar path ahead of Cardano, where the rewards generated on Bitcoin and stablecoin will be used to buy back ADA and thus push its price upwards.

The arguments of Charles Hoskinson are based on the two main aspects: the ongoing and further fiscal expansion in the U.S. and the emergence of stablecoins as sovereign digital digital financial resources. The U.S. government is yet to avoid cases of overspending; therefore, there is a risk of the dollar being devalued. With its decoupled supply and centralized agreement, Bitcoin will continue to be a hedge-asset, more so as institutional access has become easier with spot ETFs.

Stablecoins Drive Digital Dollar’s Financial Hegemony

At the same time, stablecoins such as USDC and USDT are heavily exposed to U.S. Treasuries. The current tether alone holds approximately $120 billion in Treasuries and makes over 1 billion dollars in Q1. The Reserve Fund of Circle also is weighted intensively in the U.S. Treasury securities and repurchase agreements. Such stablecoins end up strengthening the U.S. debt markets even as it drives the digital dollar supremacy.

Commerce Secretary Howard Lutnick, speaking in April 2024 as CEO of Cantor Fitzgerald, underscored the strategic importance of stablecoins:

“Dollar hegemony is fundamental to the United States of America. It matters to us, to our economy…That’s why I’m a fan of properly backed stablecoins. I’m a fan of Tether. I’m a fan of Circle.”

Entering stablecoin markets at the right time would make Cardano the first major blockchain asset to take advantage of regulatory certainty, given that a U.S. central bank digital currency (CBDC) is no longer on the cards due to a backlash under the Trump administration.

ADA Faces Inflation and Supply Pressure

At the moment, ADA has lost 35% on a year-to-date basis, but it has gained 56% during the last 12 months. Inflation is one of the concerns as the supply of ADA is capped at 45 billion out of which 35.36 billion are in circulation. The annual rate of inflation on Cardano is about 2% and it just happens to coincide with the long-term inflation goal of the U.S federal reserve. In comparison, the rate of inflation that Bitcoin has is a mere 0.82%.

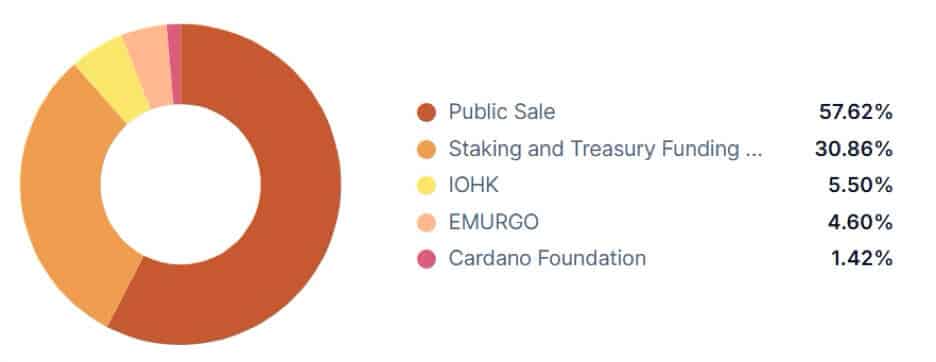

Cardano rewards staking by distributing 80% of rewards to validators and 20% to a cardano treasury that posesses an estimated 31% of the total ADA. In the event that 5-10% of this treasury approx 140 million ADA gets shifted to Bitcoin or stablecoins then this may cause a near term sell-off.

Charles Hoskinson however suggested to counter this by a Time-Weighted Average Price (TWAP) mechanism performed over OTC desks over a week to avoid disrupting the market. This build-up strategy resembles one employed by Michael Saylor of MicroStrategy, who has applied similar strategies to secretly buy Bitcoin without sparking volatility indirectly boosting the stock price of MSTR as a proxy to Bitcoin.

Cardano Struggles with DeFi and Liquidity

In the long perspective, Charles Hoskinson could convert Bitcoin and stablecoin profits into purchasing ADA back in the same manner as the corporate stock buyback practice that usually causes supplies to decrease and the prices to stabilize.

Although Cardano finished with its smart contract phase in 2021, its performance remains poor; averaging only 0.26 TPS and 2 minutes finality compared to the 12.8-second finality and high transaction throughput offered by Solana.

