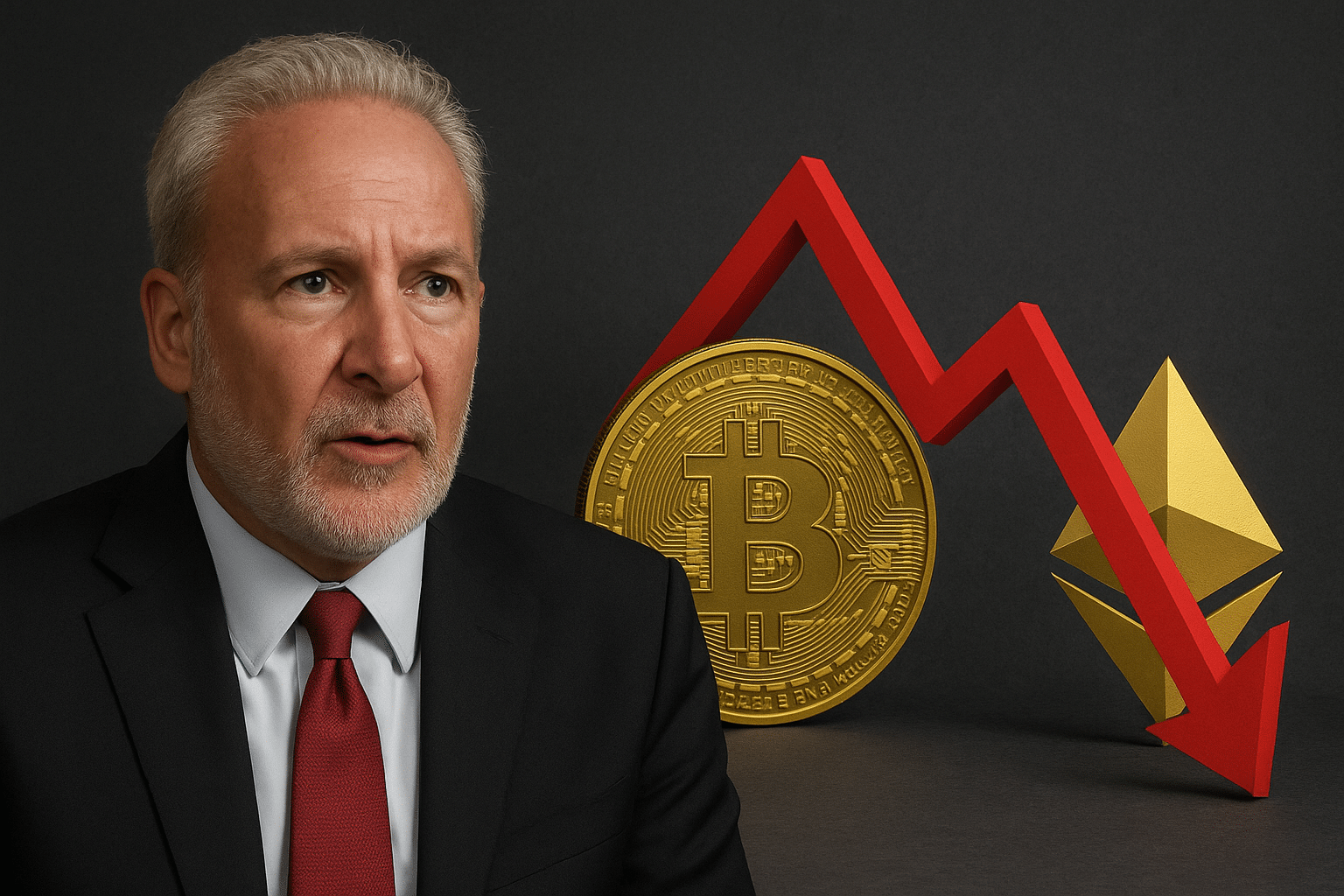

Is the Peter Schiff Warning on Bitcoin and Ethereum Crash Really Imminent?

