CME Group Releases Impressive XRP Futures Performance Report – Ignites XRP Community

0

0

The introduction of XRP futures by CME Group has become one of the most significant developments in the digital asset derivatives market in 2025.

Since launching on May 19, both the standard and micro XRP futures contracts have amassed more than $542.8 million in notional trading volume, evidence of robust institutional and retail appetite for regulated exposure to one of the industry’s most scrutinized digital assets.

According to a recent statement posted by CME Group, over 24,600 contracts have been exchanged during the first month of trading. Interestingly, nearly half of the participants have come from outside the United States, reaffirming the global reach and relevance of XRP amid evolving regulatory and technological frameworks.

The move to list XRP futures came at a pivotal moment, as regulatory clarity around the asset improved following a string of favorable legal outcomes for Ripple Labs. With its utility-driven approach and growing institutional adoption, XRP continues to distinguish itself as more than a speculative token.

CME’s new contracts serve as a bridge for traditional investors seeking price exposure to XRP without needing direct custody or wallet management, a notable benefit for institutions managing risk across both fiat and digital instruments.

Also Read: XRP Holders Called “Cosmic Royalty” in Viral CEO Message to Community

Source: CME/X

First-Month Metrics Suggest Sustained Market Engagement

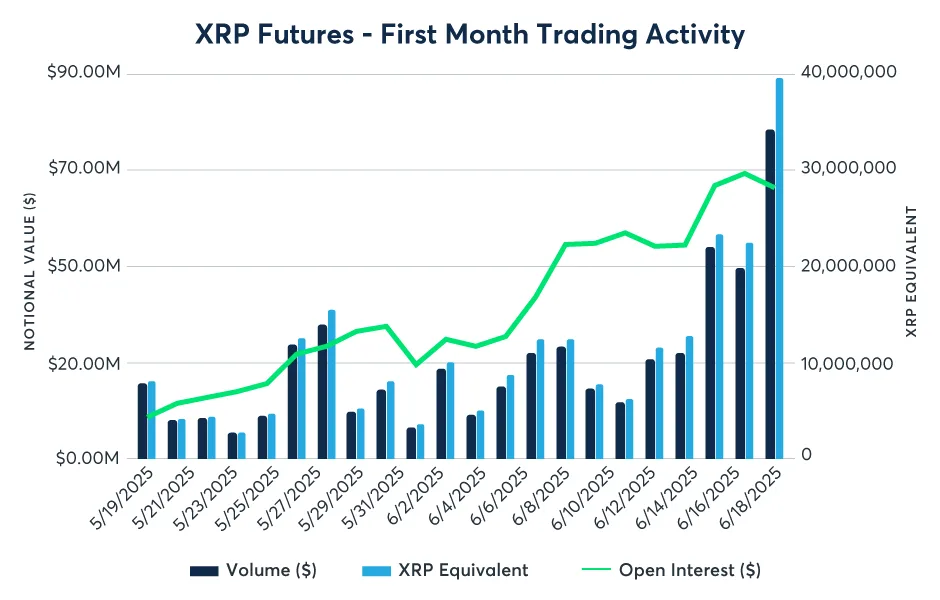

CME’s own breakdown of activity reveals that XRP futures debuted with a strong performance: $19.3 million traded on launch day alone, involving 15 different institutional firms and four retail brokerage platforms. The early momentum has not only continued but deepened, with current open interest now standing at $70.5 million.

Rather than experiencing a typical post-launch slump, trading volumes have maintained an upward trajectory. Data shared by CME illustrates a consistent climb in active positions, with daily trade volumes remaining elevated throughout the contract’s first 30 days.

This consistency points to genuine strategic interest, as opposed to speculative flurries.

Source: CME Group Website

Beyond the raw numbers, what’s particularly notable is the composition of the participants. ETF issuers, hedge funds, proprietary trading firms, and active retail investors are all represented.

Their engagement reflects growing confidence in XRP as an asset class, one capable of functioning across both speculative and utility-based roles in the financial system.

Institutional Infrastructure and On-Ledger Growth Reinforce Outlook

CME’s optimism around XRP appears to extend beyond just derivatives trading. Its 2025 market outlook highlights accelerating adoption of the XRP Ledger (XRPL), citing a sharp increase in daily transaction counts and active wallet addresses.

According to on-chain analytics platforms, XRPL is currently processing over 1.6 million transactions daily, surpassing even some Ethereum Layer 2 networks in throughput.

Driving much of this ecosystem expansion is Ripple’s $1.25 billion acquisition of Hidden Road Partners. The institutional prime brokerage firm has already cleared the first block trade on CME’s XRP futures platform, signaling Ripple’s intentions to merge traditional and crypto finance more directly.

The acquisition positions Ripple to offer services across margin trading, clearing, and risk management, enhancing the XRP ecosystem’s attractiveness to institutional players.

In parallel, the launch of RLUSD, Ripple’s stablecoin initiative, is already bolstering XRPL liquidity. RLUSD is fully backed by U.S. dollar reserves and short-term Treasuries, and has been praised for its real-time settlement features and native compatibility with decentralized exchange functions on the XRPL.

CME analysts also emphasize the potential for cross-margining XRP positions against other regulated products, which could further integrate digital assets into mainstream financial portfolios.

With tools like RLUSD acting as on-chain liquidity rails, the foundation is being laid for XRP to serve broader functions in global finance, especially in corridors where traditional banking infrastructure is constrained or inefficient.

A Turning Point for XRP’s Institutional Journey

The early performance of CME’s XRP futures has gone beyond expectations, reinforcing the narrative that XRP is not just surviving the regulatory gauntlet; it is thriving in a new, more mature era of digital finance.

With institutional-grade infrastructure, real-world financial integrations, and increased transparency, XRP is poised to become a central pillar of cross-border liquidity.

CME’s data is more than a snapshot of trading interest; it’s a reflection of evolving investor behavior and strategic repositioning within crypto finance.

As more regulated vehicles emerge to support digital asset exposure, XRP appears to be leading the next wave of adoption, supported not only by speculative capital but by tangible, enterprise-level use cases.

For more analysis on the institutional evolution of digital assets, follow our updates on 36crypto.com.

Also Read: Ethereum Foundation to Double Donations for Tornado Cash Cofounder’s Defense

The post CME Group Releases Impressive XRP Futures Performance Report – Ignites XRP Community appeared first on 36Crypto.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.