BlackRock’s IBIT Shocks Market After Snapping Up 700,000 Bitcoin Fast

0

0

- BlackRock’s IBIT now holds over 700,000 BTC, shocking the crypto industry.

- ETF accumulation rate raises concerns over Bitcoin’s future liquidity and market balance.

- Analysts project IBIT could control 10% of Bitcoin supply by 2028.

BlackRock’s iShares Bitcoin Trust (IBIT) has stunned the market by becoming the first spot Bitcoin ETF to acquire over 700,000 BTC in just 18 months. This sharp accumulation makes it the fastest and largest institutional Bitcoin grab on record.

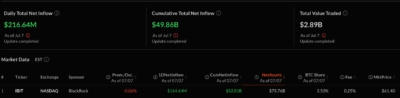

According to SoSoValue, IBIT added another $164.64 million in inflows on July 7, pushing its total holdings past the 700,000 BTC mark. That would give the fund a position calculated to be greater than $75 billion at current market prices, or almost 3.5 percent of the entire circulating supply of Bitcoin.

IBIT has recorded an average BTC net inflow of about 39,000 each month since its approval in January 2024. BlackRock ETF was buying through price dips when Bitcoin was facing price pressure around the mark of $108,000 without showing any signs of diminishing appetite despite the circumstances.

Source: SoSoValue

Also Read: XRP on the Edge: Bollinger Band Squeeze Hints at Massive Price Move

Rapid Growth Sparks Concerns Over Bitcoin Concentration and Market Liquidity

The pace of accumulation is now drawing significant industry attention. IBIT’s current holdings surpass those of Strategy, the Mt. Gox estate, and the majority of known miner treasuries. This concentration of BTC under one issuer is triggering conversations about long-term effects on liquidity and market balance.

Some analysts now suggest that if current trends persist, IBIT could surpass the one million BTC mark by early 2026. This would equate to close to five percent of the entire Bitcoin that has ever been mined. It is also projected that, assuming the same pace of ETF demand, there could be a 10 percent share (approximately 2.1 million BTC) by 2028.

The form of IBIT, accompanied by high institutional trust in BlackRock, is drawing in huge capital allocations. Its clear operations and controlled structure have given it a leading position as a firm seeking exposure to Bitcoin without direct custody.

Although the ultimate repercussions of this quick accumulation are not presently known, one thing is definite: IBIT has radically changed the narrative on why to own Bitcoin and its institutional nature due to its fierce stocking.

BlackRock’s IBIT has shocked the market by securing 700,000 BTC in record time. Its unmatched growth is now forcing the industry to consider what concentrated ETF ownership could mean for Bitcoin’s long-term future.

Also Read: Expert Shuts Down XRP Burn Rate Panic With Shocking 70,000-Year Supply Claim

The post BlackRock’s IBIT Shocks Market After Snapping Up 700,000 Bitcoin Fast appeared first on 36Crypto.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.