0

0

This article was first written in The Bit Journal/ At a time when the world of crypto is excelling due to the prevailing regulatory changes, Peter Schiff pours cold water with his Bitcoin and Ethereum crash prediction. Is his prediction right or wrong?

Long-time crypto critic and gold advocate Peter Schiff has predicted a grim picture of the future with dire warnings to digital asset investors of an imminent Bitcoin and Ethereum crash. In his prediction about what he calls an imminent Bitcoin and Ethereum crash, he stated that it would “obliterate the rest of the altcoin market” besides triggering “a wave of bankruptcies, defaults, and layoffs.”

According to a post on X by Peter Schiff, the coming Bitcoin and Ethereum crash will send shockwaves throughout the entire crypto space. Peter Schiff suggested that Bitcoin’s weakening relative strength signaled what he called a downtrend for BTC and ETH, adding that it would lead to the next phase of the bear market, which could trigger a cascade.

Failures throughout the Crypto Industry

According to him in another post, the crash could result in massive financial losses, bankruptcies, loan defaults, and widespread layoffs across crypto firms and service providers. Peter Schiff further opined that the Bitcoin Bear Market was imminent, stating that the flagship cryptocurrency was 34% versus gold since it hit its record high in August. At the time of writing, Bitcoin was retailing at $111,319.

The grim picture of a crypto crash painted by Peter Schiff comes following a week-long volatility within the broader cryptocurrency market, making the market sentiment increasingly cautious. The prediction is tied to the macroeconomic backdrop in addition to the threat of a dollar crisis fueled by monetary instability and eroding global trust in the USD’s value.

Tariffs Announcement Triggered Bitcoin and Ethereum Crash

US President Donald Trump announced on October 10, 2025, through his Truth Social page that he would impose a 100% tariff on all incoming Chinese goods. The announcement is thought to have been the main trigger of the impending crash in addition to other cryptocurrencies. At the time of writing, the broader cryptocurrency market had liquidated over $19 billion in a few hours, marking the largest liquidation since the pandemic.

In his warning regarding his predicted Bitcoin and Ethereum crash, Schiff has also mocked Michael Saylor’s company, Strategy, whose balance sheet is heavily exposed to Bitcoin. Currently, Strategy holds over 640,031 BTC, worth more than $71 billion as of the time of writing, making it the largest corporate holder of the digital asset.

Conclusion

Despite the ongoing criticism and warning of an impending crypto crash by Schiff, crypto enthusiasts believe his analysis may have overlooked the cryptocurrency’s structural benefits, including portability, fixed supply, and independence from centralized control. Only time will tell whether gold’s short-term dominance will negate BTC’s broader role as a hedge against fiat devaluation and prove Schiff right.

Glossary to Key Terms

Bitcoin: A virtual currency that’s used as an investment and a form of payment for goods and services

Ethereum: A decentralized software platform built on blockchain technology, known for its native cryptocurrency, ether (ETH),

Altcoins: This refers to any cryptocurrencies that are not Bitcoin; the term is a portmanteau of “alternative” and “coin”.

Crypto market crash: If a cryptocurrency investments drop by a lot that is called a cryptocurrency crash.

Frequently Asked Questions about Schiff’s prediction on Bitcoin

What does Peter Schiff say about Bitcoin?

Schiff has criticized Bitcoin’s volatility and emphasized safer, more stable assets like gold and silver, which are delivering strong returns.

Is Peter Schiff accurate?

Peter Schiff’s predictions have a mixed record, with notable successes and several misses, making his overall accuracy uncertain.

What is Peter Schiff’s main problem with Bitcoin?

Schiff believes that Bitcoin and other cryptocurrencies are hype-driven assets that are structurally weak, and vulnerable to an imminent collapse that could lead to widespread crypto bankruptcies.

What is the reaction of crypto enthusiast to Schiff’s claims?

Bitcoin advocates believe that crypto asset’s fixed supply, decentralization, and historical resilience, give it an advantage of gold.

Read More: Is the Peter Schiff Warning on Bitcoin and Ethereum Crash Really Imminent?">Is the Peter Schiff Warning on Bitcoin and Ethereum Crash Really Imminent?

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.