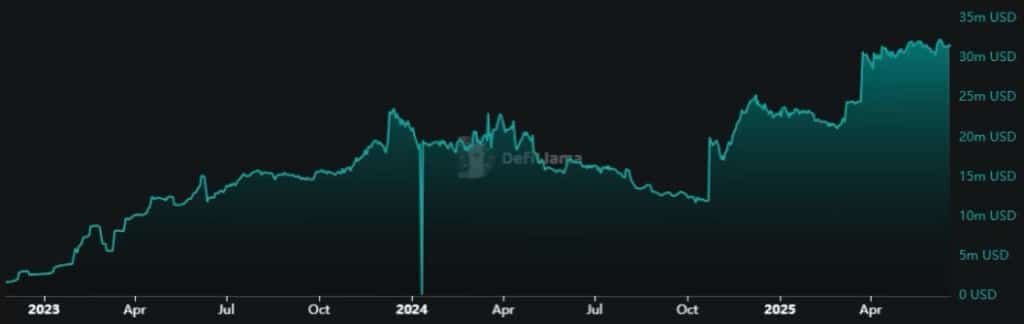

ChainSpect ranks Cardano at the 34th position in terms of real-time TPS with a paltry 267.5 million in DeFi total value locked (TVL) as compared to Solana with 8.3 billion and Ethereum with 62.7 billion. The amount of the stablecoins on Cardano is only $ 31,44 million in contrast to the liquidity on Ethereum or Solana.

The DeFi of Cardano is furthered by the lack of liquidity resulting in slippage and losses. Confidence, diminishing volatility, and enhanced lending may be increased through the provision of stablecoin liquidity.

Stablecoins Offer Stability Amid Altcoin Volatility

According to Charles Hoskinson, a liquidity infusion of roughly 100 million in stablecoins can do wonders in enhancing Cardano dApp activity. DexHunter is the most popular platform in the Cardano ecosystem by the number of users, whereas Lenfi boasts the largest TVL, which is just $11.62 million falling significantly short of the DeFi activity on the main chains.

The altcoin markets are highly speculative and diluted, stablecoins are a much hoped-for stability and sustainable income. The underlying application of stablecoin loans exhibits maturity in Ethereum. Cardano needs to venture into risky treasury policies to be competitive.

Cardano would potentially become a more versatile financial platform that is sustainable and geared towards growth upon adopting the proposal by Charles Hoskinson to diversify into Bitcoin and other stablecoins within the crypto economy that is currently changing.

Conclusion

As Charles Hoskinson suggested, diversification into Bitcoin and stablecoins of the Cardano treasury can be a strategic shift to rejuvenate its DeFi environment. In a regulatory environment, where stablecoin dominance is on the rise and institutions are becoming less risk-averse, launching an extension like this could make Cardano a more stable and growing blockchain as the crypto industry becomes more competitive.

Follow us on Twitter and LinkedIn, and join our Telegram channel to be instantly informed about breaking news!

Summary

Charles Hoskinson has suggested that 5 to 10 percent of the Cardano treasury of \$1.2 billion be converted into Bitcoin and stablecoins to generate a form of sovereign wealth. Following the GPFG in Norway, the transfer is meant to stabilize the price of ADA, stimulate DeFi usage, and prepare Cardano to grow over time as stablecoin legitimacy and lackluster ecosystem performance on Cardano compare to Solana and Ethereum. Market timing and clarity of regulation may benefit this radical strategy.

FAQs

1. What did Charles Hoskinson propose?

To shift 5–10% of ADA’s treasury into Bitcoin and stablecoins.

2. Why Bitcoin and stablecoins?

To hedge risk, earn yield, and buy back ADA.

3. How will price impact be reduced?

By using OTC desks and TWAP strategy over a week.

4. How does it help Cardano DeFi?

It boosts liquidity, lending, and dApp activity.

Glossary Of Key Terms

Cardano (ADA): A proof-of-stake blockchain founded by Charles Hoskinson.

Stablecoins: Cryptos like USDT/USDC are pegged to the U.S. dollar.

ADA Treasury: Cardano’s reserve, partly from staking rewards.

DeFi: Decentralized financial services like lending and trading.

TWAP: Trade strategy to reduce price impact over time.

Spot ETF: Real-time, tradable Bitcoin investment product.

Circle (USDC): Stablecoin issuer backed by U.S. Treasuries.

Tether (USDT): Leading stablecoin, holds U.S. government debt.

DexHunter: Cardano’s top DEX aggregator by users.

Lenfi: Cardano’s top lending app by value.

References

Read More: ADA to BTC? Cardano Treasury Diversification Sparks DeFi Revival Debate">ADA to BTC? Cardano Treasury Diversification Sparks DeFi Revival Debate

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.