Bitcoin ETFs Bleed $100M, Analysts Fear Major Support Break

0

0

US spot Bitcoin BTC $109 494 24h volatility: 1.7% Market cap: $2.18 T Vol. 24h: $76.68 B exchange-traded funds (ETFs) registered a combined $101 million in net outflows on Oct. 22, while BlackRock’s iShares Bitcoin Trust (IBIT) managed an inflow of $73.6 million.

Meanwhile, Ethereum ETFs mirrored the trend, with a total net outflow of $18.7 million, according to SoSoValue data.

On October 22, U.S. spot Bitcoin ETFs recorded a total net outflow of $101 million, while BlackRock’s IBIT saw a net inflow of $73.63 million. Spot Ethereum ETFs had a total net outflow of $18.77 million, with BlackRock’s ETHA being the only fund to post inflows, totaling $111… pic.twitter.com/SyjVnSaHYd

— Wu Blockchain (@WuBlockchain) October 23, 2025

Analysts claim that the decline is a result of persistent macroeconomic uncertainty and reducing confidence in risk assets following US President Donald Trump’s tariff announcement earlier in October and the US government shutdown.

Critical Support Under Pressure

Bitcoin currently trades around $110,000, having failed to reclaim the $113,000 level earlier in the week. Analysts from Bitfinex warn that the $107,000–$108,000 range has become increasingly fragile, noting that institutional buyers have been largely absent during the pullback.

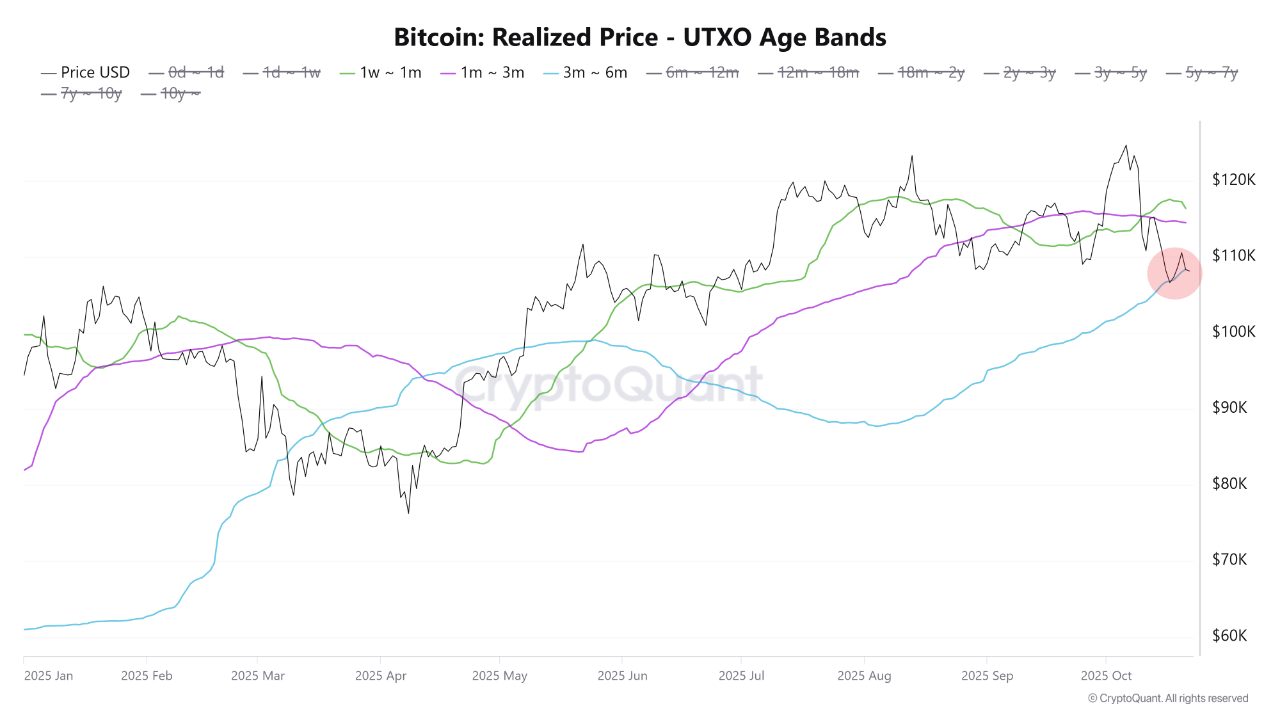

Between October 13 and 17 alone, spot Bitcoin ETFs saw outflows exceeding $1.23 billion, a clear sign of fading demand. According to CryptoQuant, the 3–6 month UTXO realized price level, currently around $108,300, is acting as a key mid-term support.

BTC UTXO Age Bands | Source: CryptoQuant

This means that Bitcoin is testing the average cost basis of holders who accumulated during the last rally. A decisive break below this level could trigger further downside.

Market Data Shows Demand Exhaustion

Data from Glassnode revealed that Bitcoin now trades below both the short-term holders’ cost basis ($113,100) and the 0.85 quantile ($108,600), levels that historically mark a transition into mid-term bearish phases.

A Market Hedged in Fear

Bitcoin trading below key cost basis levels signals demand exhaustion. Long-term holders are selling into strength, while rising put demand and higher volatility show a defensive market.

Read the full Week On-Chain below👇https://t.co/2aZJU8meBX pic.twitter.com/ze4EowUPwh

— glassnode (@glassnode) October 22, 2025

Long-term holders have ramped up distribution, with daily spending exceeding 22,000 BTC, indicating sustained profit-taking pressure.

Also, options data show rising demand for put contracts as traders hedge against further declines. Implied volatility has surged, while open interest remains near all-time highs, indicating growing nervousness among market participants.

BTC Options OI | Source: Glassnode

Analysts note that short-term rallies are being met with defensive positioning rather than optimism, i.e., recovery momentum may take time to rebuild.

Importantly, if institutional inflows fail to rebound in the coming weeks, analysts warn that the market could enter a prolonged consolidation phase below $110,000. However, a sustained defense of the $108,000 zone, backed by renewed ETF demand, could stabilize price action and set the stage for recovery heading into November.

The post Bitcoin ETFs Bleed $100M, Analysts Fear Major Support Break appeared first on Coinspeaker.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.