How XRP Tokenholders Turned the Tide in Ripple’s Legal Battle

0

0

The Ripple SEC case marked a significant legal victory for Ripple Labs in its ongoing battle with the U.S. Securities and Exchange Commission (SEC). The decision, finalized in August 2023, brought an end to a lengthy legal dispute that began in 2020.

XRP tokenholders played a crucial role in securing Ripple’s victory. Their involvement, including submitting affidavits and gathering evidence, was instrumental in shaping the outcome of the case.

Key Developments in the Ripple SEC Case

Back in 2020, the SEC filed suit against Ripple Labs for selling XRP tokens as an unregistered security. The case involved whether or not the payment-based digital asset XRP was subject to regulations under the SEC. Ripple’s defense was that XRP was not a security and therefore was not subject to the SEC’s jurisdiction.

In 2023, Judge Analisa Torres issued a mixed decision. She concluded that XRP tokens sold on public exchanges were not securities, but tokens sold to institutional investors were. This was a key moment in Ripple SEC.

Also read: XRP Holders Demand Closure as Ripple SEC Battle Ends

XRP Tokenholders: A Game-Changing Influence

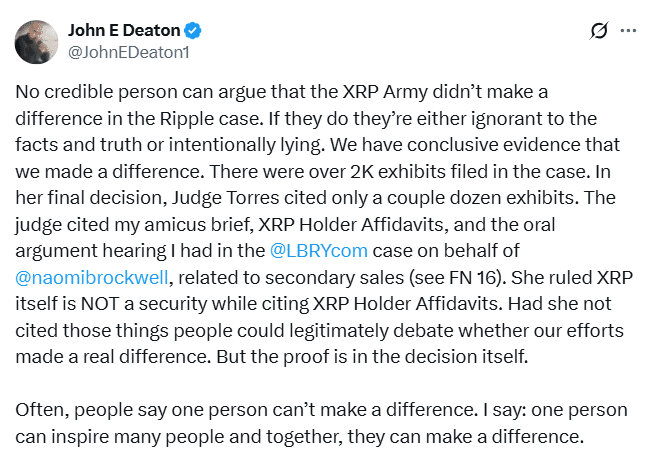

XRP tokenholders played a key role in the Ripple SEC case. John Deaton is a well-known crypto evangelist that mobilized the XRP Army to take action. He noted that the SEC lacked an adequate representation of XRP holders’ interests in its case.

Ripple’s Vice President Deborah McCrimmon acknowledged the importance of the XRP Army. She commended their unsolicited efforts in trying to locate key evidence that was used in Ripple’s defence. Through social media campaigns and petitions, the XRP community supplied Ripple with much-needed resources.

The Fair Notice Defense and XRP Holders’ Contribution

One of Ripple’s key defenses in the Ripple SEC case was “fair notice”. Ripple said the SEC had failed to give clear guidance on the regulatory status of XRP.

A large part of this defense was supported by the XRP Army. They have found SEC statements and speeches that were critical to Ripple’s argument.

Often these statements were spread throughout the public domain, and they were key evidence for Ripple. The XRP Army pulled this information from public sources and published it on social media. McCrimmon conceded that work by XRP holders saved Ripple thousands of dollars in legal fees.

Amicus Briefs: A Vital Support in the Ripple SEC Case

Amicus briefs were another key factor in the Ripple SEC case. Deaton filed an amicus brief on behalf of XRP holders. Judge Torres referenced this brief in her final decision. The brief outlined the impact of the case on XRP holders and the wider cryptocurrency community.

Deaton’s amicus brief and the affidavits from XRP holders provided the court with a clear understanding of the real-world implications of the case. This highlighted the significant impact the SEC’s actions could have on the cryptocurrency market.

The Ripple SEC Case Ruling and Market Impact

The SEC ruling in the Ripple case had a tremendous impact on the market. The decision helped XRP gain back investor confidence. The decision was made official and XRP saw a price spike, reaching as high as $3.35 for a short time. While the price did correct after hitting this peak, the legal victory gave XRP a strong foothold in the market.

This decision is considered a victory for not just Ripple, but the entire cryptocurrency industry. It showed that regulatory certainty is a key factor for growth of digital assets. The Ripple SEC case also established an important precedent for how digital assets will be regulated moving forward.

The Potential for an XRP ETF

After the ruling, speculation about the potential existence of an XRP ETF started circulating. An XRP ETF would open up access to institutional investors to buy XRP, potentially resulting in huge inflows of capital in the system. XRP proponents have argued that an ETF could help further establish XRP as a legitimate asset class.

New listing requirements enacted by the SEC may pave the way for an XRP ETF. XRP has already fulfilled one of these prerequisites because the US dollar equivalent of Ripple (XRP) has traded for six months on a designated contract market. The approval of an XRP ETF could be the next significant step towards the future of Ripple and the cryptocurrency market.

Conclusion

Ripple SEC case has set a precedent in the crypto regulation industry. Ripple has been able to achieve this victory in part because XRP tokenholders played a key role in pulling together evidence and garnering sympathy. Their help was key to a winning ruling.

Also read: Following Ripple SEC Resolution BlackRock Eyes XRP ETF

Summary

Ripple SEC case, Ripple won the case with help from XRP tokenholders. They helped with filing affidavits and collecting evidence that would be essential to Ripple’s defense.

Judge Torres ruled that public XRP was not a security. This legal victory sets the stage for further XRP ETF approval, boosting market confidence and potentially igniting long-term institutional capital allocation into XRP.

Appendix: Glossary of Key Terms

Ripple SEC Case – Ripple Labs vs U.S. SEC, after Ripple Labs decided to challenge whether or not XRP is an unregistered security.

XRP Tokenholders: Investors or users who hold XRP tokens, crucial in supporting Ripple’s defense.

Fair Notice Defense: Ripple’s argument that the SEC failed to provide clear regulatory guidance on XRP’s status.

Amicus Brief: A legal document filed to offer additional information or perspective in a case.

XRP ETF: A proposed Exchange-Traded Fund allowing easier institutional access to XRP.

FAQs for the Ripple SEC case

1- What was the Ripple SEC case about?

The Ripple SEC case centered on whether XRP tokens were unregistered securities under U.S. law.

2- How did XRP tokenholders influence the case?

XRP tokenholders played a key role by submitting affidavits and gathering evidence to support Ripple’s defense.

3- What was the final ruling in the Ripple SEC case?

The court ruled that XRP tokens sold on public exchanges were not securities, but those sold to institutional investors were.

4- What is the potential impact of an XRP ETF?

An XRP ETF could open doors for institutional investors, potentially boosting XRP’s market value and adoption.

Read More: How XRP Tokenholders Turned the Tide in Ripple’s Legal Battle">How XRP Tokenholders Turned the Tide in Ripple’s Legal Battle

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.