Stellar Price Surges 90% in a Week as Charles Hoskinson Applauds Its Resilience – Bulls Eye $0.80

0

0

Highlights:

- The Stellar price rises 11% to $0.48, marking significant growth.

- Charles Hoskinson praises Stellar’s survival through bear markets.

- XLM is overbought, cautioning a potential pullback before a major rally to $0.80-$1.

As of July 14, the crypto market is blazing with new ATH, led by Bitcoin, which has hit $123K. Moreover, Stellar price (XLM) has notably shown a splendid bullish muscle, rising 11% in a day to trade at $0.48. XLM is now up 90% in the past week, reinforcing the growing hype among investors in the market.

According to Cardano founder Charles Hoskinson, Stellar and Hedera (HBAR) have managed to survive the storm of the past few years. The goodwill message he sent portrays the resilience and strength that the networks have demonstrated, overcoming the bear markets.

Congrats to Stellar and Hbar, they have weathered the storms of the past few years and are growing well.

— Charles Hoskinson (@IOHK_Charles) July 14, 2025

Meanwhile, Crypto Virtuos has indicated that within a single week, the price of XLM tripled to $ 0.4461, a level not recorded in recent months. Such an increase in price has sparked speculation about its potential growth, with a target price of $ 0.50 being very plausible.

Stellar ($XLM) with stellar performance in the last week.

Price almost doubled in the last week and is still going up. $.5 looks very chasable from here. pic.twitter.com/xC1ayh1Dei

— Crypto Virtuos (@CryptoVirtuos) July 13, 2025

This tremendous change in prices coincides with several activities in the Stellar network. This includes the increment in volumes and interests among investors.

XLM Open Interest and Derivatives-Based Analysis

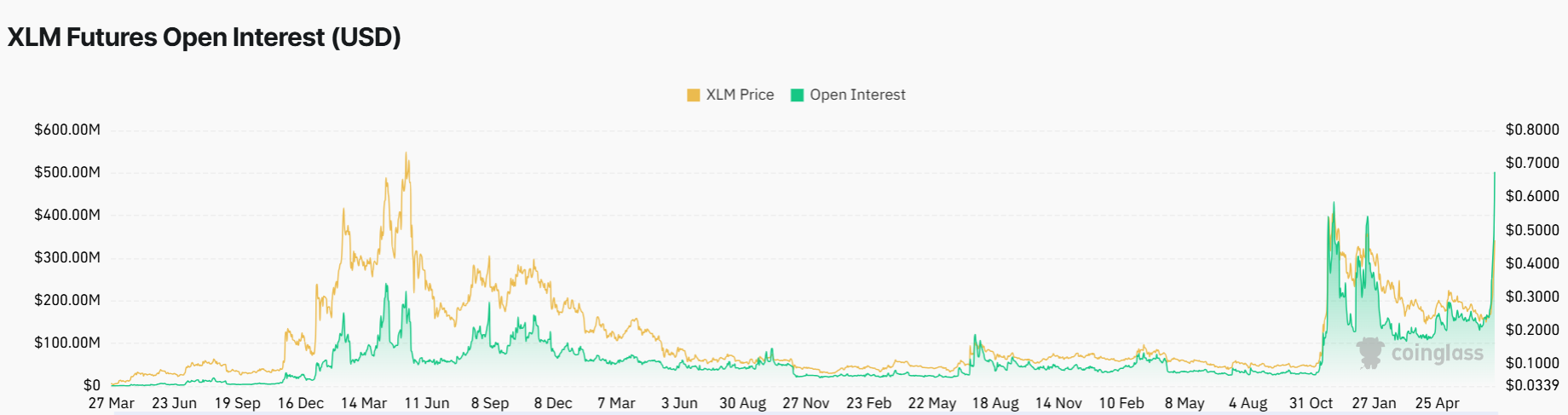

The recent rise in Stellar’s price is also reflected in the derivatives industry, which is suddenly gaining traction over XLM. Statistics surrounding the open interest of XLM (especially on futures contracts) indicate that traders are becoming increasingly willing to hedge against the price movement of XLM.

