Solana ETF Applicants Submit Revised S-1 Filings, Raising Hopes for Potential Listing

0

0

Highlights:

- Seven firms submit revised Solana ETF filings, now including staking details for rewards.

- Bloomberg analyst doubts SEC approval soon, citing ongoing discussions and filing revisions.

- Regulatory shifts under Trump fuel optimism for Solana ETFs amid eased crypto policies.

On June 13, seven companies—Fidelity, Franklin Templeton, Grayscale, Bitwise, 21Shares, VanEck, and Canary Capital—submitted revised S-1 filings to the U.S. Securities and Exchange Commission for their proposed spot Solana (SOL) exchange-traded funds (ETFs). The updated filings now clearly include staking details, allowing fund managers to stake the SOL held in the ETF to earn rewards. The amendments come after a Blockworks report stated the SEC asked firms earlier this week to revise their applications.

UPDATE: Multiple stories broke the news earlier this week that the SEC had reached out to issuers requesting them to submit updated documents for their Solana ETFs & to include staking. As of 5 PM EST we have 6 of the 7 hopeful Solana ETF issuers that have submitted those S-1's pic.twitter.com/WqPI2jf2CW

— James Seyffart (@JSeyff) June 13, 2025

Solana ETF Approval Unlikely Soon, Says Bloomberg Analyst

Bloomberg ETF analyst James Seyffart believes an approval isn’t likely next week. He explained that more discussion is expected between the SEC and fund issuers to finalize key points. Seyffart noted that before the launch of Bitcoin ETFs, there were many filings and revisions over several months. Spot Bitcoin ETFs in the U.S. only went live in January 2024, over a decade after the first application was submitted by Gemini founders Tyler and Cameron Winklevoss back in 2013.

I think there needs to be a back and forth with SEC and issuers to iron out details so i doubt it. If anyone remembers the Bitcoin ETF launch there were *A LOT* of filings over the preceding couple months before launch.

— James Seyffart (@JSeyff) June 13, 2025

ETF expert said he believes all the new filings include language about staking. He agreed with a user on X who suggested that past ETF approvals might speed things up. However, Seyffart added that this doesn’t apply to staking, which is a separate issue. This update comes as the U.S. SEC is also reviewing Ether (ETH) spot ETFs that aim to include the long-awaited staking option. Seyffart said he doesn’t know what will really happen. On April 30, Bloomberg said there’s a 90% chance the SEC will approve a Solana ETF in 2025.

Would love to hear directly from Atkins, but all good chance of happening. Here’s our latest odds of approval for all the dif spot ETFs via @JSeyff https://t.co/nLhYJJmO9U pic.twitter.com/4AcJVwhics

— Eric Balchunas (@EricBalchunas) April 30, 2025

Regulatory Shift Sparks ETF Optimism

A lot of new filings are happening as U.S. regulators ease crypto rules. People believe the SEC might soon allow Solana ETFs to trade. Under pro-crypto President Donald Trump, the SEC and CFTC are changing how they deal with crypto. The SEC has also dropped cases against Binance, Coinbase, and Kraken. In recent months, commissioners have talked more with crypto companies. Their goal is to work together and create clear rules for the industry.

Recently, VanEck and 21Shares urged the SEC to follow its standard “first-to-file” process. This approach means the SEC should approve ETF applications based on the order they were submitted, giving priority to early filers.

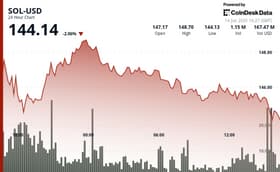

Solana has expanded quickly over the past year, boosting speed for wider Web3 use. A U.S. green light for spot Solana ETFs could challenge Ethereum’s market lead. Some firms already rely on SOL for treasury management. For example, SOL Strategies Inc. (CSE: HODL) currently holds over 420,000 SOL tokens as part of its treasury strategy. As more institutions begin to adopt Solana, it could drive a strong price surge later this year. Bitwise CIO Matt Hougan recently said the crypto market is now in a phase of accumulation and may see a major rally by the end of the year.

I think this is the "Summer of Accumulation" — a moment for long-term investors to build positions ahead of an epic EOY run.

— Matt Hougan (@Matt_Hougan) June 13, 2025

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.