0

0

This article was first published on The Bit Journal.

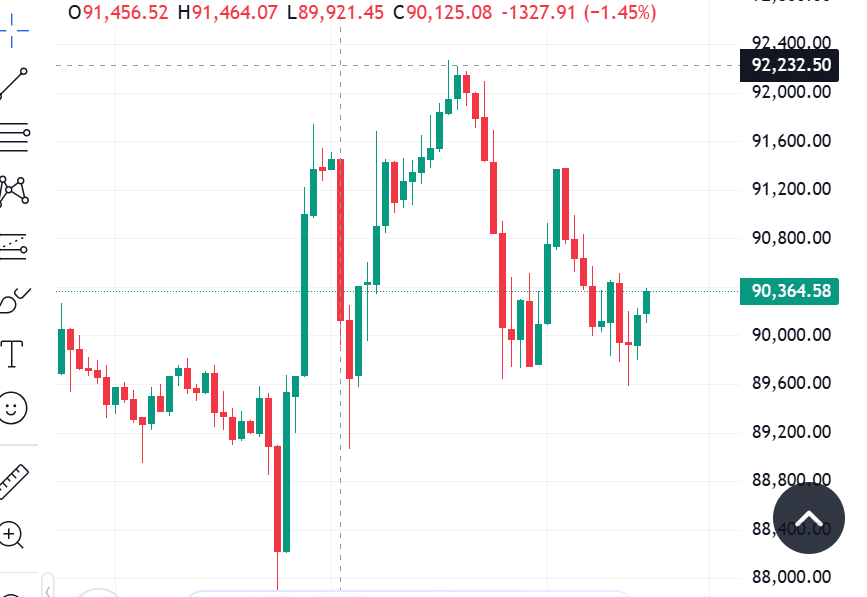

Bitcoin has just logged its sharpest pullback since 2018, and trading patterns place Europe at the center of the move. Timezone data shows that the largest wave of selling hit during European market hours, while Asian and U.S. sessions saw far smaller swings. The broader market held a recent rebound, but liquidity stayed thin ahead of a key central bank decision, turning this into a regional shock rather than a full market breakdown.

Spot prices capture the split. Live data shows Bitcoin trading around 90,100 USD, after brief attempts to reclaim the 92,000 region. Ether changes hands near 3,100 USD, Cardano sits around 0.43 USD and Solana trades close to 134 USD. Volumes remain active, but order books are thin enough that one region turning risk off can move prices quickly and leave slower participants reacting instead of leading.

A breakdown of intraday flows shows that most of the recent downside in Bitcoin arrived during European business hours. That cluster of selling likely reflects a mix of regional macro worries, ongoing regulatory noise and year-end portfolio adjustments. In a market that trades 24 hours a day, local time still matters when large funds, structured products and market makers choose to cut risk in the same window.

The contrast with 2018 is important. In the last major pullback of this size, crypto prices leaned heavily on retail enthusiasm and aggressive leverage. Today the landscape includes exchange-linked vehicles, institutional custody and more active derivatives hedging. When Europe sells now, it can still hurt, but it often reflects rule-based risk management instead of pure fear, which helps explain why major altcoins did not collapse in lockstep with Bitcoin.

The resilience of Ether, Cardano and Solana has become a useful check on sentiment. Ether holding near 3,100 USD suggests that demand for smart contract capacity and staking rewards remains firm, even as short term traders take profits. Cardano anchored around 0.43 USD points to steady interest from longer term participants who still treat it as a core holding in the layer-1 space. Solana trading in the mid-130s, after a strong rally earlier in the year, continues to behave like a high beta blue chip rather than a fading story.

Key indicators back the idea of a reset, not a collapse. Daily trading volumes remain solid, open interest in futures has cooled without vanishing, and perpetual funding rates have drifted back toward neutral levels from previous extremes. Timezone flow data shows that selling pressure was concentrated rather than global, which supports the case that this move is a sharp adjustment rather than a structural breakdown.

Over the coming months, the path for Bitcoin will likely hinge on central bank decisions and overall appetite for risk assets. If policymakers confirm a gradual shift toward easier conditions in 2026, Bitcoin has room to revisit the 95,000 to 100,000 region, with support building in the high-80,000s where buyers recently stepped in. A more hawkish tone could drag focus back toward the 85,000 zone and keep rallies capped until fresh liquidity returns.

Ether may continue to trade inside a broad 2,800 to 3,400 band as investors weigh short-term selling from structured products against optimism around scaling upgrades and layer-2 growth. Cardano could move between 0.38 and 0.55 if on-chain activity and staking participation improve, especially as analysts already track a slow grind higher from the low-0.40 range.

Solana, which tends to amplify broader market moves, might test the 150 region on renewed risk appetite, while deeper pullbacks toward 115 remain possible if volatility spikes again and liquidity thins out.

For all four assets, classic crypto indicators still matter. Rising active addresses, stable exchange reserves, and consistent developer activity usually support accumulation during drawdowns. On the other side, overheated leverage, extreme funding rates or a sudden drop in liquidity can quickly turn a promising bounce into a short lived relief rally, particularly when one timezone starts the selling and others follow later.

The latest selloff shows that regional flows can still shake a maturing crypto market. Europe appears to have driven the heaviest round of Bitcoin selling since 2018, yet the stability of Ether, Cardano and Solana points to an ecosystem that is bruised rather than broken.

For disciplined market participants, that blend of Bitcoin volatility and altcoin resilience creates both risk and opportunity, as long as decisions rest on data, time horizon and clear risk management instead of fear. This analysis is informational and should not replace independent research or professional advice.

What triggered the latest Bitcoin drop?

Most of the downside arrived during European trading hours, where selling from larger players met relatively thin liquidity and pushed prices sharply lower in a short period.

Why did Ether, Cardano and Solana hold steadier levels?

These assets benefit from network usage, staking demand and active developer communities, which helped them avoid the same degree of forced selling seen in Bitcoin.

Are these price projections guaranteed outcomes?

No. They are scenario-based views that depend on macro conditions, liquidity and on-chain trends, and they can change quickly if market data or policy signals shift.

Spot price

The current market price at which an asset can be bought or sold for immediate settlement.

Liquidity

The ease with which an asset can be traded without causing a large move in its price.

Funding rate

A periodic payment between traders in perpetual futures that keeps contract prices aligned with the spot market.

Read More: BTC, ETH, ADA, SOL Price Outlook After Europe Fueled The Sharpest Bitcoin Selloff Since 2018">BTC, ETH, ADA, SOL Price Outlook After Europe Fueled The Sharpest Bitcoin Selloff Since 2018

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.