HBAR Shakes Off Recent Losses as Surging Demand Signals Possible Breakout

0

0

Hedera is poised to recover from recent lows. Improvements in overall market sentiment signal that HBAR buyers are beginning to regain control.

Key technical indicators are now pointing to a steady uptick in demand for the token, hinting at a possible price rebound.

HBAR Gears Up for Rebound as Bulls Take Charge

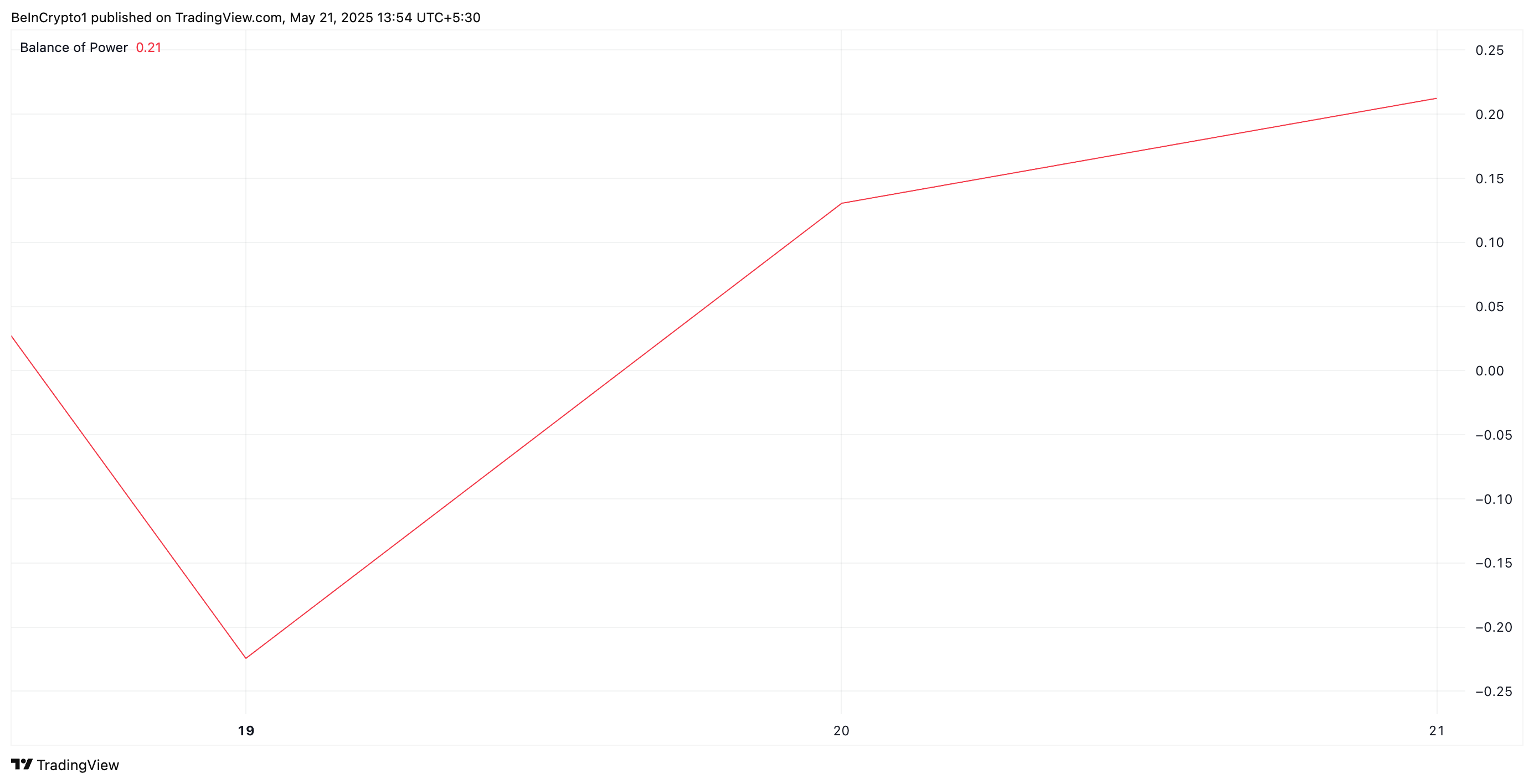

HBAR is showing early signs of recovery as technical indicators point to investors increasing their buying activity. For example, in recent sessions, the altcoin’s Balance of Power (BoP), which measures the strength of buyers versus sellers, has shifted in favor of the bulls. At press time, HBAR’s BoP is positive and in an uptrend at 0.21.

HBAR BoP. Source: TradingView

HBAR BoP. Source: TradingView

This indicates that HBAR buyers dominate the market and show stronger control over price action than sellers. It hints at the potential for a sustained upward move in the asset’s price.

