WLFI Voters Approve Full Fee-to-Burn Plan With On-Chain Proof

0

0

According to public updates and market trackers, WLFI buyback now routes 100% of protocol-owned liquidity fees into market purchases and permanent burns, with on-chain proof on supported chains.

Early counts indicate community approval at nearly 99.8 percent and active exchange volumes that maintain deep liquidity during headline moments.

What changed

Voters approved a plan that sends all protocol fees from treasury liquidity to buy WLFI and then retire those tokens. Partner and third-party LP fees remain outside the scope, which protects external providers while reducing float. Team notes indicate that each WLFI burn will be linked to verifiable transactions on explorers.

“The goal is to reduce circulating supply and reward long-term holders,” a policy summary states.

Read More: Crypto Weekly: WLFI Buyback, SwissBorg Breach, and Polygon Woes

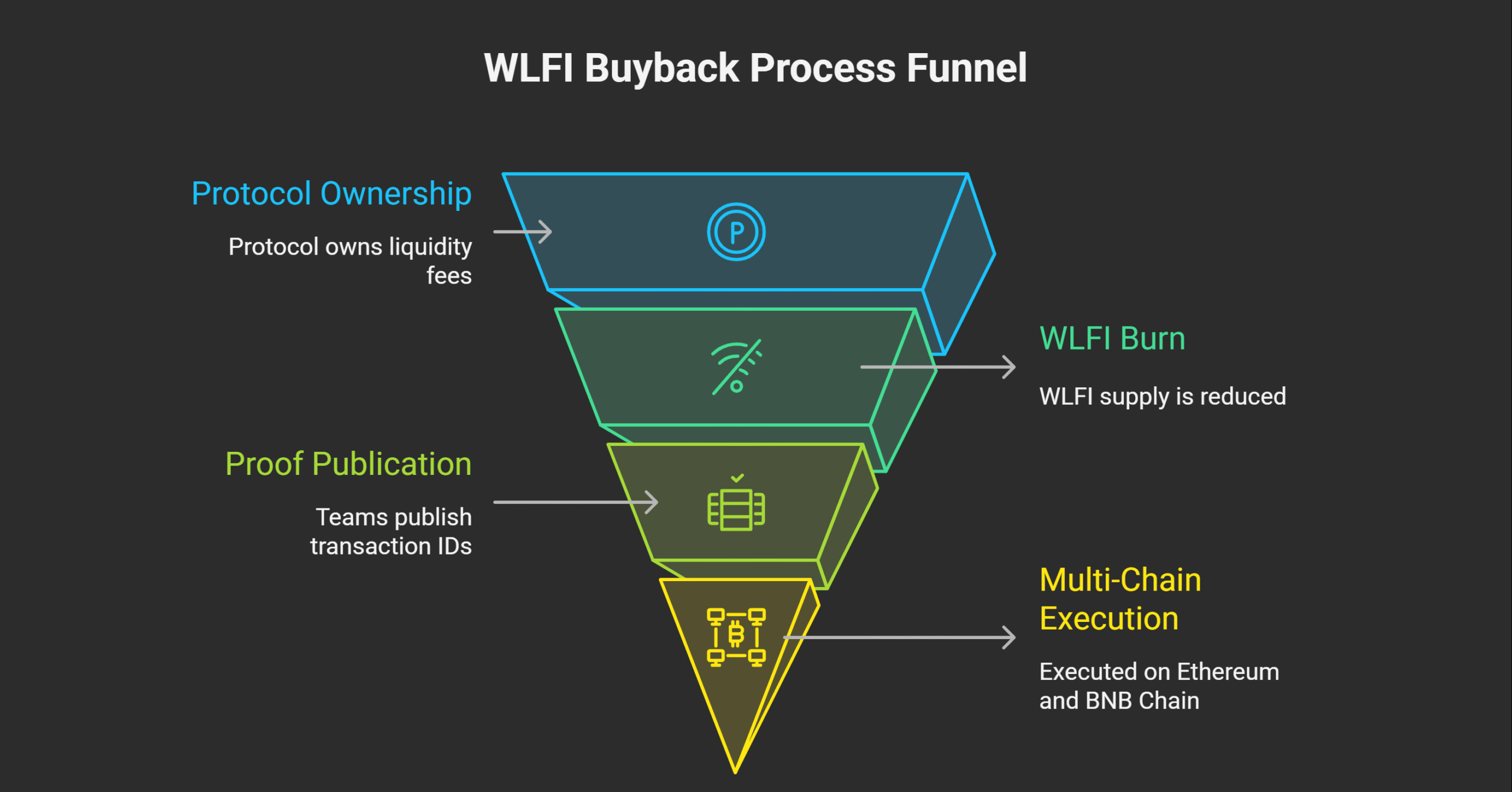

How the WLFI Buyback Runs

Coverage confirms three pillars. One, only the protocol owns liquidity fees and fund purchases. Two, every round ends with a WLFI burn that reduces supply.

Three, teams publish proof so readers can match announcements to transaction IDs. Reporting also notes multi-chain execution that includes Ethereum and BNB Chain, with Solana support under review.