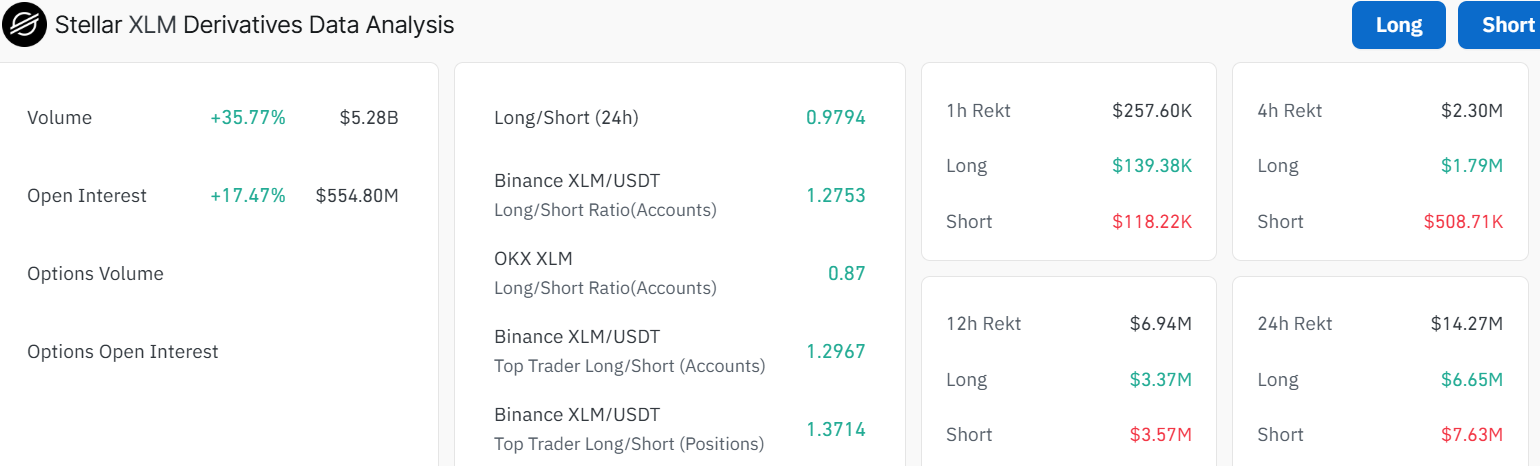

The open interest in XLM Futures indicates that the market’s interest has grown significantly with the rise in price. This suggests the extent to which XLM has become a subject of interest among retail and institutional investors. Over the recent past, the open interest has increased significantly, with a 17.47% rise in open interest, reaching $554.80 million. Notably, its volume has spiked by 35% to $5.28B indicating heightened interest.

The strong balance between long and short positions in the derivative analysis of XLM further confirms the positive sentiment.

Stellar Price Could Cool Off Before a Substantial Rally to $0.8

According to the daily chart outlook, the Stellar price (XLM) has broken out in a parabolic curve, indicating a strong bullish grip. The bulls have taken total dominance, leaving the bears in the dust, as they have established immediate support at the 50-day MA (0.27) and the 200-day MA at ($0.30).

However, the Relative Strength Index (RSI) indicates overbought conditions, as it reads at 90.65. This signals intense buying pressure in XLM. A healthy correction could be plausible, allowing the bulls to sweep through liquidity. Additionally, the MACD momentum indicator maintains a buy signal, prompting traders to accumulate more XLM tokens.

A bold look at the XLM/USD daily chart shows a hallmark of bullish sentiment. However, traders should be cautious, as overbought conditions signal a looming correction. In such a case, the $0.39 safety net will be in line to absorb the dip. On the other hand, if the support zones hold and Stellar price sweeps through liquidity, a fresh rally toward the $0.8-$1 level could be plausible in Q4. In the meantime, traders should be careful to escape the bull trap and set a stop-loss in case of a change in trend.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.