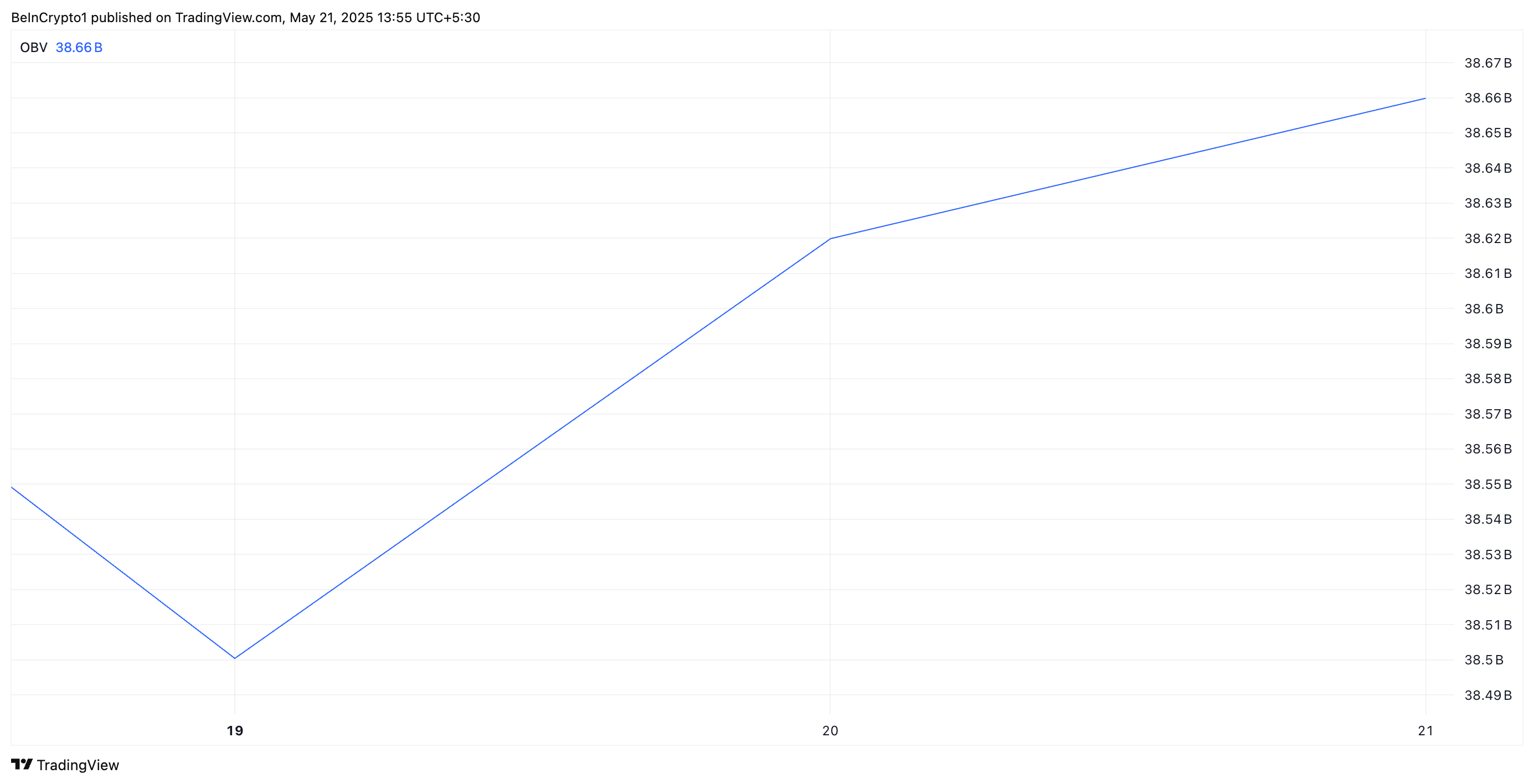

Further, HBAR’s rising On-Balance Volume (OBV) confirms the growing buying pressure and positive momentum in the spot markets. As of this writing, the indicator is at 38.66 billion.

HBAR OBV. Source: TradingView

HBAR OBV. Source: TradingView

The OBV measures buying and selling pressure by tracking cumulative trading volume based on whether prices close higher or lower. When OBV climbs this way, it indicates that volume is flowing into the asset on up days, suggesting increasing demand and potential for a price rise.

Technical Indicator Signals Buyers Are Regaining Control

The steady rise in HBAR’s Relative Strength Index (RSI) reinforces the growing bullish momentum. Currently sitting at 52.53 and climbing, the indicator signals increasing buying pressure and a potential continuation of the upward trend.

The RSI indicator measures an asset’s overbought and oversold market conditions. It ranges between 0 and 100, with values above 70 suggesting that the asset is overbought and due for a price decline. Conversely, values under 30 indicate that the asset is oversold and may witness a rebound.

HBAR’s RSI reading indicates that the bulls are gradually regaining market dominance, which would drive up its value in the near term. If this continues, HBAR could break above the $0.20 price mark to trade at $0.23.

HBAR Price Analysis. Source: TradingView

HBAR Price Analysis. Source: TradingView

However, if selling activity intensifies, HBAR could resume its decline and break below $0.19. If bearish pressure strengthens, the altcoin could fall toward $0.12.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.