Price, Volume, And Flow

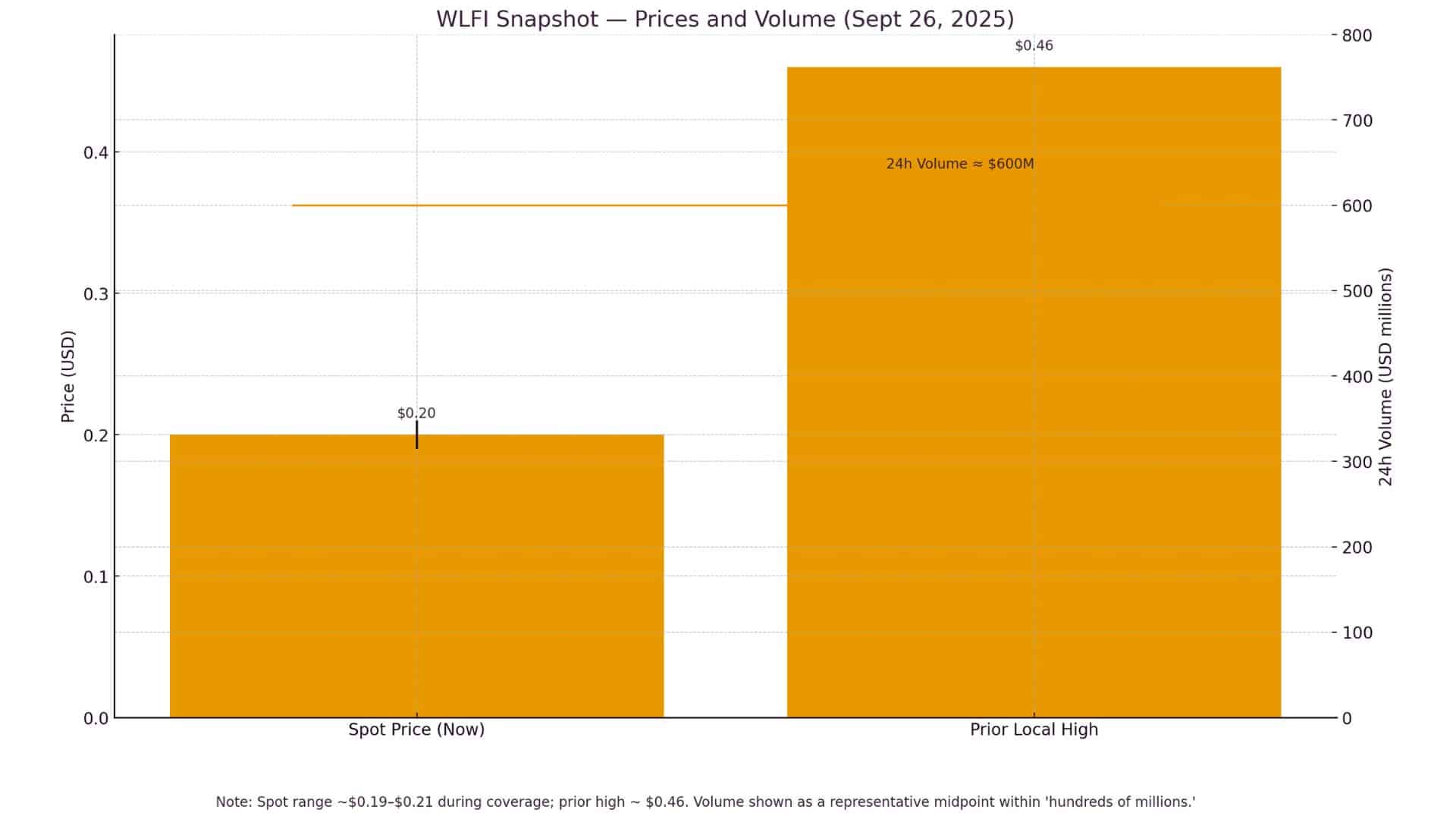

As of September 26, 2025, WLFI trades around $0.19–$0.21 on major exchanges, with a 24-hour volume in the hundreds of millions. Prior coverage cites a peak near $0.46 during early sessions and sharp swings after listing.

Recent reports place WLFI near the twenty-cent area during the vote window, with billions in cumulative trades since launch and a local peak of nearly forty-six cents in early sessions. Forecast notes flagged a possible slip toward the mid-teens if momentum were to fade.

Traders can watch whether the WLFI buyback soaks sell pressure on red days, or whether softer volumes slow the WLFI burn cadence.

Quick table

| Metric | Reading (dated) |

|---|---|

| Spot range | ~$0.19–$0.21 (Sept 26, 2025) |

| Prior local high | ~$0.46 (early Sept reports) |

| Vote approval | ~99.8% (Sept 19, 2025 reports) |

| Scope | POL fees only; partner LPs excluded |

Signals and risks

A live WLFI buyback can tighten float when fees climb. Listings and product pushes can add order flow that helps each WLFI burn move the needle. Risks stay clear. If trading volume cools, fee revenue falls, and the WLFI buyback slows. Readers should verify every WLFI burn-through posted link before citing any numbers.

Verified Steps, Chains, Proof

- Route 100% of protocol-owned liquidity fees to buys.

- Execute a WLFI burn after each round.

- Publish on-chain proof for transparency.

- Stage rollouts across Ethereum and BNB Chain; Solana in scope.

- Record near-unanimous approval at ~99.8%.

Conclusion

