XRP Futures ETF Becomes Fastest CME Contract to Hit $1 Billion Open Interest

0

0

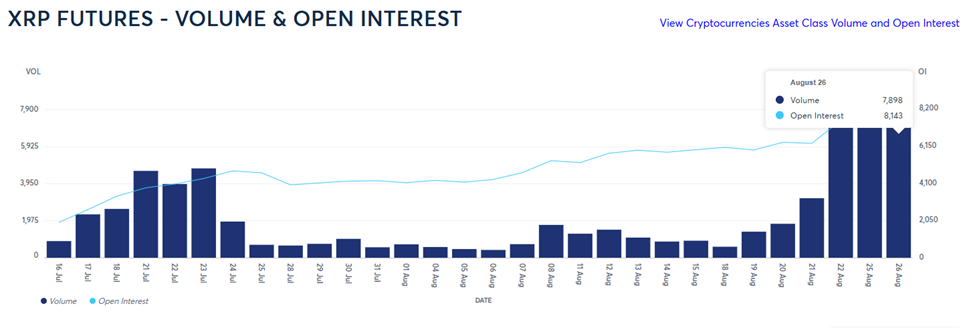

XRP set a new benchmark on Wall Street’s largest crypto trading venue, the Chicago Mercantile Exchange (CME). Ripple’s powering token became the fastest CME contract in history to surpass $1 billion in open interest (OI).

The token crossed this milestone in just over three months since launching in May 2025.

Record Futures Growth Sparks Fresh Speculation Over Spot XRP ETF Approval

The CME Group confirmed the achievement in an update on August 26, describing it as a sign of increasing maturity in crypto derivatives markets.

“Our Crypto futures suite just surpassed $30 billion in notional open interest for the first time ever. Our SOL and XRP futures, along with ETH options, each crossed $1 billion in OI, with XRP being the fastest-ever contract to do so, hitting the mark in just over 3 months. This is a huge sign of market maturity, with new capital entering the market,” CME wrote.

XRP Futures Volume and Open Interest. Source: CME Group

XRP Futures Volume and Open Interest. Source: CME Group

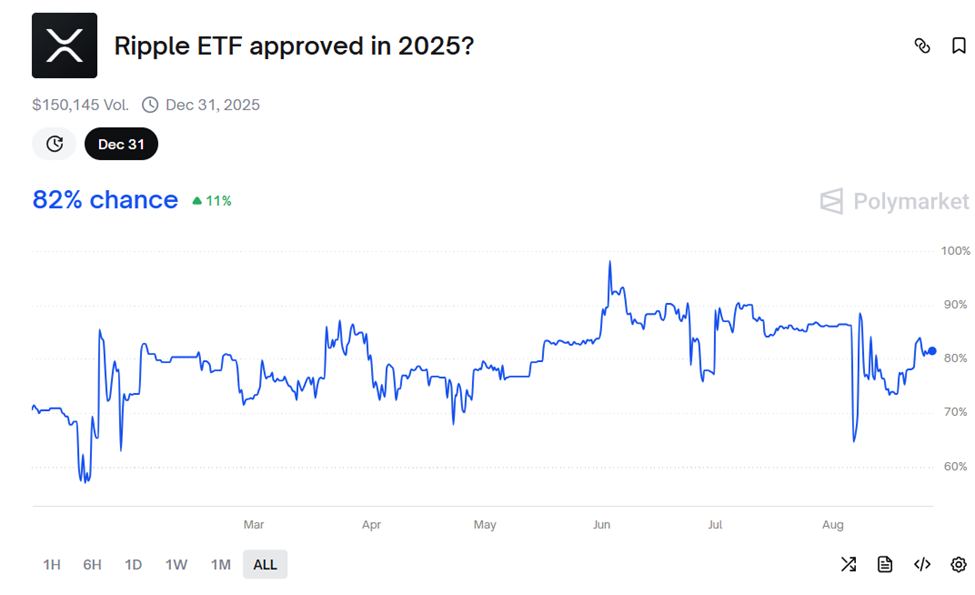

The speed of XRP’s rise on CME has fueled a fresh round of speculation about the potential for a spot XRP ETF.

Nate Geraci, president of the ETF Store, noted that XRP already has over $800 million in futures-based ETFs. In his opinion, the demand for spot products is being underestimated.

“CME Group says XRP futures contracts have crossed over $1B in open interest… fastest-ever contract to do so. There’s already $800+ million in futures-based XRP ETFs. Think people might be underestimating demand for spot XRP ETFs,” he said.

Prediction markets appear to agree, currently assigning an 82% chance that a Ripple-backed ETF will be approved before the end of 2025.

XRP ETF Approval Odds. Source: Polymarket

XRP ETF Approval Odds. Source: Polymarket

The milestone comes against the backdrop of XRP’s paradoxical market position. With a market capitalization of around $178 billion, XRP is the world’s third-largest cryptocurrency.

On paper, it is bigger than asset management giant BlackRock, whose market capitalization was $176 billion as of this writing.

Yet, according to Nate Geraci, it remains among professionals’ most disparaged assets. Pro-XRP attorney John E. Deaton reinforced that view.

“XRP is the single most hated crypto by institutional and professional traders/holders. XRP is the most loved crypto by retail investors/holders,” wrote Deaton.

This tension between institutional skepticism and grassroots loyalty has defined XRP’s trajectory for a long time.

Retail holders have embraced it as a token with utility-driven potential, hence the “XRP has cult-like following” adage.

Meanwhile, institutions remain cautious due to Ripple’s recently concluded but longstanding legal battles with US regulators.

Futures Momentum Meets Skepticism Over XRP’s Long-Term Value

However, not everyone is convinced that XRP’s futures success will translate into long-term value.

Some critics argue that stablecoins, smart contracts, and oracle solutions like Chainlink have eclipsed the asset’s original function as a bridge currency.

They contend that bridge tokens face structural limitations, since every purchase for transaction purposes is matched by an immediate sale, producing neutral demand pressure.

The XRP Ledger itself has also been criticized for limited adoption and functionality compared to more feature-rich networks.

While the momentum on CME speaks for itself, investors are impatient about the XRP price.

As of this writing, XRP was trading for $3.00, up by over 3% in the last 24 hours.

Ripple (XRP) Price Performance. Source: BeInCrypto

Ripple (XRP) Price Performance. Source: BeInCrypto

XRP’s surge to $1 billion in open interest suggests that capital flows into the asset at scale. This may be toward speculating, hedging, or gaining exposure to potential regulatory breakthroughs.

If regulators approve a spot ETF, it would mark a critical test of whether XRP’s loyal retail base. It could also reveal whether a growing futures market can translate into sustained institutional adoption.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.