Theta Network Price Faces Bearish Pressure Despite 9% Surge in Trading Volume

0

0

Highlights:

- The price of Theta Network has dropped 1% to trade at $0.88 in the past 24 hours.

- Theta Network leads the booming crypto AI sector, driving innovation with powerful GPU resources.

- THETA technical indicators show mixed signals despite derivatives data signalling strong trader confidence.

The Theta Network price has dropped 1% to the $0.88 mark, despite the 9% surge in trading volume. Meanwhile, Theta Network is operating at the head of one of the highest-developing fields in crypto, where cryptocurrency meets AI. Grayscale reports that twenty AI crypto tokens currently have a market capitalization worth $20 billion, which is a big increase from $4.5 billion at the beginning of the year.

Crypto x AI is the highest-growth sector in crypto, and projects like Theta are leading the charge with EdgeCloud's on-demand, high-performance GPU resources! https://t.co/5hAsE6gmme

— Theta Network (@Theta_Network) May 28, 2025

Using EdgeCloud’s powerful GPUs, Theta Network, under AI Tools & Resources, is working to improve AI development. It reflects heightened investor focus on AI projects built on blockchain, meaning Theta will be central in influencing future developments in decentralized AI.

Theta Network Price Outlook

The Theta Network price (THETA) has entered a rough period, with the coin trading within a descending parallel channel. Recently, the digital token fell quickly from its previous top and is now trading lower than its 200-day moving average, which reflects a weak long-term trend.

Currently, Theta price trades around $0.88, and its daily chart clearly shows there have not been long-lasting profitable rises to the upside. An RSI level sits at equilibrium at 51, indicating neither the buyers nor the sellers are in control. Besides, the MACD suggests that bears are in charge, so sellers could keep markets moving lower. This is evident as the blue MACD line has flipped below the orange signal line.

Derivatives Market Highlights Strong Trader Engagement and Risk Appetite

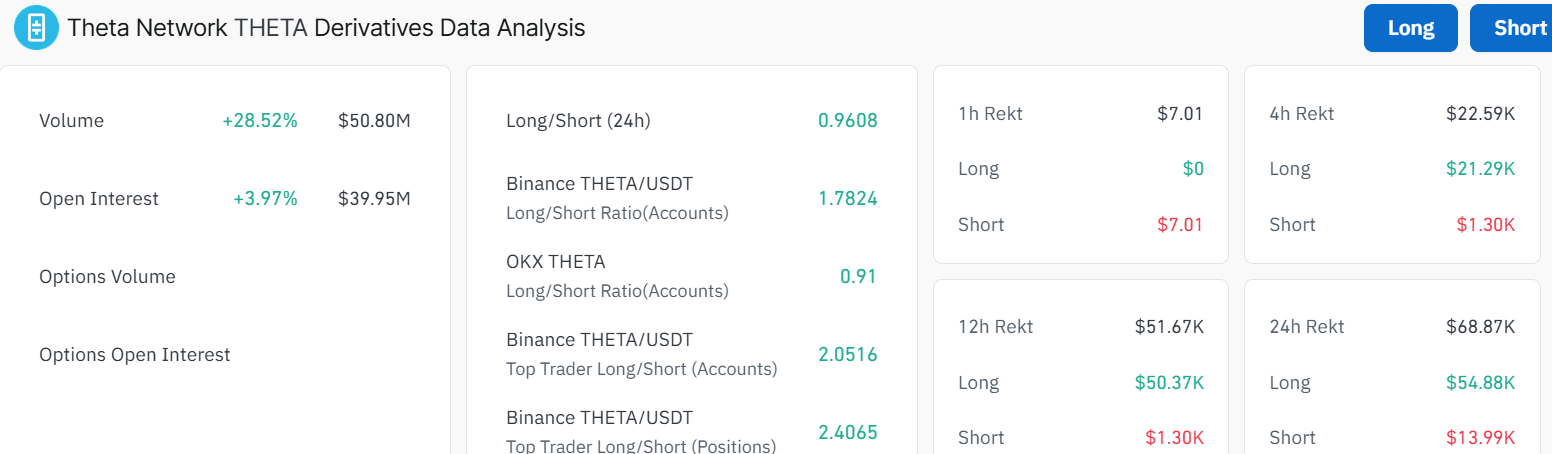

Even with Theta Network’s quiet price activity, its derivatives data shows traders are actively and frequently involved. There has been a big jump in the trading volume of token derivatives, going to $50 million, marking a 28% rise. Futures markets are seeing greater interest, surging 3% as total outstanding contracts now amount to nearly $40M.

Long-to-short ratio analysis on Binance and OKX proves that most traders believe prices will increase. The long and short ratio sits at 0.96, slightly below 1, signaling some bearish prospects. The support level indicates that traders with experience are hopeful that the trend will reverse higher and a bullish breakout will take place, even though things currently look bearish.

Resistance Challenges Ahead with Opportunities for Reversal

The Theta Network price shows some mixed signals however, the odds tend to tilt towards the bears. Meanwhile, the bulls need to overcome the immediate resistance at $1 to reclaim the major resistance at $1.48. Only a break above this mark would confirm that the bear market is ending, and new opportunities for rising prices would arise.

On the other hand, if the bears keep exerting pressure and the $1.48 resistance proves too strong, the Theta Network price could drop. Should resistance not be overcome, the crypto market could see a continuation of stagnation or a further fall. In such a case, the 0.85 support will be in line to absorb the potential selling pressure. Increased selling appetite will drive the THETA token to $0.81, $0.67, and $0.57 support zones.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.