Based on the latest research, WLFI buyback anchors the token plan with near-unanimous support, exclusions for partner LPs, and on-chain proof for every WLFI burn. Watch fee accruals, burn frequency, multi-chain rollouts, and any moves to add more revenue sources.

Also Read: WLFI Price Surges 10% as Traders Bet on Buyback-and-Burn Plan

Summary:

The WLFI buyback channels all protocol-owned liquidity fees into open-market purchases and a permanent WLFI burn, with public proof. Coverage shows near-unanimous approval, heavy trading, and reference prices of around twenty cents, with an early peak of nearly forty-six cents.

Track fee inflows, posted transactions, and possible scope expansions. The setup can tighten supply, yet it depends on sustained volume to keep the WLFI burn mechanism funded.

Glossary of key terms

- Protocol-owned liquidity: liquidity that the protocol controls and monetizes.

- Buyback and burn: using revenue to buy tokens and retire them forever.

- On-chain proof: public transaction links that show purchases and burns.

- Burn address: A wallet with no private key. Tokens sent there cannot be spent, so they are removed from circulation forever.

FAQs about WLFI Buyback

What funds the WLFI burn?

Protocol owned liquidity fees, not partner or community LP fees.

How often will burns occur?

Teams run manual rounds and post links. Timing depends on fees accrued.

Where can holders verify each burn?

Follow official announcements and match every link on the relevant explorer.

Does the policy change take effect immediately?

Supply drops when burn transactions are settled on the chain.

Read More: WLFI Voters Approve Full Fee-to-Burn Plan With On-Chain Proof">WLFI Voters Approve Full Fee-to-Burn Plan With On-Chain Proof

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.